After some significant increases in February, housing starts across Canada went the other direction in March, according to new data published by the Canada Mortgage and Housing Corporation (CMHC) on Tuesday.

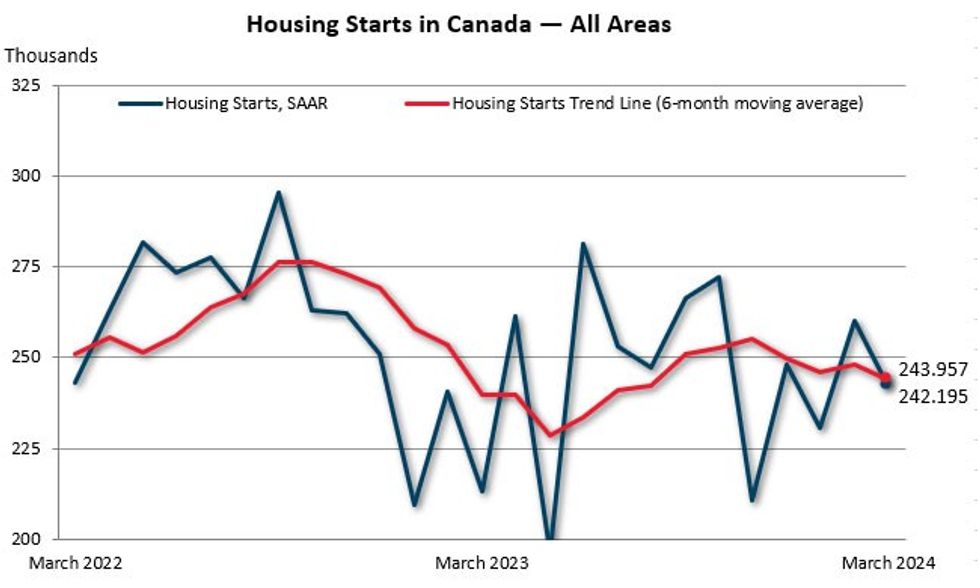

From February to March, the monthly seasonally adjusted annual rate (SAAR) of housing starts across Canada dropped from 260,047 to 242,195, representing a 7% decrease.

Notably, Toronto saw a drop-off of 56,628 units to 41,964 units — 26% — from February to March, primarily as a result of multi-unit starts falling off. Single-detached housing starts increased by 16%, while housing starts for all other kinds of housing decreased by 29%.

In Vancouver, the story was almost the exact inverse. Single-detached housing starts decreased by 17%, while housing starts for all other kinds of housing increased by 30%, resulting in Vancouver seeing a total housing starts increase of 27%, from 32,794 units to 41,720 units. The March total of 41,720 is neck-in-neck with Toronto, which leads the nation when looking at pure volume.

According to the CMHC, the decrease from February to March resulted in the six-month trend in housing starts — the six-month moving average of the SAAR of housing starts across Canada — decreasing by 1.6%, from 247,971 units to 243,957 units.

Looking specifically at urban centres with a population of 10,000 and over, decreases were also recorded across the board from February to March. Single-detached urban starts decreased by 4%, while multi-unit urban starts decreased by 8%, and total urban housing starts decreased by 7%.

The numbers fared much better when compared to last year, however. The total number of housing starts across Canada in urban centres with a population of 10,000 or more people increased from 14,756 units in March 2023 to 17,052 units in March 2024 — an increase of 16%. The significant year-over-year increase was primarily driven by multi-unit starts, which increased by 19%.

On a year-to-year basis, housing starts in Toronto saw an improvement of 10%, while Vancouver saw an improvement of 15%, both of which were also primarily the result of increases in multi-unit starts.

In a commentary statement published on Tuesday, TD Bank economist Rishi Sondhi was pessimistic about housing starts the rest of the year.

"While governments are actively looking for ways to enhance supply, we think that housing starts are likely to decline further this year, on the back of more recent weakness in pre-sales activity," Sondhi said. "What's more, industry analysis suggests that financing for purpose-built rental units currently under construction was obtained when borrowing conditions were more favourable. As they've turned tougher, this segment of the market could be impacted."

Sondhi also added, however, that housing starts are currently trending at a "solid pace" even including the decline recorded from February to March, due to elevated prices and firm pre-construction sales in the past and purpose-built rental construction being lifted by strong rent growth.

Much of the attention will now be on the federal budget, which will be tabled later today. Last week, the Government of Canada unveiled its comprehensive housing plan, after a string of teaser announcements.

Regardless of when the announced actions will come into effect, the policies will likely take some time to impact and be reflected in the market, but some experts, such as Desjardins Economist Kari Norman, believe that at least some of those policies — most notably a $15B top-up of the Apartment Construction Loan Program — will have a positive impact on housing starts.