“The most expensive home is the one you build twice; particularly if it’s in a flood zone or wildfire area,” says Jason Clark, National Director, Climate Change Advocacy at Insurance Bureau of Canada (IBC). That reality is all too fresh for countless people in Los Angeles in the wake of the recent devastating wildfires. It’s also a familiar story for Canadians who’ve been impacted by dramatic climate-related disasters in recent years – from British Columbia’s fires to Toronto’s floods. Damage and destruction from climate disasters comes with a steep price tag – and it’s only climbing. In fact, 2024 shattered the record for the priciest year for severe weather-related losses in Canadian history.

Record-Breaking Insured Losses

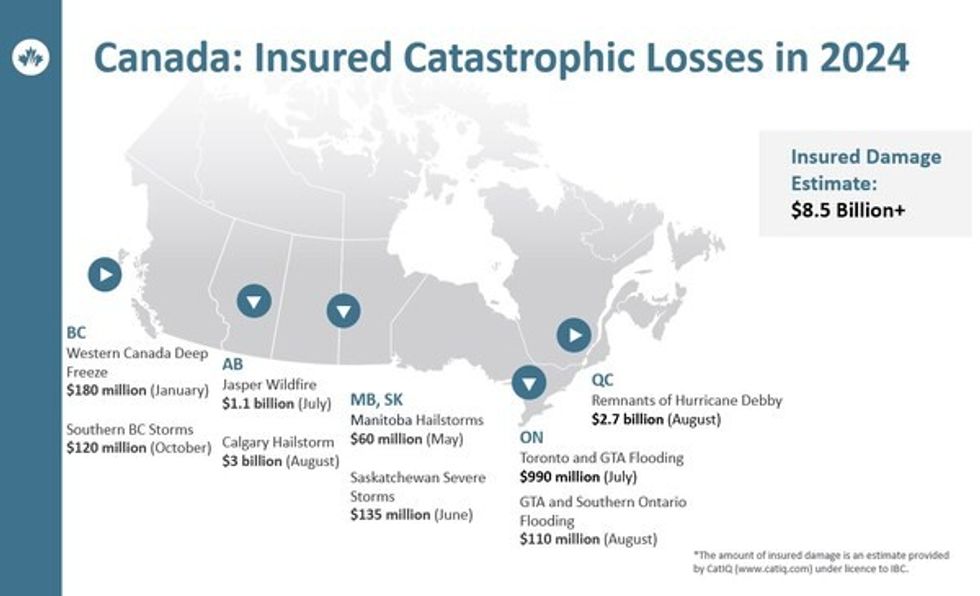

A new IBC report highlights how, for the first time in Canadian history, the country’s insured damage from severe weather events exceeded $8 billion in 2024. According to Catastrophe Indices and Quantification Inc. (CatIQ), this figure shattered the previous record of $6 billion in 2016, following the Fort McMurray wildfires. The 2024 total is nearly triple the total insured losses recorded in 2023 and 12 times the annual average of $701 million in the decade between 2001 and 2010. Yikes.

A deep freeze in Western Canada in January, flooding in the Greater Toronto Area in July and August, the Jasper Wildfire and flooding in Quebec due to remnants of Hurricane Debby in August, the Calgary hailstorm in August, and severe storms in southern BC in October all contributed to this pricey tab.

Summer 2024 was the most destructive season in the country’s history for uninsured losses due to wildfires, floods, and hailstorms. In just two months – the once easy, breezy July and August – disastrous weather events resulted in over $7 billion in insured losses and more than 250,000 insurance claims. This is 50% more than Canadian insurers typically receive in an entire year, according to IBC. Calgary’s August hailstorm, which resulted in $3 billion in insured losses in just over an hour(!), was the country’s most destructive weather event.

It doesn’t take a climatologist or an environmental activist to suggest that these costly climate-related disasters are only going to increase in prevalence – and, perhaps, in size and scope. Given that, it’s time to make changes to account for today’s – and tomorrow’s – reality.

Despite Challenges, Canada's Property Insurers "On Top Of It" (For Now)

The issue of insurability is at the centre of conversations surrounding California’s wildfires. According to data from the California Department of Insurance, insurance companies declined to renew 2.8 million homeowner policies in the state between 2020 and 2022, inevitably resulting in devastating financial impacts for some homeowners.

According to IBC, Canada’s property insurers are waving the red flag that certain regions of the country could face similar challenges. Currently, insurance covering wildfires is widely available. However, the increased frequency and severity of weather-related losses continues to create claims cost pressures. According to IBC, Canada has seen a 115% increase in the number of claims for personal property damage and a 485% increase in the costs for repairing and replacing personal property since 2019.

At the same time, Canada’s insurers face no shortage of other challenges. Due to the frequency of claims, GTA-based Desjardins insurance broker Vik Salhotra says backlogs have also become a reality. “Claims are taking longer and contractors are harder to source,” he says. “The big contractors are inundated and therefore outsourcing to third parties. These delays lead to higher costs as well. Furthermore, material and labour costs are up.”

Despite these challenges, Salhotra says Canada’s insurance providers are in good shape – for now. “Insurance companies are better prepared than people may give them credit for,” says Salhotra. “Based on recent events, it may seem like they’re not, but I actually think that this is the way of the future of thinking about the claims department. I’ve seen it even with our own reshuffling, with more adjusters and just more support. So, there is an anticipation that these weather events are here to stay and become semi-regular occurrences. The industry is based on looking at the past, then forecasting ahead to be prepared. We’re on top of it.”

Broadly speaking, Clark also says that Canada’s insurance providers are currently well-positioned to account for the changing times, both from a regulatory framework perspective and the ability to respond to disasters. “That’s been quite evident this year,” says Clark. “From a claims perspective, we experienced 250,000 claims all at a single quarter at the same time (summer 2024), which is what we would regularly experience over over a year. So, our ability to be there for Canadians and for our customers, both from a financial perspective and in terms of capacity, is certainly there. But it was no doubt a very trying and testing year for insurers, let alone the families that experienced those events and the subsequent disruption.”

As these disruptions become more frequent, premiums will inevitably begin to climb throughout the country. Canada is becoming a riskier place to insure, which is impacting insurance affordability and availability, says IBC. From the beginning of 2020 to the end of 2023, Canada’s homeowner insurance premiums rose at a higher rate than inflation, according to Statistics Canada.

“The risk in this country is going up; simultaneously, we aren’t seeing enough from governments across the country,” says Clark. “But this isn’t just a Canadian problem. Globally, we’ve seen reinsurance costs continue to rise and reinsurers readjust the way they evaluate risk, including in Canada, which makes the cost of reinsurance go up. Canadian insurers are taking on more of that, both the risk and the response, onto our books.”

1.5 Million Canadian Homes Don't Qualify For Flood Insurance

While rates may increase, insurance is largely (key word) available to homeowners across the country. Standard home insurance policies generally cover damage caused by wind, hail, fire, lightning, and certain types of water damage. However, many Canadians are surprised to learn that flood damage and water damage caused by flooding are typically not covered. With that said, optional residential overland coverage is an increasingly common add-on for the majority of Canada’s homes. There is one exception however, and that includes homes that are highly susceptible to flooding due to their location.

“Across Canada, there's about 1.5 million households, or 10% of Canadian households, that cannot access available and affordable flood insurance,” says Clark. “There’s an insurance gap for these homes built in high-risk areas, because it’s not a question of if those homes will flood; it's when, how frequently, and how costly, and that's a real challenge for homeowners. It’s something that our industry has been working on with the federal government for almost a decade now – to offer a public-private partnership that would be able to offer home insurance in those areas.”

He highlights that these homes exist because they’ve been built in high-risk areas, thanks to permissive land use planning strategies. Generally, while Canada remains insurable, the trend line that we're seeing is very troubling, says Clark. “So, we’re waving the flag to address those risks to ensure Canada is insurable down the road,” he says.

The Pressure Is On The Government

Advocates like Clark are putting the pressure on the Canadian government to take a more proactive approach to managing climate-related disasters. As outlined in the IBC report, this means investing in flood defence infrastructure, adopting land-use planning rules that prevent construction on flood plains, facilitating FireSmart programs in high-risk wildfire zones, and implementing updated building codes.

For its part, the Trudeau government released its National Adaptation Strategy and Government of Canada Adaptation Action Plan in 2023. While it’s intended to protect Canadians and plan for a changing climate, critics say it comes with gaps and shortcomings.

In October, Climate Proof Canada – a national advocacy organization also run by Clark – held its second annual National Climate Adaptation Summit. It called on the federal government to provide $5.3 billion annually over the next five years for its National Adaptation Strategy to help mitigate climate-related disasters. It also recommended the establishment of a coordinated approach to disaster preparedness, the creation of a National Emergency Management Agency, and closing the gaps across all levels of government. While the initiative was successful from a visibility perspective, Clark says immediate action is still needed.

“When you look at the federal government's own investment commitments into adaptation, they certainly fall short of what would be needed to even come close to implementing the National Adaptation Strategy,” says Clark. “So, we certainly haven’t been as successful as we would like, but believe our effort is incredibly important, and we’re working with partners like municipalities, disaster response organizations, academia, other parts of the economy, First Nations, and Indigenous leaders. It’s fundamentally important for us to all work together, because the National Adaptation Strategy is a whole-of-society approach. In the same breath, it’s quite clear that it’s severely underinvested in and not moving fast enough to meet its own targets.”

In December, a public statement from IBC President and CEO Celyeste Power called out the federal government for its lack of a national flood strategy in its Fall Economic Statement. “After the costliest summer in Canadian history, with almost $8 billion in insured losses due to floods, hail and wildfires, the Trudeau government has once again failed to invest in climate adaptation and resilience measures that are needed to keep Canadians safe. This week’s Fall Economic Statement (FES) also demonstrates a broken commitment made in Budget 2024 to implement a national flood insurance program for high-risk households by 2025. Needed funding to stand up a subsidiary of CMHC by April 1st was not included in the FES,” reads her statement.

Like Clark, Power points to the 1.5 million high-risk Canadian households that can’t access flood insurance. “Insurers have offered to partner with governments on a specialized flood insurance program that would replace costly taxpayer-funded government bailouts, such as Disaster Financial Assistance Arrangements,” reads Power’s statement. “While Finance Canada continues to study and debate this flood program, policyholders and taxpayers will continue to bear the brunt of poor planning decisions, aging infrastructure, and our changing climate.”

An independent report from the CD Howe Institute found that Canada is one of the most expensive to insure among OECD countries, revealing a direct correlation between the existence of public-private insurance partnerships (like the proposed flood insurance program) and the affordability of insurance.

Ryan Ness, Director of Adaptation Research at the Canadian Climate Institute says the gap in financial protection will only grow if more homes are built in regions at high risk of natural hazards. Ness says that Canada’s relentless agenda to build more housing supply has lacked the thorough due diligence needed when it comes to assessing environmental risks associated with certain regions or plots of land. Furthermore, climate and hazard mapping is outdated and inefficient. “It almost exclusively does not take climate change into account,” says Ness. “So, homeowners, developers, and municipal governments even have a very poor understanding of where the risky areas are.”

The protection of environmentally vulnerable land is the responsibility of all levels of government, says Ness. “All levels of government are promoting rapid housing construction – as much as can be built as quickly as possible – which is a good thing, but the governments aren’t necessarily screening whether or not the programs they’ve created and the funding that they're spending to support new housing construction, is being built in safe places," he says. "There are gaps in our policies that allow housing, and even incentivize it, to be built in dangerous places.”

The Canadian Climate Institute will release a report in February that dives into this, shares Ness. “The government needs to make sure that the funding and the incentives around new housing ensure that housing is built in safe places,” says Ness. “And when it comes to provincial and local governments, especially, to make sure that their zoning and land use policies ensure that housing is directed to safe areas, away from risks like floods and wildfires.”

It’s the same story for new infrastructure, Ness says. “Federal and provincial infrastructure funding often goes to build infrastructure in hazard zones that eventually enables housing to be built, so we need to do more to effectively screen there too,” he says. Of course, protecting existing at-risk homes also requires infrastructure spending. “There are literally millions of existing homes in Canada that are at quite high risk of flooding and wildfire,” says Ness. “As climate risks worsen, spending is going to be needed to protect those homes and communities – whether it’s flood walls or large-scale fire brakes. The costs to the insurance industry will only mount, premiums will continue to go up, and the spiral of declining coverage we see in the US could be a possibility in Canada.”

In the meantime, the federal government did launch their Climate Toolkit for Housing and Infrastructure in October. It's essentially a suite of free tools, resources, and support services for communities to help them adapt their infrastructure to changing climate conditions, and reduce greenhouse gas emissions during new home and infrastructure constructions. The toolkit includes a help desk, an online platform, and access to climate and infrastructure experts.

UPDATE: On January 29 (just after this article was published), the Government of Canada issued a press release that stated its intentions to modernize the country’s recovery funding program to protect against the devastation caused by extreme weather events. The upcoming modernization of the Disaster Financial Assistance Arrangements (DFAA) program is anticipated to come into effect on April 1, 2025, with a goal to offer quick and efficient financial assistance in the aftermath of a disaster. In short, it will provide increased investment in disaster mitigation and recovery; incentivized risk reduction ,and pre-disaster planning; and increased support for disaster victims.

Tips For Homeowners

It should go with out saying that homeowners do their due diligence when it comes to risk and insurance. It’s important to know that certain types of flood insurance is an add-on and not automatically there. A 2022 study by BNN Bloomberg and RATESDOTCA found that half of respondents don't have overland water damage insurance, and that 32% of homeowners were unaware that standard home insurance policies don’t cover water damage from seepage, overland flooding, or sewer backup.

“I don’t think that people understand how vital flood and sewer back-up coverage is,” says Salhotrah. “Water damage is actually the most prevalent and frequent claim." He considers overland water damage insurance essential.

Of course, saying that Canada's insurers are well prepared doesn’t preclude the reality that premiums will increase. “That’s the nature of the business; you can’t compare it to car insurance, where you’re at fault or you’re not,” says Salhotra. “The losses of a few are paid for by the premiums of many; it’s inevitable that we’re going to see rates increase on property due to increases in these types of events.” The advice for homeowners is to shop around to ensure the best premiums for their property,

In the meantime, the federal government is working on a national public flood portal that will communicate the level of risk associated with different regions. “Updating these maps and ensuring homeowners have access to this data is really important,” says Clark. “We’ve been trying to encourage the federal government to move as fast as possible to make that data public, which will better inform individuals and households.”

The time to act is now – both in terms of reducing emissions and improving infrastructure. “The data and the science are clear; climate change is driving increases in the types of extreme weather and climate hazards that cause disasters in Canada,” says Ness. “Things like extreme storms, flooding, and wildfires are all on the uptick, and will continue to be on the upswing due to climate change. Yet, we continue to build homes in dangerous places, which is going to increase the amount of homes, people, and assets in harm’s way.”