After extensive speculation and debate about hypotheticals, the City of Surrey released a draft of its operating budget on Saturday, confirming its intention to raise property taxes a result of the City's police force transition.

Surrey homeowners are now facing a proposed property tax increase of 17.5%, consisting of the following:

- A 9.5% General Property Tax increase to fund Policing Shortfall;

- A 7.0% General Property Tax increase to fund:

- General inflationary pressures

- Hiring of additional 25 police officers, 20 firefighters and 10 bylaw officers for 2023

- City Wide Operations (non-public safety);

- A 1.0% Roads and Traffic Levy.

Based on the City's estimations, this total 17.5% tax increase will translate to an additional $403 in annual taxes for the average single-detached home, and would raise the property tax amount for the average assessed single-detached home in Surrey to $3,000. The City notes that this "would place Surrey in the middle for property taxes collected for the respective average assessed home in Metro Vancouver."

Surrey Police Service Saga

The idea to establish the Surrey Police Service was initially raised during former mayor Doug McCallum's first term, in the late 90s and early aughts. It wasn't until McCallum's third term that Surrey City council approved a motion to establish the Surrey Police Service (SPS) in 2018. At that time, of the 19 Canadian cities with a population over 300,000, Surrey was the only city without its own local police department.

Current Mayor Brenda Locke unseated McCallum in October's civic election, winning the mayoral seat by fewer than 1,000 votes. Wanting to halt the transition to the SPS, and retaining the Surrey RCMP, was a key promise she and her Surrey Connect party campaigned on. "We need to keep the Surrey RCMP right here in Surrey," she said during her election night victory speech.

In early January, Locke shocked many by flouting the risk of a one-time 55% property tax increase if the City were to complete the transition to the Surrey Police Service, saying that "it is abundantly clear that a switch to the Surrey Police Service would create an untenable financial burden for Surrey taxpayers during these challenging economic times."

Councillors and pundits called the statement a scare tactic, and when asked by STOREYS at the time why the property tax increase had to be collected all at once, rather than spread out across years, the Mayor's Office declined to comment.

On Saturday, along with the budget draft, Locke reiterated the sentiment and reinforced her stance of retaining the RCMP as the official Police of Jurisdiction for Surrey.

"It is now clear just how much this misguided experiment to change policing in Surrey is costing Surrey residents and businesses," Mayor Locke said. "The money wasted by the policing transition, combined with the so-called 2.9% property tax rate for four years implemented by the previous Council, means we are now having to play catch up on core City services, such as the hiring of firefighters and bylaw officers. Surrey can ill afford to continue with the police transition and we are starting to set our finances straight with this budget."

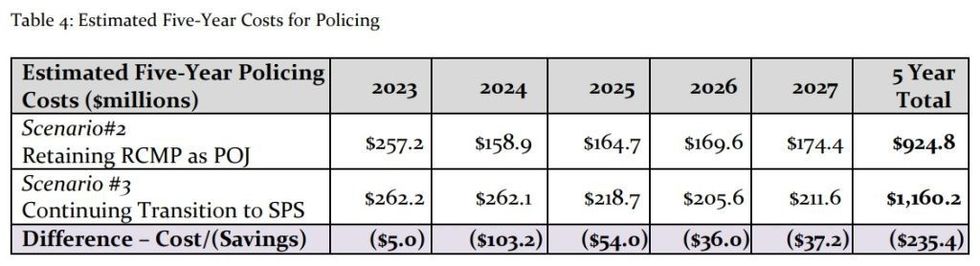

An 88-page staff report presented to council in December estimated that if Surrey were to carry on and complete the transition to the SPS, policing costs for the City would require an additional $235.4M from 2023 to 2027.

On Saturday, the City said that although retaining the RCMP would save that additional $235.4M, because the transition process already began under the previous council, there already remains a shortfall of $116.6M that needs to be accounted for. In other words, Surrey homeowners will be facing a property tax hike regardless of which way the City goes on policing.

RELATED: The 30 BC Municipalities With The Highest Property Tax

The Decision

The City noted that this budget draft was crafted under the assumption that Surrey will retain the RCMP, but the jury, in the form of British Columbia's Minister of Public Safety Mike Farnworth, is still out on that decision.

Farnworth has the final say on the matter, and a decision was expected before February. However, on January 26, Farnworth said that despite the City, RCMP, and Surrey Police Service all submitting detailed reports making their respective cases, he needed "additional information" in order to fulfill his responsibility of ensuring adequate and effective policing is maintained in Surrey.

The City is now requesting a decision from Farnworth by March 31.

In the meantime, a public meeting of the Finance Committee to consider the budget will be held at 2 pm on Monday, March 6, where the public can attend and provide comment in-person. The City is also accepting written comment from now until 12:00 pm on Friday, March 3.