Canadians are feeling the crunch of sky-high inflation and climbing interest rates.

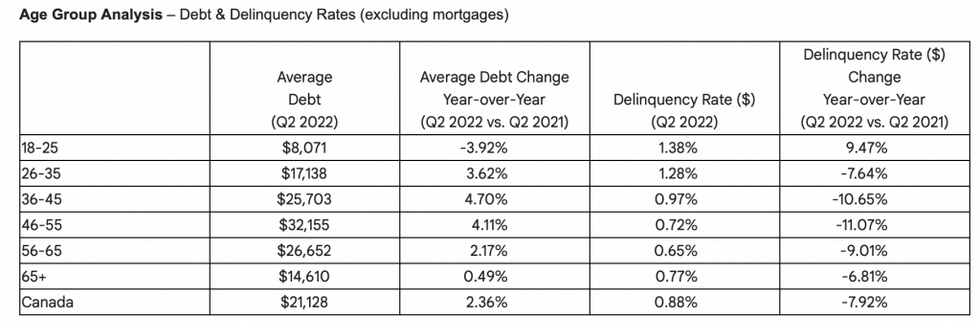

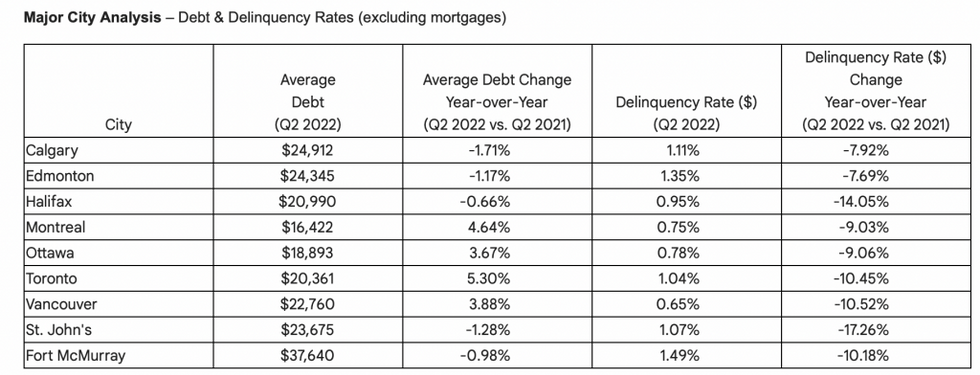

Total consumer debt has climbed to $2.32T, an increase of 8.2% in Q2 2022 compared to last year, according to Equifax Canada’s most recent Market Pulse consumer credit trends and insights report. Increases in new lending and higher spending linked to inflation have pushed non-mortgage debt to $591.4B, up 5.2% from Q2 2021. Meanwhile, average non-mortgage debt per consumer is now $21,128, an increase of 2.4% compared to Q2 2021.

“The cost of living has been increasing across Canada and indeed globally with rising inflation being seen across essentials like housing and energy as well as many other goods and services,” said Rebecca Oakes, Vice-President of Advanced Analytics at Equifax Canada. “Financial stress is becoming a very real thing for many more Canadians. Its impact on consumer credit is not just visible in day-to-day credit card spending, but also in other non-mortgage debt like auto loans and lines of credit, where balances are on the rise.”

As a glaringly clear sign of the times, credit card demand and balances continue to increase. Over the last quarter, credit card balances rose to the highest level since Q4 2019 and increased by 6.4% compared to the Q1 figures. The biggest shift in consumer credit balance has been on those with lower credit scores, who may have a higher risk of missing payments. Credit card balances for consumer segments with a credit score lower than 620 (anything above 600 is consisted good by most lenders) rose by 7.4% compared to Q1 2022 and showed a 16.2% increase from Q2 2021. .

“Credit card spending is reaching historically high levels,” says Oakes. “High consumer demand for credit cards means a competitive marketplace for lenders. As a result, the credit limits being offered on new cards are much higher than we've seen in previous periods.”

The average credit limit on new cards is over $5,800, the highest it has been in the last seven years. The average monthly credit card spend per card-holding consumer was almost $2,370 in Q2 -- a figure that’s up by $427 (22%) compared to Q2 2021. New card volume is also growing quarter over quarter with a 16.2% increase from last quarter, says Equifax Canada.

As the report reveals, the recent housing market slowdown has had little impact on new mortgage amounts, but monthly payments are up. According to Equifax Canada, new mortgage volume fell by 16.4% in Q2 2022 when compared to the peaks of Q2 2021. The report highlights how high home prices have hurt first-time homebuyers. While we’ve seen an appreciated softening of prices, the average loan amount of first-time homebuyers only dropped by 0.5% this quarter when compared to last quarter; yet their average monthly payments increased by 10%. Ouch.

The average loan amount for new mortgages in Canada remained high at $367,500, with average loans for first-time homebuyers at $430,700. In Toronto and Vancouver, where home prices are the highest in the country, the average loan amount for first-time homebuyers has exceeded $600,000, despite some price correction in these markets.

“The cooling housing market in Canada should not be mistaken for increasing affordability,” highlights Oakes. “Affordability depends not just on home prices, but also on monthly payment obligations for a mortgage. Higher interest rates coupled with high inflation can really stretch a consumer’s monthly expenditure, while many could find it difficult to qualify for a mortgage.”

It’s not just high gas prices that are making a dent in the bank accounts of drivers. As the report highlights, high car prices are driving up average auto loan amounts. Overall, new originations for auto loans are declining year over year. However, the deep subprime and subprime segments are starting to see a rise in new originations, with 1.2% and 4.1% increases in new auto loans and bank-comparable loans when compared to Q2 2021. High car prices continue to drive up the average amount for auto loans ($28,000) and comparable loans ($33,000) by 4.8% and 10% respectively, when compared to the same time period last year.

Not surprisingly, financial stress indicators are on the rise in Canada. In the second quarter, consumer insolvency rose to the highest levels since the start of the pandemic. This was primarily driven by consumer proposals, which saw a 20.7% rise compared to the prior year and accounted for 76% of all insolvencies.

An increase in the number of credit accounts with missed payments led to a 4% jump in the 90 day+ account delinquency rates. This was the third quarter in a row where an increase was seen. However, large growth in overall non-mortgage debt combined with a fall in the average balance of delinquent accounts masked some of the emerging financial stress with 90 day+ balance delinquency rates still remaining below pre-COVID levels and showing a fall compared to the prior year.

“The good news is that government and lender support during 2020 and 2021 led to overall reductions in debt levels. Balances on accounts where we are seeing consumers starting to miss payments are lower than 12 months ago,” says Oakes. “The not-so-good news is that over 100,000 more consumers missed a credit payment this quarter compared to last year. Around one in 30 of credit-using individuals failed to meet at least one credit commitment.”

According to Equifax Canada, credit cards and auto loans are seeing the biggest jump in account-level delinquencies, with 5% and 5.9% increases from last quarter, respectively.

“The rapid rise in inflation and interest rates is clouding the economic outlook. Early indications in our data suggest financial stress is starting to emerge; Canadians should continue to be mindful of their spending and debt obligations,” advised Oakes.