A growing number of Canadians are not prepared to deal with unexpected financial stressors — a situation that is more perilous for variable-rate mortgage holders.

According to the latest Seymour Financial Resilience Index, 76% of Canadians — equivalent to 19.5 million adults between the ages of 18 and 70 — are not financially resilient, meaning that they’re not able to get through financial hardships, stressors, or shocks that result from unplanned life events.

From June 2021 to June 2023, the number of financially resilient households fell from 31% to 24% across Canada. However, the number of households that are extremely vulnerable to financial stressors has dropped from 21% to 18% since June 2022.

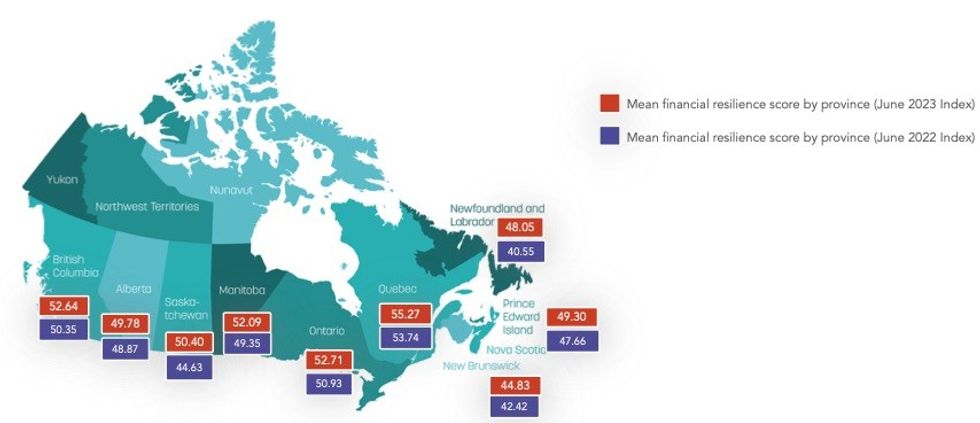

The Index measures Canadians' financial resiliency at the national, provincial, and individual levels three times per year. A score of zero to 30 indicates extreme vulnerability to financial stressors, a score of 30.01 to 50 indicates financial vulnerability, 50.01 to 70 is approaching resilience, and 70.01 to 100 represents financial resiliency. This latest iteration is based on responses from over 5,000 Canadians collected in June 2023.

At the national level, Canada's mean financial resilience score sat at 52.44 in June 2023. While it marks a two-point increase from June 2022, it has fallen three points since June 2020, when Canadians' resiliency was aided by pandemic-era savings and financial relief from the government.

Locally, the least financially resilient province was New Brunswick, with a score of 44.83, while Quebec’s 55.27 put it at the high end of the scale. Ontario and British Columbia were nearly tied, with respective scores of 52.71 and 52.64.

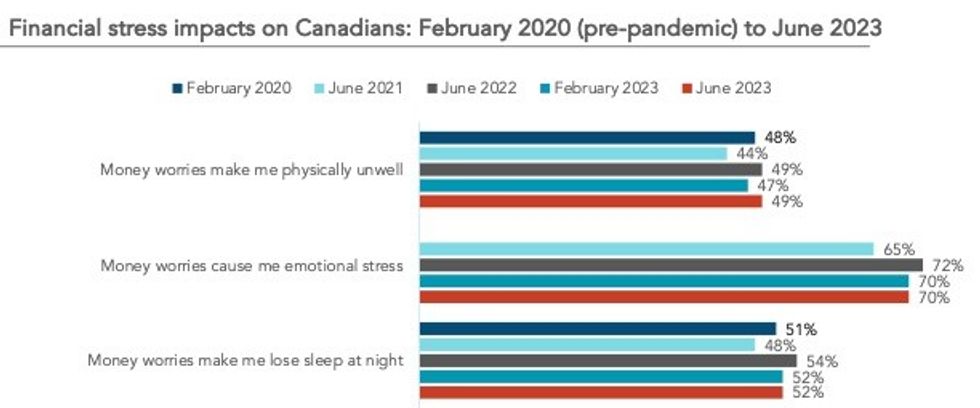

The number of households experiencing high levels of stress over their current and future financial obligations has risen from 43% to 52% in two years; 49% reported being physically unwell over their monetary concerns, and 70% felt emotional stress.

One significant source of anxiety is the housing affordability crisis, with 55% of Canadians indicating that it poses a problem for them. The figure rises to 69% amongst financially vulnerable Canadians, and to 82% amongst those who are extremely vulnerable.

Following the rapid rise of interest rates over the last year and a half, Canadians with mortgages are decidedly less financially resilient than they were in June 2021. Those with variable-rate mortgages have fared even worse.

While 33% of mortgage holders were financially resilient in June 2021, the figure had fallen to 22% as of June 2023. Over the same time, the number of mortgage holders who were extremely vulnerable or financially vulnerable rose from 32% to 44%.

Regarding those with a variable rate mortgage, only 18% were financially resilient in June 2023; 46.4% were extremely or financially vulnerable.

"The interest rate environment compounding on top of the housing affordability crisis is impacting many of these households with evidence of increased financial vulnerability," the report observed of variable-rate mortgage holders.

Eighty-eight percent of variable-rate mortgage holders reported that rising interest rates are a problem for them, and 33% said that their debt levels were unmanageable. The latter figure falls to 24% amongst those with a fixed-rate mortgage.

With inflation rising and the threat of a recession looming, 50% of Canadians had a liquid savings buffer of at least three months, but 24% had a buffer of less than three weeks.

As of June 2023, 69% of households had significantly reduced their non-essential expenses, and 52% had drawn down on their savings. However, due to the high cost of living, 62.5% of Canadians reported spending either more or the same as their household income.