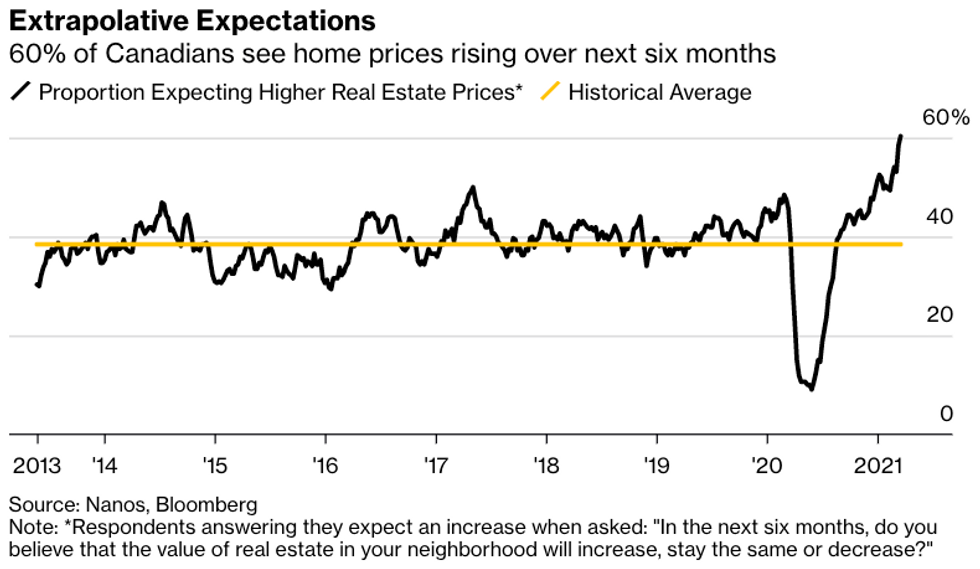

Six out of 10 Canadians believe the value of their neighbourhood's real estate will rise over the next six months, according to new survey results from Nanos Research Group for Bloomberg News.

Bloomberg reports this is the first time such readings have surpassed 60% since 2008, when polling began.

This exuberance adds to the growing concern that the country's real estate market -- as well as that of the GTA -- could be sitting in bubble-territory.

"The concern is these so-called extrapolative expectations will attract the wrong sort of demand -- from speculators or investors fearing they will miss out -- that will hyper-inflate the market, exacerbate inaffordability for young or low-income families, add to rising mortgage debt and amplify the risks of a destabilizing market crash," says the Bloomberg report.

READ: Is An “Affordability Crisis” Looming Over the GTA Housing Market?

But Bloomberg's newest data isn't the only evidence that supports the bubble theory -- this is a conversation that's been on the table for weeks, if not months, and only continues to see itself backed up.

For instance, Statistics Canada reported last week that home sales had risen at their fastest pace in more than three decades in February. New house prices were on the rise in 22 of the 27 census metropolitan areas (CMAs) surveyed, resulting in the national index being pushed up 1.9%.

Meanwhile, the Canadian Real Estate Association (CREA) recently reported that according to the MLS Home Price Index -- which tracks price trends far more accurately than is possible using average or median price measures -- national home prices increased more than 17% year-over-year.

The reasons for these price changes, by now, read as textbook: mortgage rates are laying low, the desire for ground-level homes (and space for a home-office) has increased massively through the pandemic, and there's argument that a rural boom may lie in the post-COVID future.

However -- and Bloomberg notes this -- "concerns are beginning to mount."

Indeed, there are now early signs of overheating in Canada’s housing market, and Bank of Canada Governor Tiff Macklem recently acknowledged “some signs of excess exuberance.”

That said, Macklem downplayed the need for action.

Despite admitting to the sure signs of overheating, Macklem said there are -- so far -- no plans to raise interest rates until the economy and employment are back on track following the declines caused by COVID-19.

Meanwhile, in the GTA specifically, the market for single-family homes grows ever-hotter, with home prices and transactions in the region soaring to record-breaking heights.

Last month, for example, the average price of a home in the region -- including all types of houses and condos -- rose 14.9% year-over-year to $1,045,488, surpassing the million-dollar mark for the first time in history, according to the Toronto Regional Real Estate Board (TRREB).

Zooming out to Canadians as a collective, Bloomberg reports residents aren’t expecting [price growth] to stop. The Nanos poll's share of respondents who believe real estate's value will rise is up massively from last May's 9% (a then-piddly percentage, courtesy of COVID).

In addition to mortgages remaining accessible and backyards remaining covetable, the report notes political action is constrained, as Prime Minister Justin Trudeau's government determines whether they're keen on triggering an election this year.

"The housing rally has been a key driver of new wealth and confidence at a time of great uncertainty," the report says, "and policy makers will be wary of tampering."

With files from Ainsley Smith.