On the heels of a (surprisingly) strong few months for Canada’s residential construction sector, national housing starts took a nose dive in November, new data from Canada Mortgage and Housing Corporation (CMHC) shows.

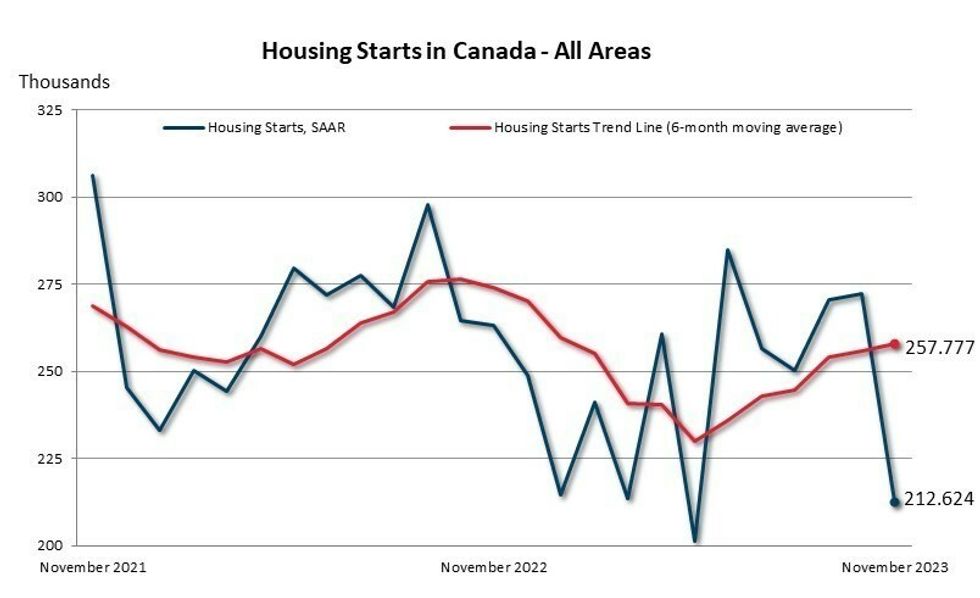

The government agency said on Friday that the monthly seasonally adjusted annual rate (SAAR) of total housing starts in Canada plunged 22% on a month-over-month basis to just 212,624 units.

Although the six-month moving average of the monthly SAAR rose to 257,777 units last month, the increase was nominal, at just 0.7%.

Speaking specifically to urban centres — those with populations of at least 10,000 — total starts fell 23% to 195,363 units. That total was comprised of 151,297 multi-unit starts (down 27%) and 44,066 single-detached unit starts (down 7%).

CMHC's Deputy Chief Economist, Kevin Hughes, pointed out that it was multi-unit construction that dragged down the national rate of starts. He also said that the “notable drop” in starts “should not come as a major surprise and reflects tighter economic conditions impacting construction timelines.”

Hughes added, “As the more difficult borrowing conditions and labour shortages now seem to be showing in the starts numbers, we can expect to see continued slower starts rates in the coming months.”

In a similar manner to last month, housing starts were down in both Montreal and Toronto, with drops of 30% and 39%, respectively. Vancouver deviated from the gain observed last month with a 39% drop recorded. The decrease in starts in both Toronto and Vancouver is attributed to a significant decline in multi-unit starts.

Rural starts also dropped down to 17,261 units last month.

TD Economist Rishi Sondhi commented on the data this morning, saying that “some payback was in store for starts” after the gains observed in October.

Even so, Sondhi acknowledged that starts remain strong on a trend basis, “supported by condo construction (reflecting past gains in pre-sales) and purpose-built rental units (boosted by skyrocketing rents and government programs).”

Like Hughes, Sondhi expressed that TD’s view is that starts are likely to trend lower in the months to come, in large part due to the increasing weakness of national home sales.

“However, we're anticipating some bounce-back took place in December, consistent with rising permit issuance in recent months,” Sondhi also said. “Government actions (such as eliminating the GST on purpose-built rental building) coupled with robust population growth will likely keep the level of starts elevated through 2024, even with the anticipated downtrend.”