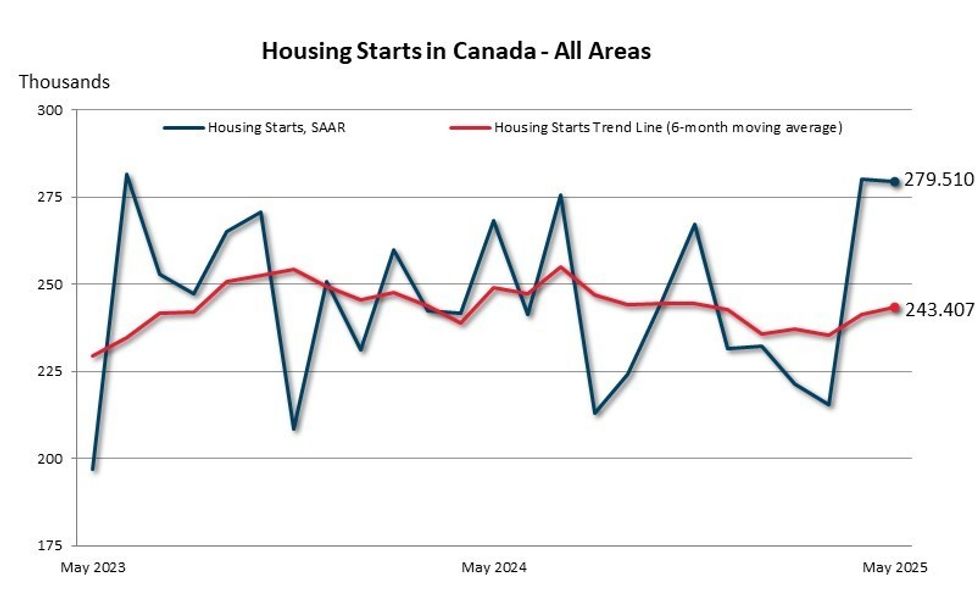

After surging 30% month over month in April, the seasonally adjusted annual rate (SAAR) of housing starts remained more or less flat between April and May with a 0.2% drop, as homebuilding in markets in Ontario and BC continued to weaken.

In the longer term, the six-month trend in housing starts also remained relatively flat in May, posting a 0.8% increase and hovering at 243,407 units, while actual housing starts grew 9% year over year, from 21,814 units last May to 23,745 units.

The data comes from the Canada Mortgage and Housing Corporation's (CMHC) latest housing starts report, and shows that May was a more subdued month compared to April when not only the SAAR of housing starts surged, but actual housing starts were up 17% year over year — the "highest actual housing starts for the month of April on record," according to CMHC.

As pointed out in an analysis from Desjardins Economist Kari Norman last month, however, April's high activity was an outlier compared to the previous four months and spoke more to "natural fluctuations of multi-unit starts and their reporting dates, rather than an indication of a turnaround in the sector," she wrote.

As expected, housing starts returned to more moderate levels in May, with gains driven by continued high activity in Quebec and the Prairie provinces, particularly in Manitoba and Saskatchewan where total housing starts grew by 209% and 206%, respectively, compared to May 2024.

“Growth in actual starts activity in May was once again driven by increases of single-detached homes and purpose-built rentals in Québec and the Prairie provinces," said Tania Bourassa-Ochoa, CMHC’s Deputy Chief Economist. "By contrast, weak condominium market conditions in Toronto and Vancouver have contributed to significant declines in overall housing starts in these regions, in line with our recent analysis on these markets."

Looking at Canada's largest cities, the national growth was fuelled by an 11% year-over-year increase in actual housing starts in Montreal and pulled down by a 10% month-over-month decrease in Vancouver starts and a 22% year-over-year decrease in Toronto starts, both driven by lower multi-unit starts.

The recent CMHC analysis referenced by Bourassa-Ochoa looks at the current state of Toronto and Vancouver's condominium markets, highlighting plummeting sales, sliding prices, and ballooning inventory — all factors that have led to increased project cancellations and reduced construction activity.

For an overview, all condo sales (including resale, new, and pre-construction units) fell 75% in Toronto and 37% in Vancouver between mid-2022 and the end of Q1-2025. Slow sales, paired with record high condo apartment completions in 2024, led to steady inventory growth, which culminated in the current 58 months of inventory in Toronto and prices dropping 13.4% in Toronto and 2.7% in Vancouver between Q1-2022 and 2025.

On the construction front, the result has been five- and 10-fold increases in the number of condo project cancellations compared to 2022 in Toronto and Vancouver, respectively, and a consistent downtrend in multi-unit starts in the two major cities.

Monday's national housing starts data comes soon after the release of the Financial Accountability Office of Ontario's quarterly economic monitor, which analyses a number of economic indicators, such as employment and inflation, and also home sales and housing starts for the first quarter of 2025. Findings from the report point to continued strain in the Provinces' economy, with housing starts being no exception.

According to the report, "high construction costs and weak sales as households continue to face housing affordability challenges" have pushed provincial housing starts down 20.2% to 12,700 compared to the 15,900 units started in 2024-Q4, marking the "lowest level of housing starts since 2009."