Spring saw Canadian housing markets rebound across the board. In May alone, sales trended upwards in 70% of local markets, and on par with the clear resurgence in demand, home prices rallied.

This is reflected in the latest Teranet-National Bank Composite House Price Index, which tracks observed or registered home prices across 11 CMAs: Victoria, Vancouver, Calgary, Edmonton, Winnipeg, Hamilton, Toronto, Ottawa-Gatineau, Montreal, Quebec City, and Halifax. All properties that have been sold at least twice are considered in the calculation of the index.

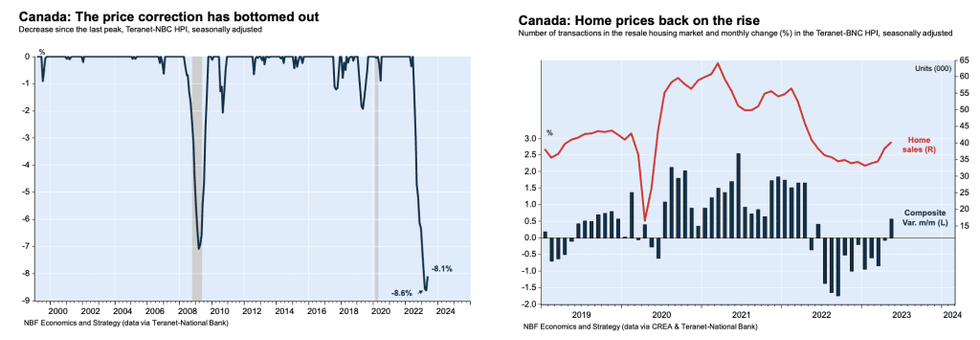

May’s reading, released Monday, shows a rise of 1.6% in the index from April. But more notable still is the adjusted metric, which edged up by 0.6%, marking the first monthly increase in eleven months.

READ: Canadian Home Sales Continued To Climb In May, With Gains Recorded In 70% Of Local Markets

“This turnaround in property prices is due in particular to the rebound in the resale market over the past four months,” writes Daren King, Senior Wealth Advisor and Portfolio Manager at National Bank Financial, in a report this morning. “This recovery is taking place against a backdrop of record demographic growth, which is accentuating the shortage of housing supply on the market.”

Demand-related pressures are set to persist, he adds.

“With domestic housing starts falling to their lowest level in three years in May, there is no reason to believe that the shortage of properties on the market will be resolved any time soon. However, the resumption of the monetary tightening cycle by the Bank of Canada in recent weeks and the expected slowdown in economic growth could moderate price growth later this year.”

On a month-over-month basis, eight of the 11 CMA’s considered by the index posted gains, led by Toronto, where prices grew by 1.6%, and followed by Winnipeg (+1.5%), Victoria (+1.3%), Edmonton (+1.3%), Quebec City (+1.2%), Montreal (+1.0%), Hamilton (+0.5%), and Calgary (+0.1%).

As well, of 20 CMA’s not included in the index, price increases were observed in 10, with the most notable growth seen in Sudbury (+4.9%), Guelph (+4.7%), and Kingston (+4.6%).

On the flip side, Halifax, Vancouver, and Ottawa-Gatineau saw price drops of 2.6%, 1.2%, and 0.3%, respectively. Although not included in the index, notable decreases were also recorded in Brantford (-8.1%) and Sherbrooke (-4.5%).

Year over year, the index fell by 7.6% in May, which the report notes is “a smaller annual contraction than the record drop recorded the previous month.”

Nonetheless, increases were observed in three of the 11 CMAs considered in the index: Calgary (+8.3%), Edmonton (+4.9%), and Quebec City (3.1%). Conversely, prices lagged in Hamilton (-16.8%), Toronto (-10.3%), and Ottawa-Gatineau (-9.5%).

Although not included in the index, annual gains were recorded in four CMAs, including Saint John (+7.2%) and Trois-Rivières (+3.9%). Meanwhile, prices slid dramatically in Brantford (-21.9%), Peterborough (-18.5%), Oshawa (-17.7%), and Abbotsford-Mission (-17.4%).