The second quarter of 2023 saw Canadian office vacancies edge up across all segments and asset classes as the sector continues to be throttled by the work-from-home stronghold.

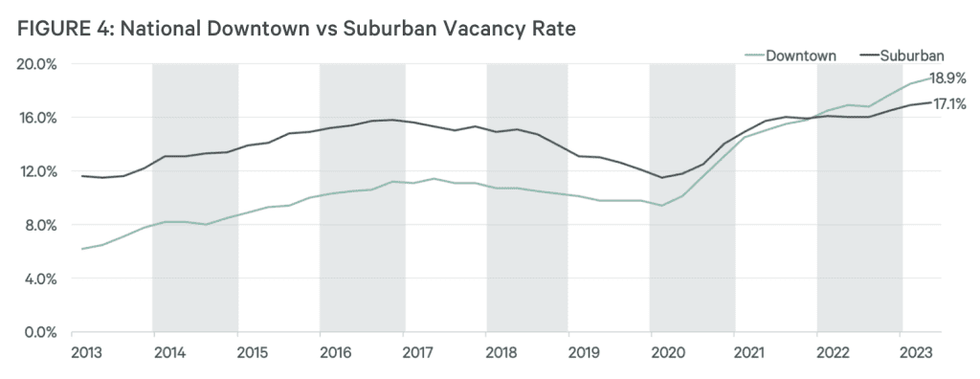

New data from CBRE reveals that the overall national office vacancy hit 18.1% in Q2 2023 -- up from 17.7% the quarter prior -- with properties in the downtown core to blame for the majority of the increase. Vacancy in the downtown segment now sits at the highest level since 1994, at 18.9%, while suburban vacancy has increased to 17.1%.

In combination with the uncertainty surrounding remote work, CBRE attributes the rise in vacancy to “a perfect storm of a recession threat, interest rate hikes, tech sector weakness, tenants rightsizing, and a new supply of office space.”

In a press release published yesterday, CBRE Canada Chairman Paul Morassutti urges readers to “dig beyond the general vacancy numbers.”

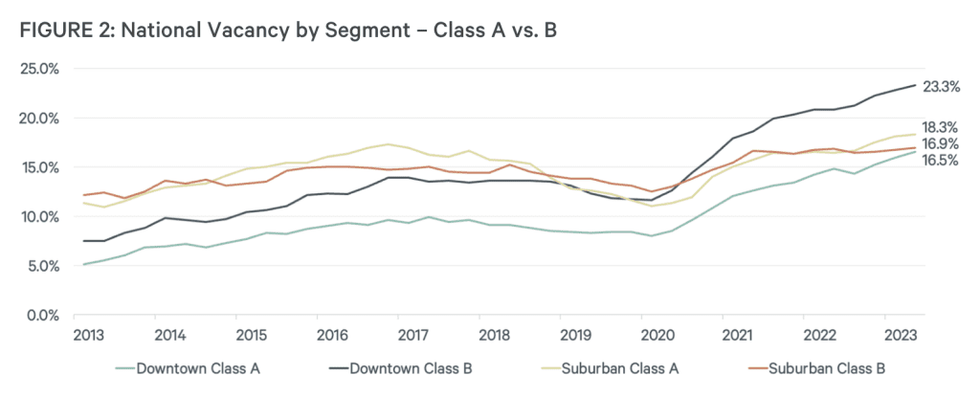

“A clear pattern of bifurcation is emerging,” he says. “Not all assets are equal.”

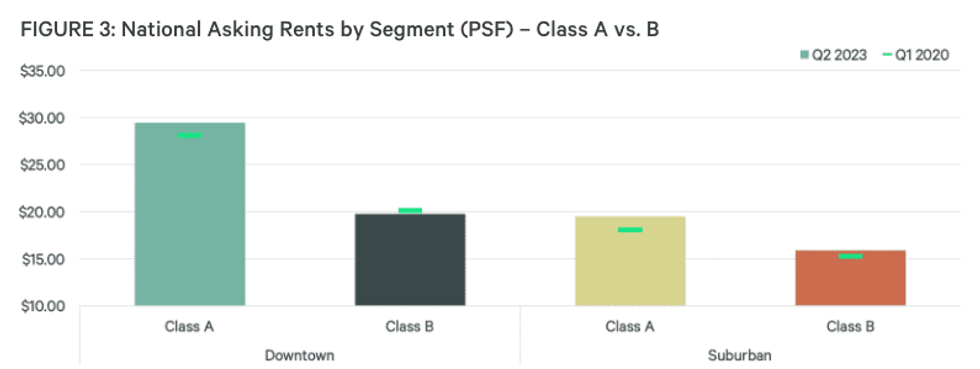

Tuesday’s report reveals that, of all office asset classes, downtown Class A remained the “tightest” in the quarter with a vacancy rate of 16.5%. Asking rents for Class A are up 4.6% since Q1 2020, averaging $29.44 per sq. ft.

Suburban Class B observed the second-lowest vacancy, at 16.9%, followed by suburban Class A, at 18.3%.

Suburban Class A in particular saw the “strongest rental profile” of all asset classes, notes the report. Rents in the asset class are up now up 7.8% since Q1 2020.

Downtown Class B has the highest vacancy of all asset classes, at 23.3%, marking a 250-basis-point increase compared to the second quarter of 2022. That annual jump is the highest of any other asset class. As well, downtown Class B is the only asset class where average asking rents are down since the start of the pandemic.

The strong performance of the suburban Class A product and the weaker conditions in the downtown Class B segment “reflect the priorities of tenants for high-quality, well-amenitized office buildings situated in office nodes that minimize commute times for their employee base,” the report explains.

As well, CRE’s data shows that national quarterly net absorption in the second quarter was about half of what was observed in the quarter prior. Net absorption remained in the negative, indicating that conditions are no doubt softening but to a lesser degree compared to the start of the year.

Still, given the uncertainty of the sector, vacancy in the sublet segment is on the rise, increasing for the fourth straight quarter in Q2. Reaching an all-time high, 16.8 million sq. ft of vacant office space was available for sublease across Canada in Q2 -- 2.5 million sq. ft above the year-ago level -- which equates to 3.4% of existing inventory.

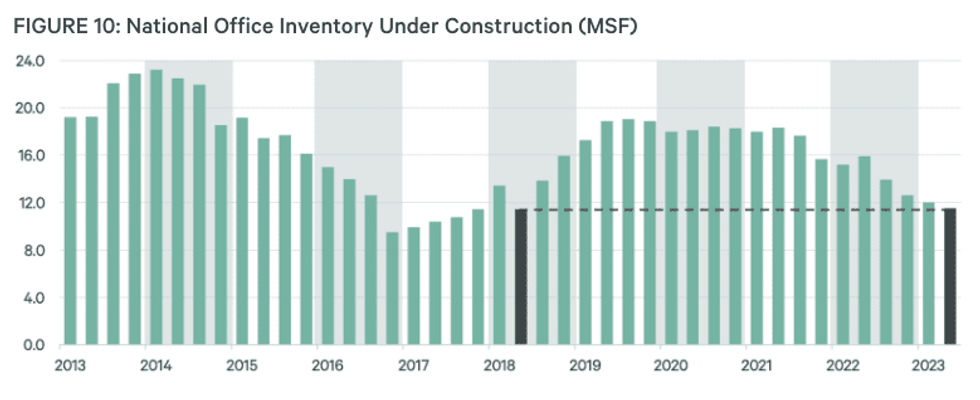

CBRE’s report also shows that 11.5 million sq. ft of office product was under construction in the quarter, translating to 2.4% of existing inventory. Of the total stock under construction, 50.7% is pre-leased.

As well, the report notes that “construction has been steadily declining since Q2 2022 as projects are completing with very few kicking-off.” If this trend persists, office construction could slide to its lowest level since 2005.