Earlier this week, the Government of Canada quietly launched public engagement on Build Canada Homes (BCH), the new federal housing entity that Mark Carney and the Liberals pledged to create during the election campaign as a way to "get the government back in the business of building."

From what was announced at the time, Build Canada Homes has drawn mixed reactions, with some saying it is long overdue for the feds to get back into homebuilding and others arguing that the federal government should support private developers rather than compete with them.

This week, the Government of Canada published a "Market Sounding Guide" for Build Canada Homes, which provides many more details about the government's vision for the new entity. All details are currently subject to change and the Government of Canada is holding public engagement until August 29.

Build Canada Homes

"Build Canada Homes will be Canada's new federal entity responsible for building affordable homes, providing financing to affordable home builders, and catalyzing a more productive homebuilding industry," the guide begins. "It will bring together key partners from across the housing ecosystem to get homes built by addressing barriers, reducing risk and helping to navigate the process of building non-market housing."

Build Canada Homes will have two major objectives, the first of which is to "Build affordable housing at scale."

"We need to dramatically scale up affordable housing to create a mix of homes that respond to needs of a diverse range of households, including low-income, while building strong, resilient communities, following the clear example of those countries that have been successful," says the Government of Canada in the guide.

The second objective is to "Build faster, better and smarter."

"We need to build housing using advanced materials with manufacturing and construction methods that improve productivity and scalability to reduce the cost, time, and environmental impacts of building," the guide states.

Structurally, Build Canada Homes is currently envisioned as "a single window for proponents at every phase of the development process, working in close partnership with developers, investors, manufacturers, other orders of government and Indigenous partners to get housing financed and built."

How Build Canada Homes Will Work

Build Canada Homes will partner with builders and housing providers "focused on long-term affordability," accelerate timelines to bring federal lands to market, reduce project costs and support the delivery of affordable housing, speed up the modernization of construction methods (such as standardized designs, Building Information Modelling, and offsite manufacturing), and "filling market gaps in financial product offerings."

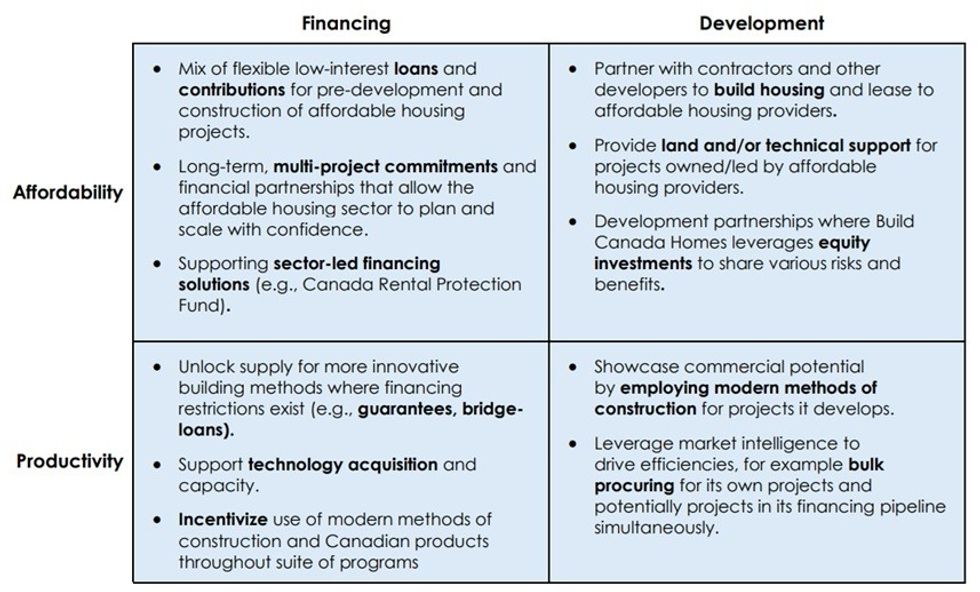

How BCH will operate can generally be split into two branches: financing and development.

Under the financing branch, BCH could provide a mix of flexible low-interest loans and contributions to get pre-construction projects off the ground. It could also provide long-term commitments towards multiple projects to affordable housing providers to help them grow their portfolios, or provide financing towards other financing programs such as the Canada Rental Protection Fund.

Other financing approaches could be more sector-focused, such as financing to support technology acquisition, incentivizing the use of modern methods of construction, and more unique financing options that may not currently exist.

On the development side, the guide notes that "A range of development approaches could be available to Build Canada Homes, from directly contracting builders to construct housing and leasing it to affordable housing providers, to acting as a facilitator by bringing together land, financing, project proponents, and other orders of government to move projects forward."

The BCH could also inject equity investments in development partnerships and leverage market intelligence to drive efficiencies (such as bulk procuring for its own projects), on top of showcasing construction methods with its own projects.

Other financial tools BCH may utilize include loans at below-market interest rates and with more flexible terms, such as with greater risk shares or longer amortizations. It may also provide loan guarantees, contingent liabilities, contracts for differences, and offtake agreements that reduce investment risk and provide federal assurance.

The Build Canada Homes Approach

"Build Canada Homes' investments may depend on the needs, risk profile, and potential to achieve Build Canada Homes' policy objectives," the guide says. The investment approach has four underpinning principles:

- Investment funding reflects housing outcomes;

- Sharing risk-taking to drive sector change;

- Sharing rewards in successful projects; and

- Leveraging sector expertise and convening partners.

BCH's investment selection criteria will also have four major pillars: scale (the number of affordable units or number of projects), affordability/community sector growth (such as co-ops, non-profits, and Indigenous housing providers), innovation in homebuilding (such as prioritizing Canadian-made materials and modern construction methods), and efficient use of public dollars (such as ensuring that private investors do not disproportionately benefit from public investment).

Finally, the federal government emphasizes partnerships.

"Build Canada Homes will not be able to drive results alone," the guide concludes. "The housing sector must be ready to respond to the opportunities Build Canada Homes presents. Strong partnerships with provinces, territories, municipalities and Indigenous partners are necessary to coordinate action to deliver key outcomes in the investment strategy."

During this public engagement period, the government says it is hoping to receive feedback from developers, community housing providers, governments, Indigenous governments, and financial institutions, as well as academics, research groups, and even institutional investors. The public engagement period ends on Friday, August 29.