Canadian borrowers should prepare to see their purchasing power slashed in the coming months; a half-point rate hike is all but guaranteed in next week’s Bank of Canada announcement, with more very likely on the way, according to market analysts.

Should these multiple supersized hikes come to fruition, that’s going to rapidly escalate the cost of getting, renewing, or refinancing a mortgage, even for those opting for a fixed rate, say lending experts.

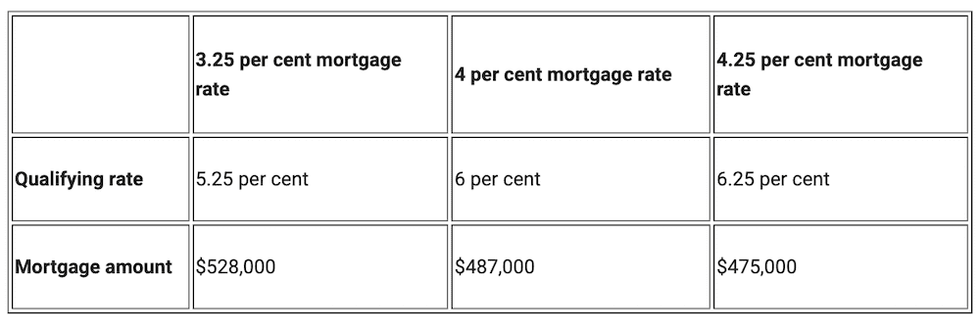

That’s because the impact of these hikes will be felt beyond just higher monthly payments for variable mortgage holders; they’ll also push more new borrowers to a qualification threshold that’s higher than the mortgage stress test. Currently, all mortgage applicants (not including those renewing with their existing lender) must prove they can carry their mortgage at a rate of either 5.25%, or their contract rate plus 2%, whichever is higher.

READ: As Fixed Mortgage Rates Hit 4%, Fewer Buyers Can Afford to Lock In

“Many homebuyers are not aware of this nuance, and it would affect their affordability even if home prices were to slow down or down over the next year," says Leah Zlatkin, mortgage broker and expert at LowestRates.ca.

She adds that this will effectively reduce competition in the mortgage marketplace, as more borrowers won’t be able to withstand being retested when switching lenders. “For those refinancing, a calculation above 5.25 per cent may mean they’ll need to stay with their current lender because they cannot afford to be stress tested at a higher rate. This eliminates the opportunity to shop around for better mortgage rates,” she says.

According to Zlatkin, keeping in mind that each mortgage is different, the change to the stress test will generally be felt on mortgage rates starting at 3.26%; for every 0.25% increase above 5.25%, buyers can expect about $12,000 less in financing.

She calculates that someone with a household income of $100,000 with a mortgage rate of 3.25% who qualifies at 5.25 per cent, would get a mortgage of around $528,000. At a rate of 4%, however, they’ll then be stress tested at 6%, reducing their buying power to approximately $487,000. That shrinks even further with a rate of 4.25%, resulting in mortgage eligibility of $475,000.

The Benefits of Variable “May Be Limited”

“Rate hikes coming in higher and faster than previously anticipated could quickly affect mortgage affordability for a significant population of homebuyers,” says Sung Lee, RATESDOTCA expert and licensed mortgage agent. “Major banks have already pushed fixed-rates higher several times over the past few weeks with some approaching the four per cent mark for uninsured products. Lenders are also decreasing the variable rate discount from prime.”

This has led to confusion for borrowers, who suddenly find themselves choosing between higher fixed rates now, or the promise of steeper variable rates to come.

“If the spread between variable and fixed-rate mortgages shrinks, the appeal of variable rates, for some, may also shrink,” he says. “While there still may be a number of months in which a variable rate could be beneficial, those days may be limited.”

Another option he sees coming to the foreground is the hybrid mortgage, which allows borrowers to split their mortgage into fixed and variable components (usually half-and-half). The two mortgages can have the same terms, or be set to different terms, for example a five-year-fixed rate and a three-year-variable rate. The split allows some protection in the case of skyrocketing rates, while taking advantage of a lower rate for part of the mortgage, bringing down monthly payments.

“Most people aren’t aware that hybrid mortgages exist. They think their only options are to go with either a fixed rate or a variable rate,” says Mr. Lee. “But at a time when rates are volatile, a hybrid mortgage comprised of a 50 per cent fixed rate and a 50 per cent variable rate could be a great option. Similar to taking a balanced approach to an investment portfolio, it’s possible to diversify one’s mortgage portfolio to hedge against interest rate risk.”