UPDATE: The Bank of Canada has chosen to hold the overnight interest rate for the third consecutive time.

This week — Wednesday, July 30 — brings another Bank of Canada (BoC) interest rate decision and, as has been the case in months past, trade talk is fully interlaced into the overall rate discussion.

Canada is now looking at a 35% tariff on all Canadian imports into the US after August 1 — on non-CUSMA-compliant exports.

Meanwhile, leading up to this week’s decision, we have the new data releases to think about that will play into Governing Council’s announcement. That includes the latest labour market numbers — which showed employment declining by 83,000, the unemployment rate falling to 6.9% — and the Consumer Price Index print, which came in at 1.9% year over year, up from 1.7% in May.

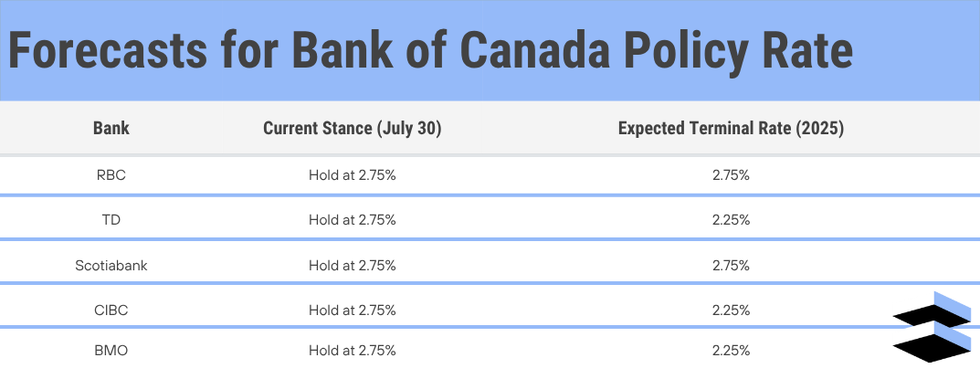

As for Canada’s ‘Big Five’ banks, there seems to be a consensus on what this week’s rate announcement will bring. In more specific terms, here’s what they’re forecasting. To recap: last month, we saw the central bank hold the policy rate at 2.75% — the level it’s been since March.

RBC: ‘Not this cycle’

Economists with RBC appear to be steadfast in their belief that the BoC will hold the policy rate steady. That said, they are anticipating that this week’s “May’s gross domestic product (GDP) report for Canada will likely show a larger 0.2% decline, though most of it is expected to have reversed in June.”

“Trade tensions remain heightened and economic data is still soft. However, the Canadian labour market showed signs of bottoming out in June, and sentiment indicators, which took a nosedive in March, have also partially recovered,” continued Claire Fan and Abbey Xu in a Friday report.

“Critically for Canada, CUSMA exemptions are allowing the vast majority of Canadian goods exports to enter the US duty-free. Echoing business reports from the latest BoC outlook survey, we continue to consider the most severe economic scenarios as less probable than earlier in spring, and expect the economy will remain soft over the second half of this year but won’t contract.”

According to Fan and Xu, the big data point to watch is inflation — “that have surprised broadly to the upside,” with “preferred core measures [having] edged higher in 2025.”

But all in all, RBC economists note that “a weakening but relatively resilient economic backdrop and prospects for larger fiscal spending are reasons why we do not expect the BoC will cut again in this cycle.”

The long-term forecast: The policy interest rate will be held at 2.75% — potentially until end of 2026.

TD: “Easing recession fears”

TD Economist Maria Solovieva put a similar forecast out in a weekly report, saying that while this week’s economic calendar “offered a clearer picture of business and consumer sentiment, along with a detailed look at May’s retail spending,” it also presented “easing recession fears” from a business standpoint specifically.

That said, “the tone from businesses was far from upbeat,” the report said — “Domestic demand is expected to stay soft. Firms’ future sales expectations turned negative for the first time in a year.”

On the consumer side of things, Solovieva wrote that “longer-term consumer inflation expectations ticked slightly higher, though are unlikely to cause much concern for the [BoC],” and that “firms also expect somewhat stronger input costs due to tariffs, though most say that they’ll absorb them through profit margins given weak demand.”

“In short, the data doesn’t signal a collapse, but it doesn’t suggest strength either,” the report went on to say. “This week’s releases don’t shift the dial for the Bank with July’s rate decision now essentially locked in – the employment report sealed a hold. The real question now is whether it stays on hold in September and beyond. For now, markets are only pricing in half a cut by year-end.”

The long-term forecast: The policy interest rate will be brought down to 2.25% by the third quarter of the year and through to at least the end of 2026.

Scotiabank: ‘No change expected’

Economists with Scotiabank have long been calling for a series of holds through 2025, which would keep the policy rate steady at 2.75%. Economist Derek Holt has particularly been a proponent of this, and said in a recent report that “no policy rate change is expected” at the forthcoming BoC meeting.

“Markets have no move priced. At the time of writing, the freshest estimates within consensus expect a hold but there remain several stale entries. Risk of a cut rests upon the BoC’s willingness to surprise (chart 17) but would be difficult to explain with a credible narrative,” he added.

“I wouldn’t be surprised to see the BoC continue to boycott the forecasting business by holding off on the production of a base case projection in favour of scenarios as it did in the last MPR in April. If it does produce a base case projection, then they would have to explain what gives them confidence to do so.”

In addition to inflation remaining hotter than it should be — with trimmed and weighted CPI leading the charge — Holt pointed out that the central bank doesn’t have a “clue what trade and fiscal policies might unfold,” leaving Governing Council in an especially tough spot and “not indicating any great reason to rush a decision other than on a total policy lark.”

The long-term forecast: The policy interest rate will be held at 2.75% in 2025, but brought down to 2.50% at some point in 2026.

CIBC: ‘Widely expected hold’

CIBC Economist Benjamin Tal is on board with the majority of Big Five economists, in that he’s calling for an interest rate hold this week — “although we suspect that it will keep the door open to future cuts should core measures of inflation ease back again,” he added in a weekly report.

“Updated forecasts are likely to show a further modest build up of slack in the economy in the near term followed by a gradual recovery. While June’s advance estimate for GDP (released a day after the BoC meeting) may show a modest rebound in activity, the economy still appears likely to have stalled during Q2 as a whole.”

Tal also touched on what’s going on in the US, underscoring the “long list” of data releases — GDP, payrolls, JOLTS, ECI, ISM and the June core PCE report — which will all play into the July 30 FOMC meeting. “Friday also represents the President’s self-imposed deadline for trade negotiations, meaning we shouldn’t be surprised to see some announcements of deals, or unilateral tariffs being applied,” wrote Tal.

The long-term forecast: The policy interest rate will be brought down to 2.50% in September and to 2.25% by December.

BMO: ‘Both hawks, doves have reasonable cases’

On the same page as CIBC’s Benjamin Tal is BMO’s Robert Kavcic, who also called for a pair of rate holds this week from the Federal Reserve and Bank of Canada in a July 25 report.

“We see both central banks firmly on hold at these upcoming meetings, but continue to assume further easing later in the year,” he said. “For the Fed, they are still balancing the risk of tariff-driven inflation against slower growth and still above-neutral rates. It’s likely just a matter of time before they move rates lower (September in our view). For the Bank of Canada, both the hawks and doves can make very reasonable cases at this point.”

Kavcic also highlighted that the BoC has lowered the policy rate by a total of 225 basis points to date — “back to what they consider neutral, while core inflation is still trending around 3%,” he added. “But, the job market is soft and the output gap is widening, arguing for rates at the lower end of the neutral range.”

The long-term forecast: The policy interest rate will be brought down to 2.25% in October and held at that level through to the end of 2025.

- Scotiabank, RBC Only Big Banks Not Calling For More Interest Rate Cuts This Year ›

- What’s In Store For Interest Rates In 2025, According To Every Big Bank ›

- Bank Of Canada Holds Interest Rate For Second Time In A Row ›

- Third Straight Hold: Bank Of Canada Keeps Interest Rate At 2.75% ›

- Where Every Big Bank Stands On September's Interest Rate Announcement ›

- Bank Of Canada Holds Interest Rate In First 2026 Decision ›