Turns out, a half-point interest rate hike isn’t all that extraordinary; following the U.S. Federal Reserve’s move to increase its Federal Funds rate by 0.75% on June 15th -- the largest since 1994 -- expectations are now solidifying for the Bank of Canada (BoC) to follow suit, further amping up borrowing costs for consumers.

The Fed’s move, made in response to an unexpectedly-high May inflation read of 8.6% -- a 40-year record -- brings its rate range to 1.5 - 1.75%.

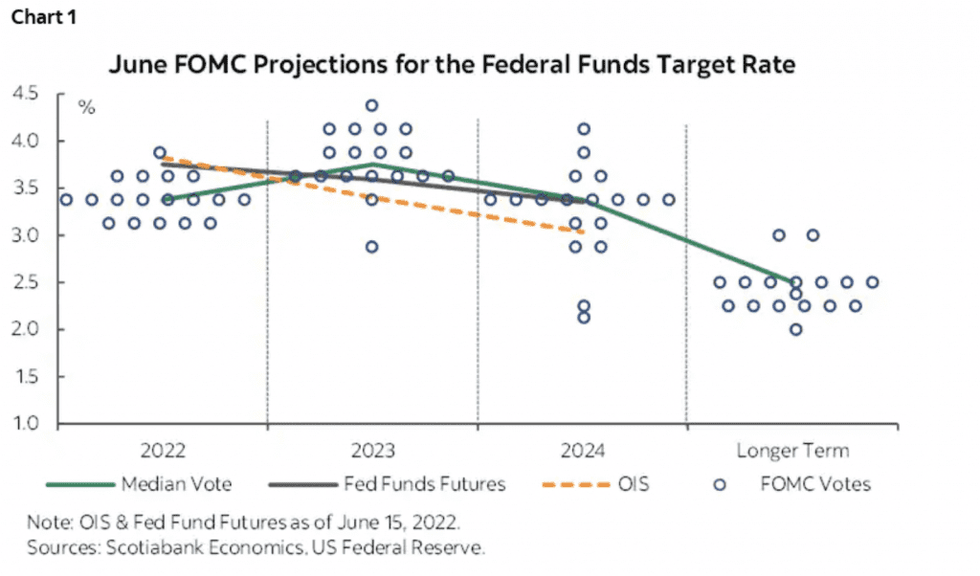

In a press conference following the Fed’s announcement, Chair Jerome Powell doubled down on more large hikes to come, saying another 0.75% increase is possible in its next meeting on July 27, with a half-point hike coming at a minimum. The market is now pricing in that the fed funds rate will rise to 3.4% this year, and to 3.8% by the end of 2023, before easing again to 3.4% in 2024.

Such an aggressive rate trajectory has led to fresh stock market correction, and has raised questions as to whether a similar-sized move -- or even a full-percentage hike -- could now be made by Canada's monetary policymakers.

Economists are certainly starting to think so.

In a note to investors, CIBC World Markets Chief Economist Avery Shenfeld and Capital Markets Senior Economist Katherine Judge wrote, “There’s little doubt that major central banks are fully engaged in an effort to bring inflation back down to earth. Monetary tightening will push up interest rates in the months ahead, and given intensified price pressures, we’ve moved all of the rate hikes into 2022 and added to our peak targets in the U.S. and Canada from where we stood a month ago. That will likely include 75 basis point hikes by both the Bank of Canada and the U.S. Fed at their next rate setting dates.”

In an interview with BNN Bloomberg, former BoC Governor David Dodge said that given central banks’ main mandate right now is to hit a neutral range as fast as possible, the size of the hikes themselves is of less importance.

“I think it's been quite clear that central banks need to get up to neutral in North America quickly to make up for lost time in 2021,” he said. “Whether they're going by 50 [basis] points, 75 [basis] points, or even making a full-point move really isn't so much the issue. The issue is to get it up quickly and to signal to the world that they are getting it up to neutral.”

A “Case Could Easily be Made” for a 1% Hike

Rob McLister, Mortgage Strategist at MortgageLogic.News, told STOREYS that Canada’s central bank “may have little choice” but to match the Fed’s 75-basis-point (bps) hike.

“The two central banks routinely coordinate given their economic ties. The BoC is fully cognizant of potential cross-border economic imbalances (e.g., adverse currency effects) if it were to take a harder line than the Fed,” he says.

While a “case could easily be made” for a full-point hike, given the BoC’s delayed start to its hiking cycle and increasingly un-anchored expectations for inflation, he points out that as of June 16th, the bond market was still pricing in a maximum 75 bps increase in the Bank’s next policy announcement on July 13. That could also mean the steep upward trajectory seen in the fixed-rate mortgage market could soon hit a ceiling.

“The bond market expected the Bank of Canada to stop hiking around 3.75%, or 225 bps higher than today,” he says. “If this terminal rate expectation holds, it's very unlikely five-year yields would exceed that level. In other words, odds are that we're not far from the top in five-year fixed rates. I'd be surprised if prime uninsured five-year fixed rates rose much into the 6-7% range. The typical discretionary rate on a big bank uninsured five-year fixed today is 5.14%.”

Government five-year bond yields hit a new decade high this week on the news of the super-charged Fed hike, reaching a peak of 3.56%, before moderating slightly to 3.34%.

As those yields soar, mortgage borrowers have been increasingly shut out of fixed-rate options. In a previous note, McLister pointed out that borrowers haven’t had to qualify at rates like today’s in 20 years, especially factoring in the OSFI mortgage stress test, which tacks on an additional 2% to borrowers’ mortgage qualifying requirements. That means today’s five-year fixed applicant is looking at a hurdle in the 6% - upper 7% range in order to secure home financing.