The industrial real estate market in Metro Vancouver is defined by a shortage of available space and land, and the amount of dollars being poured into industrial real estate shows that the demand is still strong.

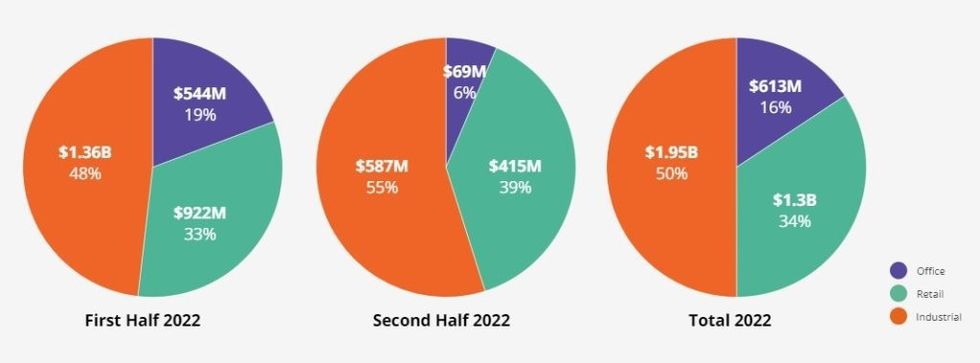

According to a year-end report published by Avison Young this week, the industrial market totaled $1.95B in sales in 2022, while the retail market totaled $1.3B and the office market totaled $613M. That means the industrial market accounted for 50% of the total $3.9B in commercial real estate sales in BC last year, while the retail market accounted for 34% and the office market accounted for just 16%.

That split remained mostly steady across the year as well, although most of the sales for all three markets occurred in the first half of the year.

Industrial

On the industrial side, the first half of the year saw 79 transactions, while the second half saw just 47, but the biggest deal of the year came in the latter -- in December -- which saw Beedie acquire a 9.66-acre facility on 7303 Meadow Avenue in Burnaby, near the Market Crossing shopping centre on Marine Way and Byrne Road, for $83M.

That deal was somewhat of an outlier, however, as only seven of the 47 transactions (15%) in the second half of the year were over $20M, after 23 of the 79 transactions (29%) in the first half surpassed that value.

"Private investors remained the most active stakeholders within this asset class on both sides of the transactions," Avison Young says, pointing out that only three purchases in the second half of the year were made by non-private entities.

Avison Young also notes that the strata industrial market was also affected by last year's interest rate increases, noting that 2022 saw a "record level of releases of units as interest rates rose."

READ: Red Bull, Hungerford, Denciti Move On Industrial Land Outside Metro Vancouver

Office

After recording 20 transactions in the first half of the year, the office real estate market saw just six in the second half, with just one transaction over $5M in each of Vancouver, Richmond, Langley, Burnaby, New Westminster, and Coquitlam.

The largest transaction of the second half of 2022 was a $22M deal for a three-parcel assembly on 309-321 Sixth Street in New Westminster, which is currently occupied by a four-storey office building, but has actually been designated by the City for redevelopment into a multi-family building, according to a CBRE sales brochure.

The year's interest rate hikes had a much larger effect on the office real estate market, however, which was compounded by timid returns to office.

"This year's theme of rising development and financing costs resulted in projects being shelved or cancelled, which extended its way to certain strata office projects," Avison Young says. "With the uncertainty surrounding rising interest rates continuing into 2023, developers are expected to continue reassessing the viability of strata office projects until proformas start penciling out in their favour."

On a more positive note, Avison Young points out that interest in office space is peaking out in the suburban markets, such as Langley, which saw multiple strata office projects completely sell out and one project -- the Langley Business Centre -- pivot from leasing to strata.

READ: 33-Storey Vancouver Centre II Downtown AAA Office Building Now Complete

Elsewhere, the retail real estate market, totalling $1.3B for the year, "continued to appeal to investors as a source of steady cashflow with future redevelopment potential," Avison Young says, and -- like both the industrial and office market -- was driven by private investors.

The COVID-19 pandemic brought an increased demand for grocery-anchored retail, and supply was also an issue, resulting in numerous single-space retail properties achieving above-market rental rates, particularly in the suburban markets. Avison Young notes that the perception of retail continues improving, and will thusly keep it as an appealing investment opportunity going forward.