Canada's housing supply issue intensified in November, as buyers continued to purchase the limited inventory available, pushing the average price of a home to a new all-time high in the process.

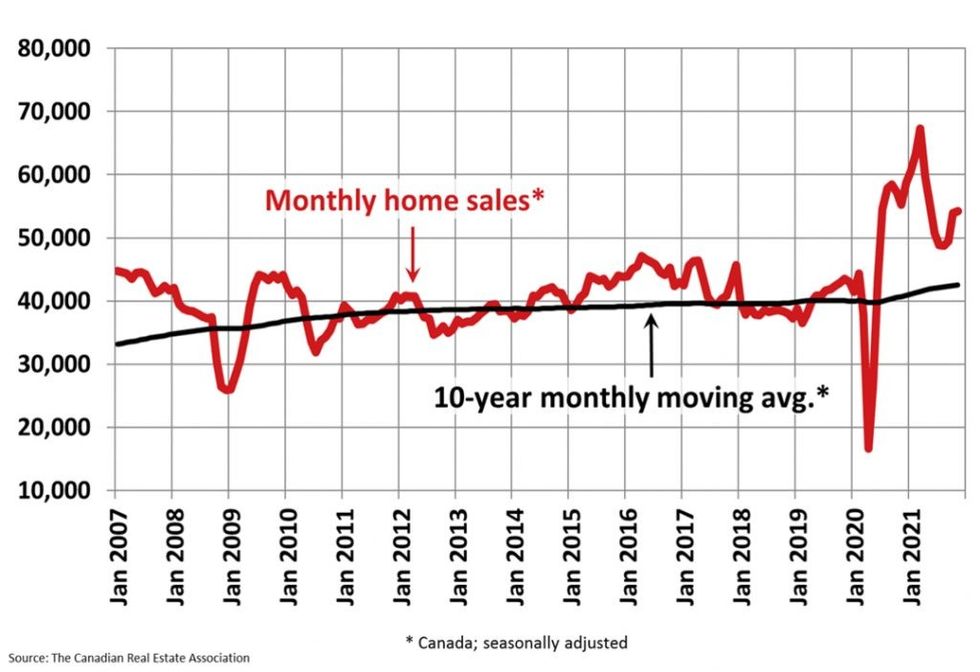

In November, national home sales rose 0.6% on a monthly basis to 54,222 after posting a 9% increase in October, but when compared to a year ago, actual home sales were down 0.7%, according to the Canadian Real Estate Association (CREA).

On a year-to-date basis, some 630,634 residential properties have already traded hands, far surpassing the annual record 552,423 sales for all of 2020.

The association says the number of newly listed homes also rose by 3.3% on a monthly basis in November, driven by gains in a little over half of local markets, including the GTA, Vancouver Lower Mainland, Montreal, and many markets in Ontario’s Greater Golden Horseshoe.

READ: Omicron Will Only Stoke the Fire of Canada’s Already Red-Hot Real Estate Market

“Housing cycles can be very long, so market trends do not care that we’ve put new 2022 calendars up on our refrigerator doors,” said Shaun Cathcart, CREA’s Senior Economist. “The fact is that the supply issues we faced going into 2020, which became much worse heading into 2021, are even tighter as we move into 2022.

With new listings up by more than sales in November, the sales-to-new listings ratio eased slightly to 77% compared to 79.1% in October. The long-term average for the national sales-to-new listings ratio is 54.9%.

At the end of November, CREA says there were just 1.8 months of inventory left on a national basis, which is tied with March 2021 for the lowest level ever recorded.

In line with some of the tightest market conditions ever recorded, the Aggregate Composite MLS HPI was up another 2.7% on a month-over-month basis to $790,600 in November. At the same time, the non-seasonally adjusted Aggregate Composite MLS HPI was up by a record 25.3% on a year-over-year basis in November.

The average selling price of a resale home in Canada last month was $720,850, beating the all-time high that was set in March of this year.

On a provincial basis, CREA says Ontario saw year-over-year price growth hit 30% in November with the GTA continuing to surge ahead after having trailed most other parts of the province for most of the pandemic.

Year-over-year price growth has also crept back up to nearly 25% in BC, though it does remain lower in Vancouver. Greater Montreal’s year-over-year price growth remains at a little over 20%, while Quebec City was only about half that. Gains are still in the mid-to-high single digits in Alberta and Saskatchewan, while gains have risen to about 13% in Manitoba.

The association says in Atlantic Canada, price growth is running above 30% in New Brunswick (higher in Greater Moncton, lower in Fredericton and Saint John), while Newfoundland and Labrador is now at 10% year-over-year (lower in St. John’s).

“November provided another month of evidence that the housing supply/demand issues facing the country have not gone away,” said CREA chair Cliff Stevenson. "Even at what is traditionally the slow time of year for housing, conditions and price trends are at the same record levels we saw this spring

."

Stevenson said things may calm down a bit through December and January, but next year’s spring market will "no doubt be an interesting one."