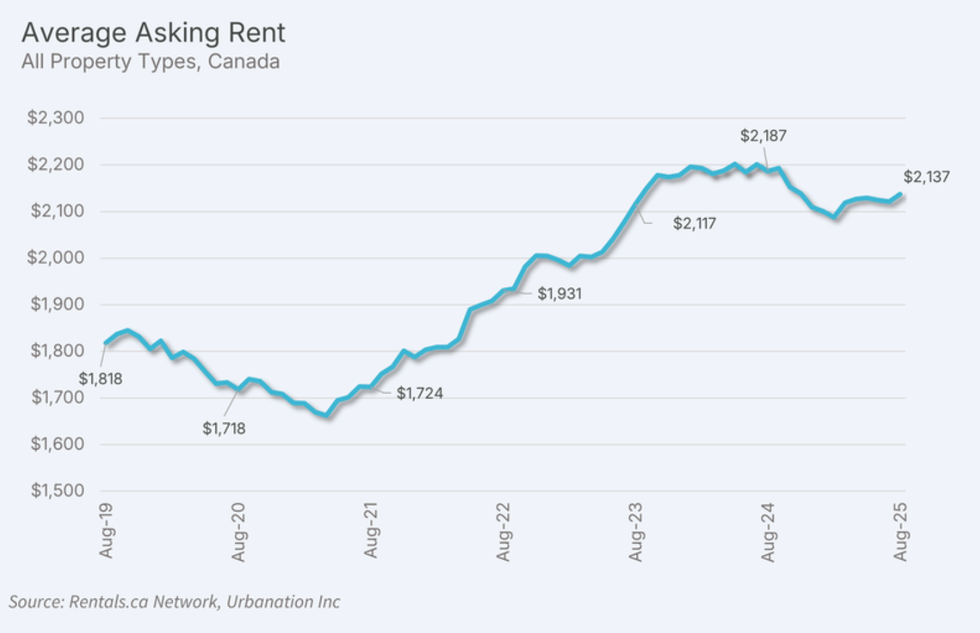

According to the latest rent report from Rentals.ca and Urbanation, August marked the eleventh consecutive month in which the national average rent declined on a year-over-year basis. This is also "the longest stretch of rent declines since the early pandemic period," says the report.

With just shy of a year of sliding rents under the nation's belt, the average price a Canadian pays to rent their home now sits at $2,137, down 2.3% from August 2024.

But despite the sustained downwards trajectory, rents are still perched 1% higher than they were two years ago, highlighting just how expensive prices became in the wake of the pandemic. Looking ahead, President of Urbanation Shaun Hildebrand says affordability should continue to improve for renters.

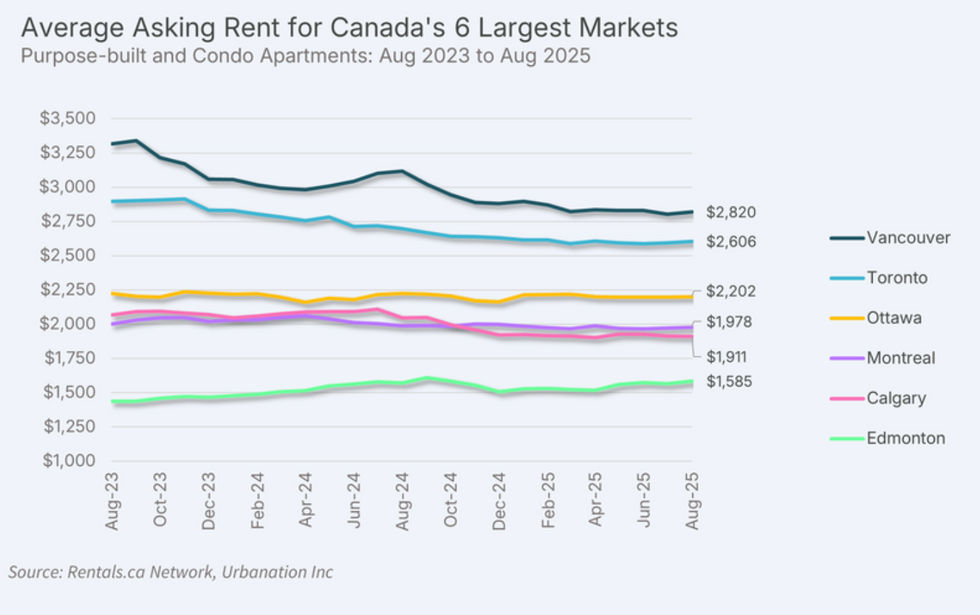

“Rents have decreased in Canada on an annual basis for almost a year now. However, rent reductions have been mild for the most part, with the steepest declines found in Vancouver, Toronto, and Calgary, where rents are high and new apartment supply has been growing quickly," he says. “Conditions should continue to favour renters in the coming months as the market enters its slower season.”

In Toronto, in Q1-2025 alone, purpose-built rental completions totalled 2,136 units, up 173% from the same period last year and representing the second highest quarterly total of the past 30 years, according to data from Urbanation.

On top of the supply glut, other factors keeping rents down include softening demand due to lower immigration and relatively lower interest rates reducing mortgage costs for landlords — two trends expected to continue for the foreseeable future.

House and townhome rentals saw rents slide the furthest in August, posting a 6% decline year over year, followed by condos at 3.7% and purpose-built rentals (PBRs) at 0.4%. These numbers echo the longer-term price trend which saw rents for PBRs grow by 22.6% over the last three years, condos by 4.3%, and homes and townhomes decrease by 0.4%.

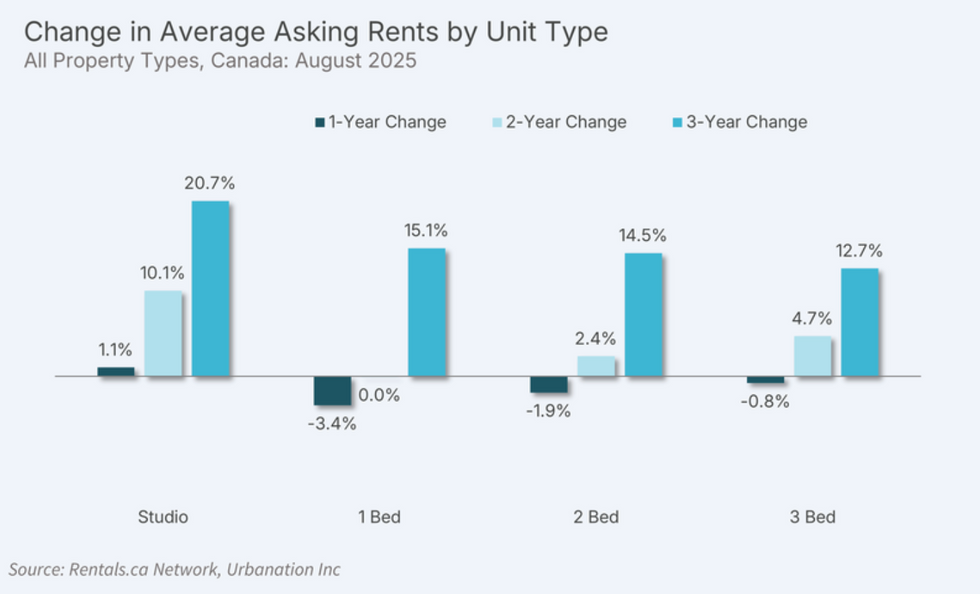

In terms of units types, three-bedroom PBRs performed the best in August, up 3.5% to $2,772, while condo studios brought up the rear with a 7.7% decline year over year. But across the entire market, studios continued to outperform other unit types, posting 1.1% growth annually, 10.1% over the past two years, and 20.7% over the past three years. For comparison, one-, two-, and three-bedroom units have all seen rent declines on a year-over-year basis.

But according to the Canada Mortgage and Housing Corporation's (CMHC) 2025 Mid-Year Rental Market UpdateMid-Year Rental Market Update released in July, growing demand for three-bedrooms could draw renters away from studios as affordability pressures persist. "This shift may make it harder for smaller units to attract tenants as households prioritize space-sharing to save money," reads the report.

Geographically, Vancouver proper remained the most expensive market in Canada, followed by North Vancouver at $3,056, Richmond, BC, at $2,740, and Oakville, ON, at $2,700. But while BC is home to some of the priciest rentals in the country, the province saw rents fall by 2.7%, second only to Alberta at -3.5%. In Ontario, rents slid -2.5%, while Saskatchewan led rent growth at 3.2%

Vancouver also saw rents fall by 9.5% — the greatest degree of all major cities — followed by Calgary at -6.6%, Toronto at -3.4%, and Ottawa at -1.0%. On the flip side, Edmonton rents ticked up by 0.9% in August. Still, Alberta is home to some of the most affordable markets in the country, including Lloydminster, where average rent is $1,179, Medicine Hat at $1,287, and Fort McMurray at $1,364.