Real estate markets across Ontario have seen a spring revival, with prices and activity rising steadily over the last few months.

When the Bank of Canada paused interest rates for two consecutive announcements in March and April, buyers returned en masse, pushing the average price in the Greater Toronto Area to $1,196,101 in May, a 3.5% increase from April, which followed a 4% jump from March.

Locally, average home prices hit $1,197,021 in the City of Toronto, $1,366,290 in Caledon, $1,415,877 in Markham, and $1,554,259 in Oakville in May. The cheapest municipality in the GTA in May was Essa, which had an average home price of $776,603; Canada's national average home price was $729K.

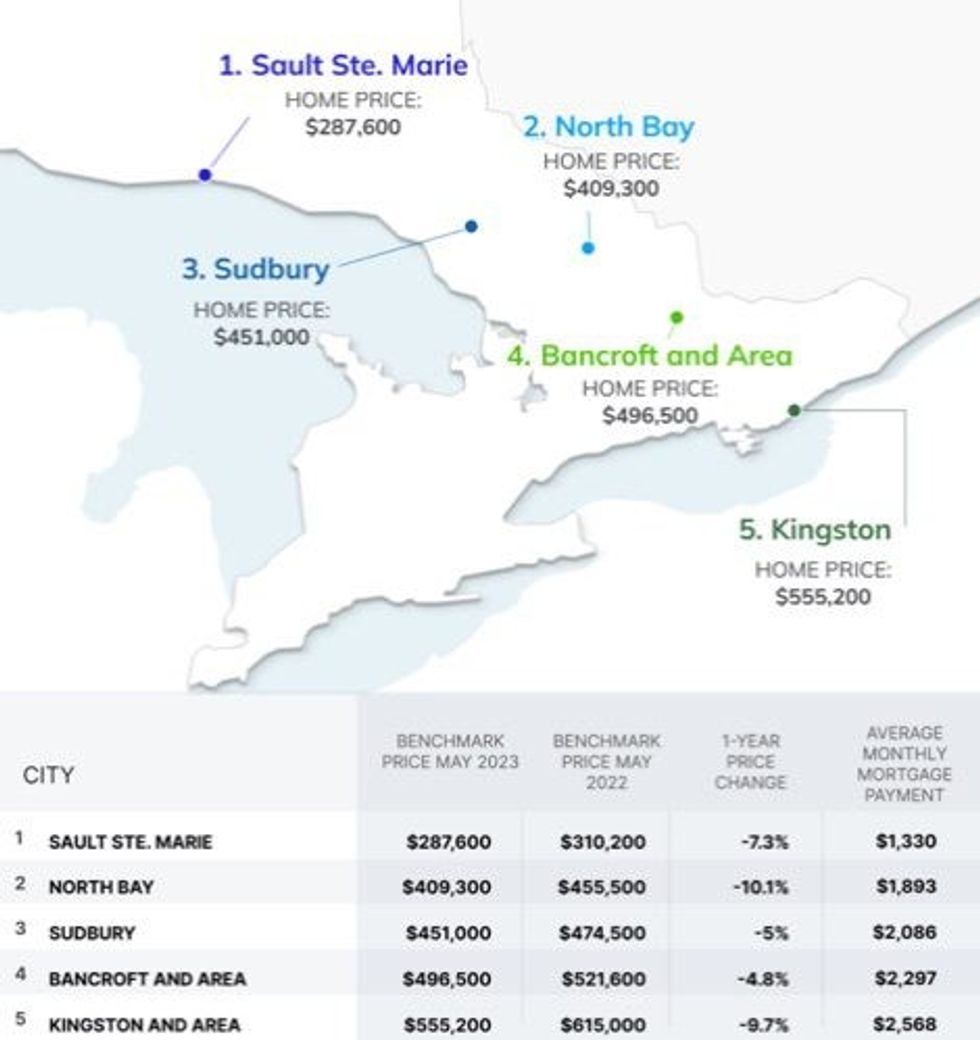

With prices soaring in markets across the province, Zoocasa sought to determine where affordable homes can still be found in Ontario. To do so, the real estate agency compared the average home price in 28 cities and calculated the average monthly mortgage payment required to purchase such a property.

Home prices were sourced from the Canadian Real Estate Association's May 2023 data, and average monthly mortgage payments were calculated assuming a 20% down payment with a 25-year amortization period at a 4.94% rate.

READ: How Home Buyers Have Reacted To The Return Of Interest Rate Hikes

Unsurprisingly, given the aforementioned home prices, the lowest prices lie far from the GTA.

According to the report, the locale with the lowest monthly mortgage payments in Ontario is Sault Ste. Marie. As of May, the city's average home price was $287,600 -- about $909K less than Toronto's -- requiring a monthly mortgage payment of just $1,330 -- nearly $1,500 less than the average rent in Toronto.

North Bay was a distant second, with an average home price of $409,300 -- although the price has fallen 10.1% since May 2022. Such an abode requires an average monthly mortgage payment of $1,893.

Sudbury was deemed the third cheapest city in Ontario, with an average home price of $451K and a corresponding monthly mortgage of $2,086. Bancroft followed, with an average home price of $496,500, which requires a monthly mortgage payment of $2,297.

Kingston, in fifth place, was the only city included in the report with an average home price above $500K. At $555,200, though, it was still far more affordable than even the cheapest GTA city, and was down 9.7% from May 2022. The average monthly mortgage payment for Kingston's average-priced home was $2,568, $240 less than rent in Toronto.

Although affordability persists in some Ontario markets, it will take a hit if the Bank of Canada raises interest rates tomorrow as some experts expect. If the bank delivers on its anticipated 25-basis-point increase, many mortgage borrowers will "feel the pinch of higher payments."