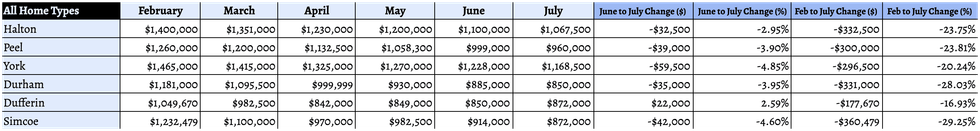

Home prices in the 905 region took another hit in July, falling even further away from their February peak.

An analysis of sales data from the Toronto Regional Real Estate Board (TRREB) found that some regions in the 905 saw average home prices plummet nearly 30%. Simcoe County, home to towns like Collingwood, Innisfil, and Wasaga Beach, has seen the largest drop, with prices there down 29.25% from February to July -- a loss of $360,479. Simcoe also saw the largest month-over-month decline, with prices slipping 4.6% from June to a new average of $872,000.

READ: Home Prices in Toronto Have Dropped More Than $500,000 in 6 Months

Durham wasn't too far behind, with the average home price there now down 28.03% from the February peak. York, Peel, and Halton have all seen declines of more than 20%, and in Dufferin, prices have fallen nearly 17%.

Homeowners who bought during the peak are now having to reconcile with the fact that their home is currently not worth as much. Durham-based broker Cliff Liu has observed this first-hand, pointing to a pair of newly-wed clients from earlier this year who purchased a home in the Rolling Acres neighbourhood of Whitby in February.

"Right after, a couple more houses came on market in the same area," Liu said. "They were just sitting for almost two months. Now they sold for almost $100,000 less than what my client had paid."

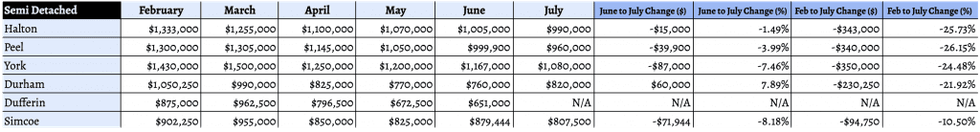

As to be expected, the decline in prices is affecting certain types of housing more severely than others. Detached homes saw some of the largest drops, with prices in York sinking nearly 38% from their February high of $1,430,000 to a new average of $1,080,000. York also experienced a substantial drop in the prices of its semi-detached houses, which fell 24.48%. Halton and Peel saw even bigger losses, with their semi-detached homes down 25.73% and 26.15%, respectively.

But Liu notes that the type of housing he's seeing be the most affected by the changing 905-area market is entry- and mid-level homes. Houses that were once going for $1.4-1.6M are now fetching $1.1-1.2M, he says. The luxury market, on the other hand, has been more protected.

"There are some new builds that were selling back in February for $2M," Liu said. "Between February and July, there's been a few that have been sold for $2.5M, $2.7M, or even above $3M."

Condos, although less common in Dufferin and Simcoe with as little as one, or sometimes even none, selling each month, saw significant drops in prices. Halton, Peel, York, and Durham all saw double-digit declines from February to July, with Durham condo townhouses seeing the biggest drop of 23.81%.

These falling prices were brought on by a drop in demand in the 905 region, fuelled by a combination of rising interest rates, soaring inflation, and a renewed interest in being closer to major urban areas. Although summer is typically a slower time in real estate, when comparing the number of sales seen in July 2022 to those of July 2021, there's a drastic change. In fact, sales are down around 50% year over year for detached homes, semi-detached homes, townhouses, and condo apartments in the 905.

Homeowners who bought at the peak might be kicking themselves now that the market has cooled, but Liu says it's not the total loss they may think it is. With the Bank of Canada rapidly raising interest rates, buyers who get a mortgage now might actually end up paying more.

"If you get it now, even though the price may be a little bit lower, you will be paying much more but all towards the interest and you're not building your equity," Liu said. "The other thing too is those people who bought, like for example, my clients who just got married, they're planning to stay in that house for the next five to 10 years, so I tried to tell them to look long term. An immediate drop in the housing price doesn't matter because you're building your equity."