As consumers and investors are increasingly transacting in de-regulated, online marketplaces -- such as the metaverse -- how consumer data is held by third-party service providers is a growing concern.

Currently, over 4M Canadians use the “screen scraping” method -- the automatic process of pulling data from the internet -- to share their financial data and access financial tools, according to Finance Canada.

However this can cause security risks since consumers are required to share their banking login credentials with third-party service providers (TPPs), also known as data brokers, who can copy consumers’ data and use it however they see fit. And this is done without consent.

Open banking, on the other hand, is a system that enables consumers to transfer their financial data between financial institutions and accredited third parties in a secure and consumer-friendly way. Could it be a way to reign in the control?

What is Open Banking?

Open banking rests on the principle that an individual has the right to control, edit, manage, and delete information about themselves and decide how and when this information is communicated to others.

The Canadian government has also been taking steps to create a formal open banking system in the financial services sector. In April 2021, an Advisory Committee on Open Banking, first appointed in 2018, submitted its final report, outlining the path in order to do so.

READ: Could the Metaverse Be the Next Big Thing in Real Estate?

The report recommends a “hybrid, made-in Canada approach that recognizes the potential for government and industry to collaborate, each with appropriate roles.”

Further recommendations include designing a common set of rules, an accreditation framework, a process to allow third-party providers (TPPs) to enter an open banking system, as well as technical specifications to allow for “safe and efficient data transfers.”

“The flow of data among financial institutions and third-party service providers must always be subject to express consent,” reads the report. Consumers can opt to move their data in one direction to allow back-and-forth exchanges of data between two parties.

The Committee also recommends limiting the scope of open banking functions to less risky, read-only activities. So, TPPs would be able to receive consumer financial data but they would not be able to edit this data on banks’ servers. By taking these measures, the Committee believes open banking could be rolled out to Canadians quicker and with necessary caution.

In March 2022, 222 days after the Committee’s final report was received, the Council of Canadian Innovators (CCI) penned a letter reminding the government of its first commitment of appointing an open banking lead.

The government swiftly responded and appointed Abraham Tachjian, the former director of digital banking at the accounting firm PwC, to oversee the proposed open banking system, which was anticipated to become operational by January 2023.

The Push for Consolidating Financial Data

Michael Garrity is one of the members of the Council of Canadian Innovators (CCI) and signed the letter sent to nudge for government action. Garrity is the co-founder and CEO of Financeit, a Toronto-based credit lender which provides credit offerings for merchants selling items to consumers predominately in the home improvement sector.

The company does $800M dollars a year in loan origination, with 8,000 merchants in Canada, according to Garrity, who adds that they personally vet every merchant to the platform.

“We have to go to third-party data sources to find out as much as possible about every merchant applying to join the platform,” Garrity tells STOREYS. “It’s not easy to vet people; we are looking to see if they are a customer who will pay us back.”

Garrity says the vetting process is imperfect.

“Each database has a slice of data about a person, so you have to get whatever data you can assemble, stick it in a data system and platform, wall it off, and have your own security measures,” he says.

Garrity says each customer should hold their own data, and an authorized set of people would be cleared to access that data to get better products and services to consumers. He also says open banking would allow people to build credit history in a different way so that “you can get ‘yes’s’ more often.”

A representative from Finance Canada said open banking will improve Canadians’ user experience by providing faster access to credit.

“Open banking is also part of the government’s work to provide stronger data protection and enhanced rights for consumers. This is an important step to foster greater inclusivity and support for vulnerable communities across Canada,” the official told STOREYS.

Open Banking Could be Utilized in Rental Space

Stephen Hogg is the open banking lead at Mastercard, a role he assumed earlier this year. He says open banking will allow for the collection of more data including rent and telecommunications payments, which can create more comprehensive record of a person’s finances.

“If you’re engaging in a digital channel and you’re presenting facts through open banking; so, here’s my finances, here’s my income, here’s my cashflow -- it doesn’t matter what background you have -- it just matters about the overall financial picture. That’s how financial decisions should be made,” Hogg says.

He says it is not banks or fintechs who are creating the need for open banking, it’s consumers and small businesses driving demand that the marketplace is now responding to.

“One of the benefits of open banking, and open data, in general, is that you get a more holistic picture of a person or small business when they are engaging a new institution, whether it be a fintech, banks, or otherwise,” says Hogg, adding that getting access to capital remains a pain point for consumers and businesses alike.

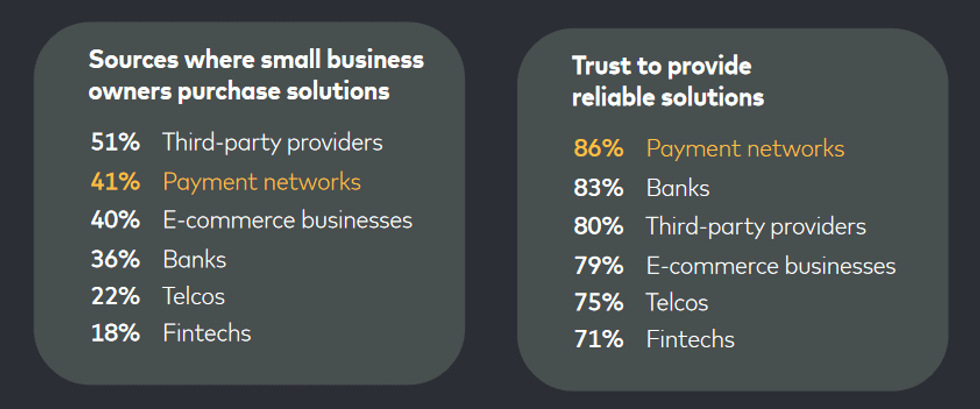

Hogg references Mastercard’s “The rise of open banking and the importance of cybersecurity amid cost uncertainty,” 2022 report, which surveyed 3,500 business owners from Canada and the United States.

Mastercard cites three open banking use cases: account opening, lending, and financial management. The report found that funding is an ongoing issue for most businesses, with 61% of Canadian business owners indicating they had received a loan and 83% saying they are looking for quicker access to capital, especially coming out of a very trying two years for the economy.

According to the report, 95% of Canadian small business owners currently link financial accounts, and 85% are looking for ways to customize the use of their data.

71% of Canadian business owners say they would share business performance data with financial institutions if it meant a decreased reliance on credit scores for loans. By contrast, 77% of U.S. businesses would be keen to share their financial data for the same opportunity.

Hogg says other markets are further ahead in open banking than Canada, and that is largely driven by regulation within those markets.

“The Australian, the U.K., and Brazil markets saw regulation which forced the hand of participants to get in line and get engaging from an open banking perspective. Meanwhile, Canada has been largely market-driven with new products and services in the form of fintechs leading open banking activity,” says Hogg.

Hogg says Canada is in a good position and can learn from other markets who are further ahead.

“We are not out ahead internationally but there is some value of being a fast follower and benefitting from all the learnings from other geographies,” says Hogg.

Note: STOREYS asked Finance Canada to confirm whether the open banking system will be operational by January 2023, but did not receive any confirmation back by publish time.