On Thursday, Canada Housing and Mortgage Corporation (CMHC) published its bi-annual housing supply report, which focuses on new housing construction trends in Montréal, Ottawa, Toronto, Edmonton, Calgary, and Vancouver.

CMHC found that total housing starts across those six census metropolitan areas (CMAs) — the six largest in the country — increased by 4% in the first half of 2024 compared to the first half of 2023, rising from 65,905 to 68,639 units.

However, it was a different story when you zoom in on Metro Vancouver, where housing starts fell in the first half of this year. CMHC attributed the decline to "slow sales and high financing costs" that "reduced profitability and increased risks."

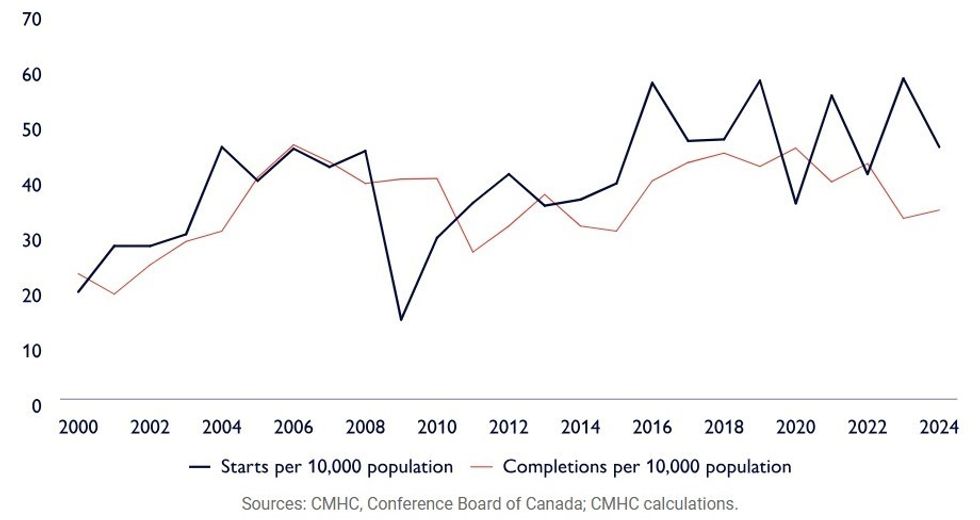

The total number of housing starts remained at near historic highs, but rapid population growth contributed to a decline in population-adjusted starts, said CMHC. When adjusted for population size, the number of housing starts dropped from last year's peak of 58.0 starts per 10,000 population to 45.6.

Meanwhile, completions per 10,000 population saw a small uptick from 32.7 to 34.2, but both are still the lowest totals since 2015, when the number was at 30.4.

Rental vs. Condo

Discussing the drop in starts in Vancouver, CMHC said most of the loss was due to a decrease in new condominium construction. Rental construction also saw a decrease, but the decrease was "relatively marginal."

In the City of Vancouver, about two thirds of multi-family unit starts were rental units, with developers citing profitability as the main factor for choosing rental over strata.

"Further away from the city, lower land costs made condominium construction easier," said CMHC. "This trend was clear in Surrey, Coquitlam, and Richmond, the cities with the next most apartment starts in the first half of 2024. Apartment starts in these cities were mostly intended for the condominium market."

This has also been reflected in pre-sale project launches. Since fall 2023, both the Metrotown area of Burnaby and the City Centre area of Surrey have seen large clusters of high-rise project launches, while the launches in Vancouver have primarily been low-rise or mid-rise projects.

Construction Trends

Another trend CMHC identified was that developers across Metro Vancouver chose to move forward on low- and mid-rise buildings, with over half of the multi-family units started during the first half of this year belonging to buildings between four and six storeys.

"This preference for smaller structures may be due to various factors limiting apartment height, including higher development cost levies for some higher-density projects," said CMHC. As one example, the crown corporation said that the development cost charges for one 550-sq.-ft unit in the City of Vancouver would amount to $19,500 in a high-density project, while the same apartment would see development charges amount to around $11,700 in Surrey. Waivers are often available for rental projects, such as in the City of Vancouver, likely contributing to the favouring of rentals over condos in Vancouver.

In terms of construction duration, CMHC found that average construction time for both rental and condominium projects continue to trend upwards, reaching an "all-time high" of 20.4 months in the first half of 2024. Notably, this is despite the fact that the average number of storeys and units per building not seeing a significant change from the five-year average.

"Some developers said changing zoning regulations were a reason for longer construction periods. At the same time, others opted to extend the length of their land loans as projects didn’t meet sales targets," said CMHC. "Additionally, rising costs and challenging financing conditions have pushed some smaller operators to sell their planned projects."