Vacant Home Tax

A Vacant Home Tax is a municipal levy on empty residential properties to discourage speculation and boost housing supply.

September 30, 2025

What is Vacant Home Tax?

A Vacant Home Tax is a municipal tax levied on residential properties that remain vacant for extended periods, typically six months or longer. Cities like Toronto, Ottawa, and Vancouver have implemented such taxes to discourage speculation and increase rental availability.

Why Vacant Home Tax Matters in Real Estate

Vacant Home Taxes matter in real estate because they address housing shortages at the municipal level. They motivate owners to rent out unused properties, generating additional housing supply and tax revenue for city programs.

Example of Vacant Home Tax in Action

A homeowner in Toronto leaves a condo empty for most of the year. They are assessed a Vacant Home Tax of 1% of the property’s assessed value unless exemptions apply.

Key Takeaways

- Implemented by municipalities to address vacancy.

- Applies when homes are left empty for extended periods.

- Encourages owners to rent out properties.

- Rates typically set as a percentage of assessed value.

- Supports local housing affordability measures.

Related Terms

- Speculation and Vacancy Tax

- Underused Housing Tax

- Housing Affordability

- Rental Market

- Municipal Property Tax

150 Slater Street in Ottawa. (Regional Group)

150 Slater Street in Ottawa. (Regional Group) 150 Slater Street in Ottawa. (Regional Group)

150 Slater Street in Ottawa. (Regional Group)

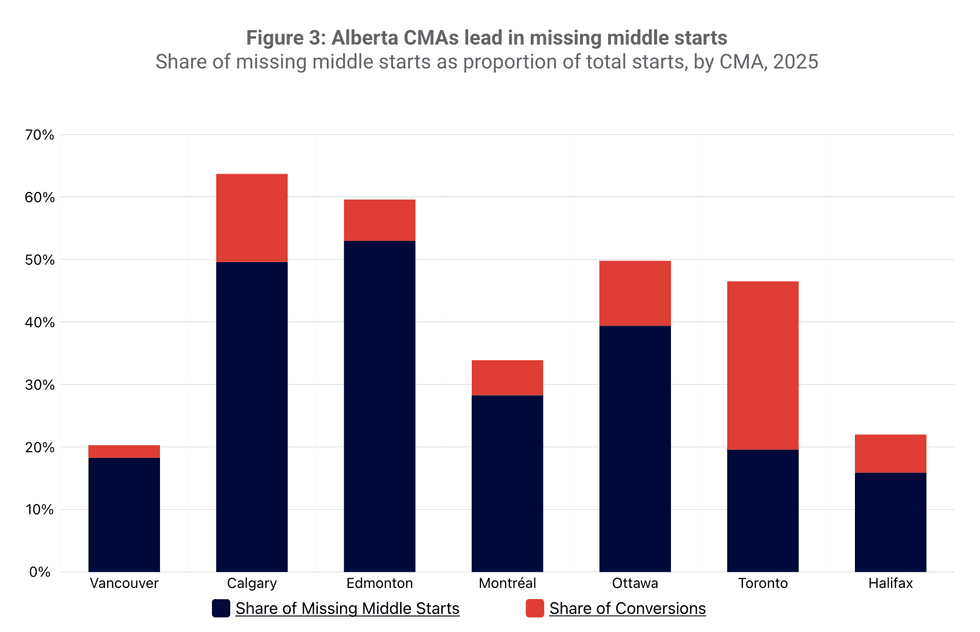

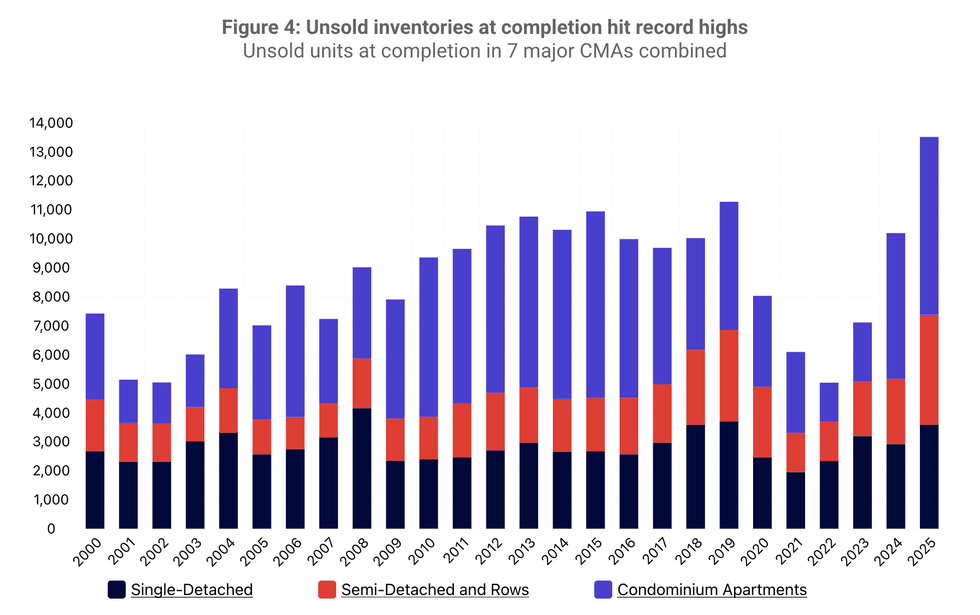

Spring 2026 Housing Supply Report/CMHC

Spring 2026 Housing Supply Report/CMHC Spring 2026 Housing Supply Report/CMHC

Spring 2026 Housing Supply Report/CMHC

Manuela Preis/Instagram

Manuela Preis/Instagram

Renderings of the 65-storey tower previously proposed for 145 Wellington Street West. (Partisans with Turner Fleischer / SKYGRiD)

Renderings of the 65-storey tower previously proposed for 145 Wellington Street West. (Partisans with Turner Fleischer / SKYGRiD)