With March now at a close, it has become clear that both physical distancing measures and economic uncertainty have led to an overall slowdown of the housing market in the Greater Toronto Area (GTA) – despite strong home sales at the start of the month.

The Toronto Regional Real Estate Board (TRREB) says that while sales continued throughout March despite the COVID-19 pandemic, it's clear the virus is causing a significant slow down. However, the board says if the current social distancing measures loosen sometime in mid to late summer, demand for homes could bounce back.

READ: Home Sales in Canada Could Drop as Much as 30% This Year: RBC

TRREB reported the sale of 8,012 homes for the month of March, a 12.3% climb from 7,132 from the same time the year prior. However, despite the increase in overall monthly sales, TRREB says there was a "clear break" in market activity between pre-and-post COVID-19 periods, which began Sunday, March 15.

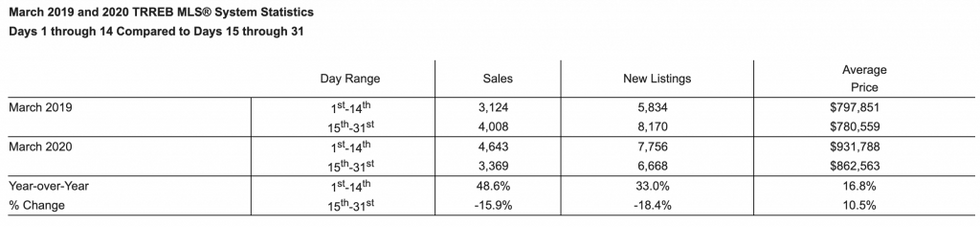

The board says while home sales were up 49% with 4,643 transactions in the first two weeks compared with last year, sales were down 15.9% with 3,369 sales compared with last year for the rest of the month.

Board president Michael Collins says while sales were strong overall compared to 2019, the impact of the virus was evident in the number of sales in the second half of the month.

"Uncertainty surrounding the outbreak’s impact on the broader economy and the onset of the necessary social distancing measures resulted in the decline in sales since March 15. Sales figures for April will give us a better sense as to the trajectory of the market while all levels of government take the required action to contain the spread of COVID-19,” said Mr. Collins.

New listings for the whole month were also up 3% to 14,424, but listings dropped by 18.4% in the latter half of the month compared with last year. The board says the average selling price in March was up by 14.5% to $902,680, while the MLS Home Price Index Composite Benchmark price was up by 11.1% year-over-year.

The average selling price for sales reported during the final two weeks of March was $862,563 – down from the first half of March 2020, but still up by 10.5% compared to the same period last year.

Looking ahead, TRREB says if there's a peak in COVID-19 infections in the spring followed by a loosening of social distancing measures starting in the mid-to-late summer, then we could see a strengthening in the demand for ownership housing throughout the fall and into the winter.

Additionally, employees returning to work from the extended leave coupled with the continuation of extremely low mortgage rates could also fuel this recovery.