While Toronto's rental market continues to feel the impacts of COVID amid the pandemic's third wave, with average rents down over 16% in Q1-2021, market dynamics show there are signs that rental conditions will strengthen as the year progresses.

Kicking off the new year, condominium lease transactions in the Toronto area reached a Q1 high of 11,928 units, up 70% from a year ago. Though, total condo rental listings fell 12% quarter-over-quarter, helping the ratio of quarterly condo leases-to-listings improve to a pandemic high of 61%, according to Urbanation's Q1-2021 rental market results.

In a sign that suggests the urban rental market may be starting a comeback, the City of Toronto outperformed the 905 region in terms of annual growth in lease activity in Q1, by a wide margin of 78% versus 46%.

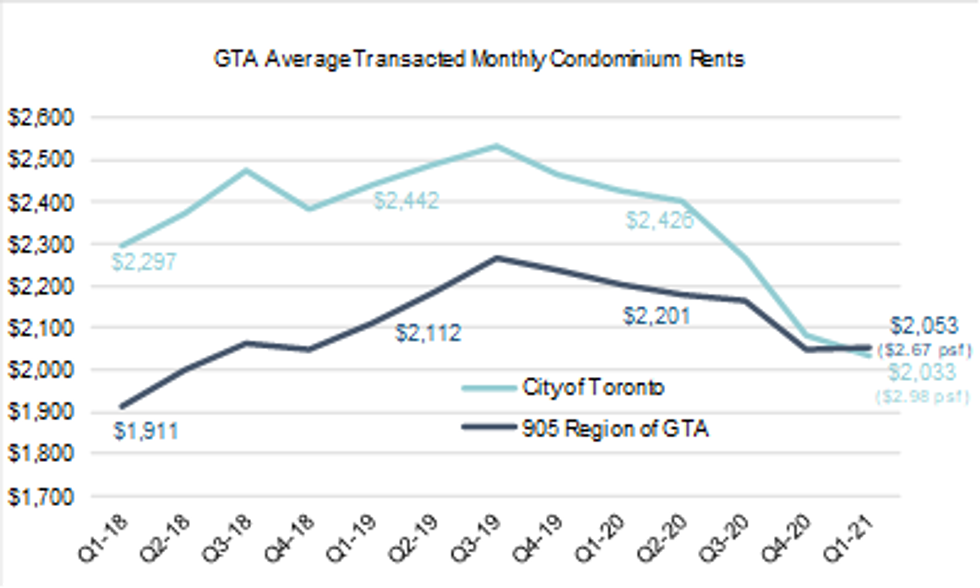

Though, there was evidence of a bottoming-out for rents in the first-quarter data. On a quarter-over-quarter basis, the average per-square-foot rents decreased 1.4% -- a significant improvement compared to the 7.5% quarterly drop recorded in Q4-2020.

READ: Why Now Might Just Be The Perfect Time to Ask for a Rent Reduction

At the same time, average monthly rents increased month-over-month in both February and March (each by more than 1%), suggesting that the market reached its low in January around the $2,000 mark and is already on the path to recovery.

At an average of $2,037, condo rents in the GTA were down 14% year-over-year in Q1, while in the City of Toronto, average rents declined 16.2% year-over-year to $2,033.

This is below the 905 average of $2,053 (down 6.7% year-over-year) for the first time ever. On a per-square-foot basis, rents remained higher in the City of Toronto than in the 905 at $2.98 versus $2.67.

“The rental market will continue to contend with COVID-19 as the third wave keeps the GTA in a lockdown during the second quarter," said Shaun Hildebrand, President of Urbanation.

"However, market dynamics were set in motion in the first quarter to generate strengthening rental conditions as the year progresses — particularly later in the second half as the population becomes vaccinated, offices start to reopen, immigration rises, and post-secondary students potentially return to in-class learning."

According to Hildebrand, these variables are "obviously subject to change and dependent upon exogeneous factors".

Though, he says "as each day passes and housing prices get more expensive, the upside for the rental market rises.”

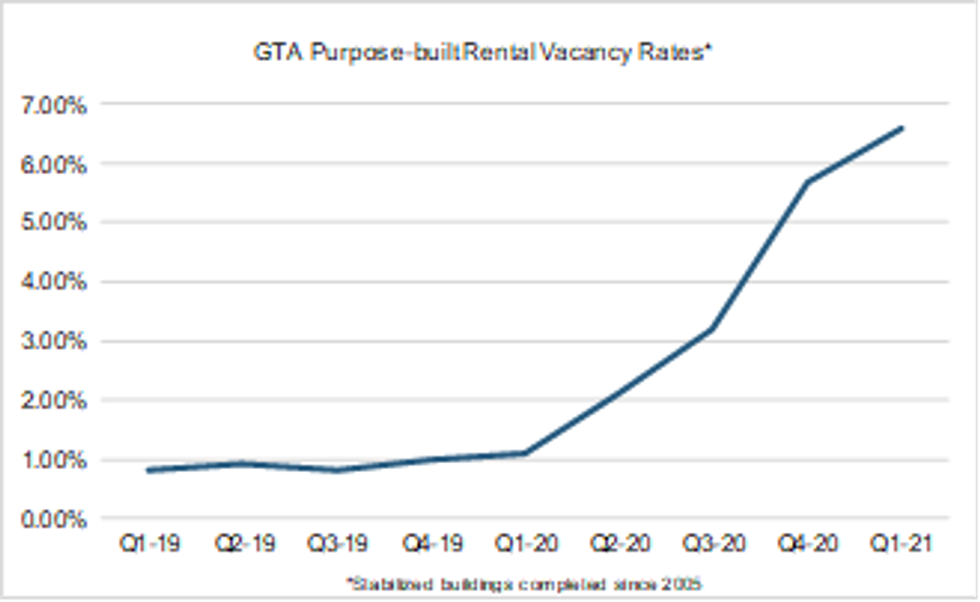

During the same period, Urbanation also found newer purpose-built rental apartment projects that have been completed in the GTA since 2005 reported a vacancy rate of 6.6% at the end of Q1-2021, increasing from an upwardly revised rate of 5.7% in Q4-2020 and from 1.1% a year ago in Q1-2020.

Here in Toronto, vacancy rates increased to 8.8% in Q1-2021 from a revised 7.3% in Q4-2020 and 1.1% in Q1-2020. In the 905 regions of the GTA, vacancy rates remained low at 1.5%.

What's more, average rents for available units within buildings completed since 2005 in the GTA were $2,278 ($3.14 per square foot) during Q1-2021, declining 8.2% (-5.3% per-square-foot) year-over-year. In Toronto, rents were down 10.1% from a year ago to $2,331 (down 7.7% on a per-square-foot basis to $3.41).

Urbanation says, "the decline in rents was additional to widespread incentives being offered in the market," as about two-thirds of these buildings were offering free rent periods of one to three months to attract new tenants.

Urbanation says it calculated that these free rent periods were equal to a rent reduction of approximately $255 per month when averaged over the course of the initial lease term.

READ: The Most-Viewed Toronto Rentals Outside of the Downtown Core

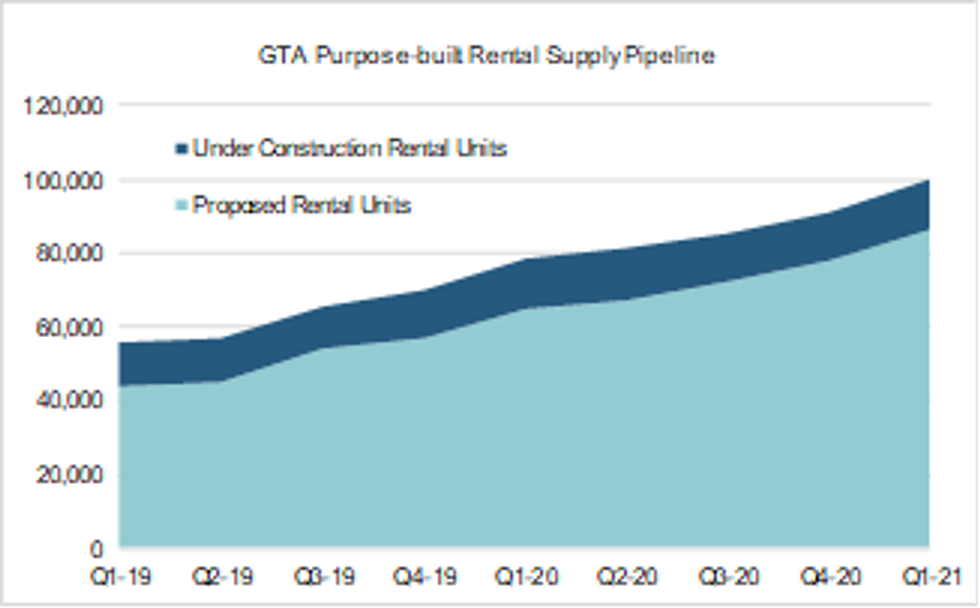

Though, while vacancy rates did increase, GTA rental supply continued to escalate, with a total of 1,009 new rental units starting construction in the year ending Q1-2021. Though, this is still down significantly (73%) from the 3,735 starts in the year ending Q1-2020.

What's more, Urbanation says the number of purpose-built rentals under construction across the GTA as of the end of Q1-2021 totalled 13,563 units -- down slightly from a year ago (13,863) but more than twice as high as the level from five years ago in Q1-2016 (5,833 units).

However, the total number of proposed purpose-built rental units that haven’t started construction reached a recent high of 86,683 units -- 34% higher than a year ago (64,757 units) and bringing the total pipeline of rental units under construction and planned in the GTA to over 100,000 units.