The housing slump that’s jarred market stakeholders over the past three years is often compared to that of the 1990s in its pattern and severity, but in the Greater Toronto Area’s (GTA) new home market specifically, it seems conditions are now even a cut below that famous downturn.

The Building Industry and Land Development Association (BILD) said Wednesday that GTA new home sales “remain exceedingly low, eclipsing the 1990s downturn, with July sales remaining at low levels not seen in decades.”

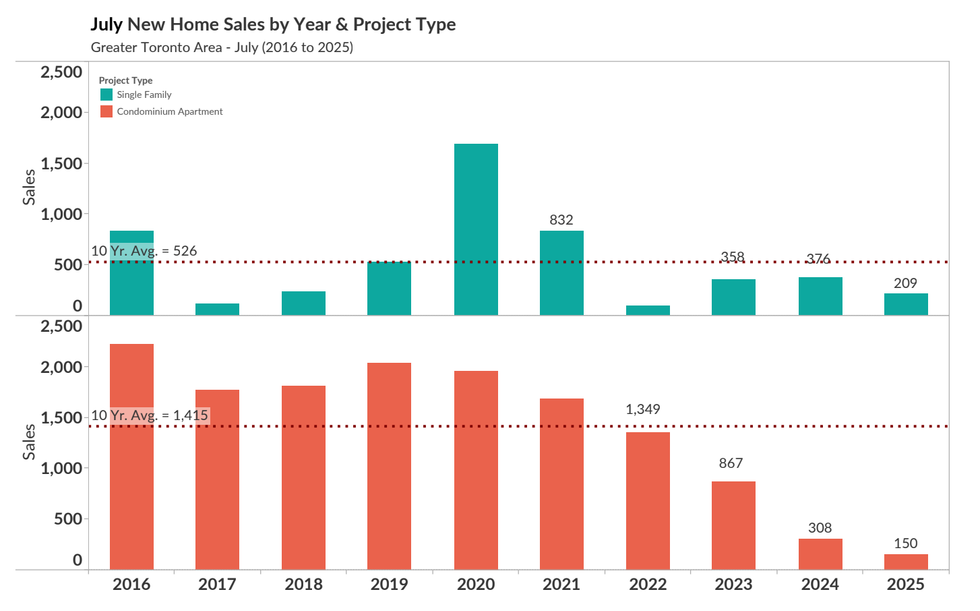

According to the BILD’s latest set of figures, there were just 359 new home transactions recorded in July, marking a 48% decline from July’s level and an 82% drop-off from the 10-year average. A typical July in the region would bring in around 1,941 sales.

“GTA new home sales in July 2025 extended the severe slowdown the market is currently in the midst of with another record low for the month,” said Edward Jegg, Research Manager at Altus Group, BILD’s official source for market intelligence.

As Jegg touched on, July’s data is in line with a dreary narrative that has been building for months. In June, BILD reported 510 sales, a figure that was down 60% year over year and 82% below the 10-year average. And in May, 345 sales were recorded, down 64% year over year and 87% from the 10-year average. Prior months brought more of the same.

While sales were down across all housing types in July, the sluggishness was most pronounced in the condominium apartment segment, which includes units in low, medium, and high-rise buildings and stacked townhouses. With just 150 sold, last month’s numbers were down 51% year over year and 89% compared to the 10-year average.

In the single-family segment — including detached, linked, and semi-detached houses, and townhouses, but excluding stacked townhouses — 209 sales were reported, and that figure was down down 44% from July 2024 and 60% below the 10-year average.

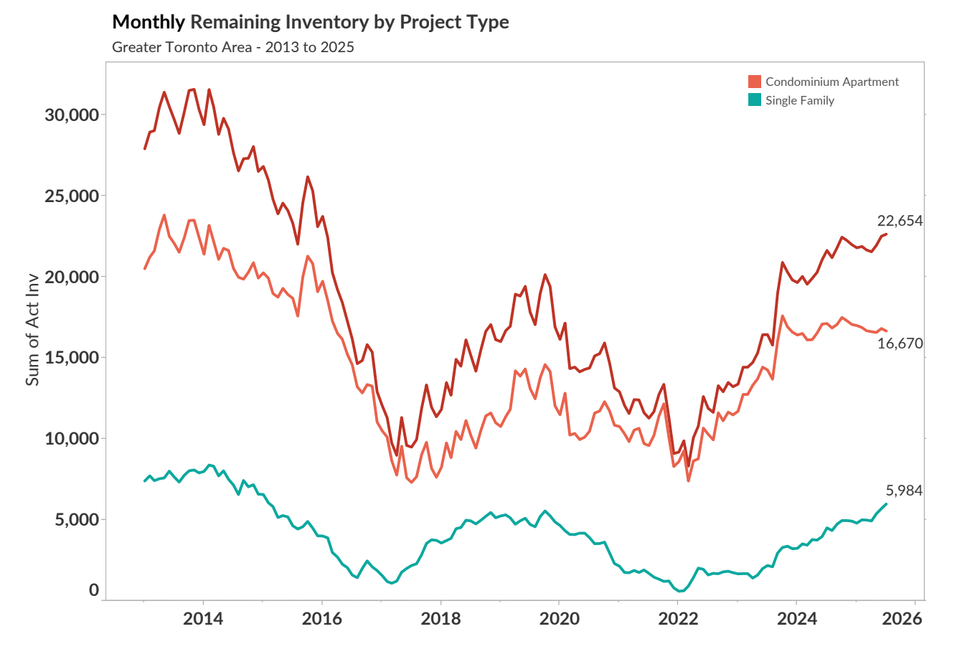

Meanwhile, there were 22,654 units of new home inventory on the market by the end of July, including 16,670 condominium apartment units and 5,984 single-family dwellings. “This represents a combined inventory level of 20 months, based on average sales for the last 12 months — which is the highest inventory level seen to date,” according to BILD.

Justin Sherwood, the Association’s Senior Vice President of Communications, Research, and Stakeholder Relations, underscores that these kinds of numbers are proof of the need for “concerted action to address the crisis that is stalling out new supply and compounding the challenges” in the housing market.

“Emerging from the 1990s downturn took years, with prolonged negative economic impacts and unemployment in the sector,” Sherwood warned. “The market, leaders within the industry and top economists are flashing every possible warning light, and the lesson from the 1990s downturn is clear: if government stands by, the pain will be deep and prolonged. To avoid repeating history, government intervention is not optional — it is urgently due.”

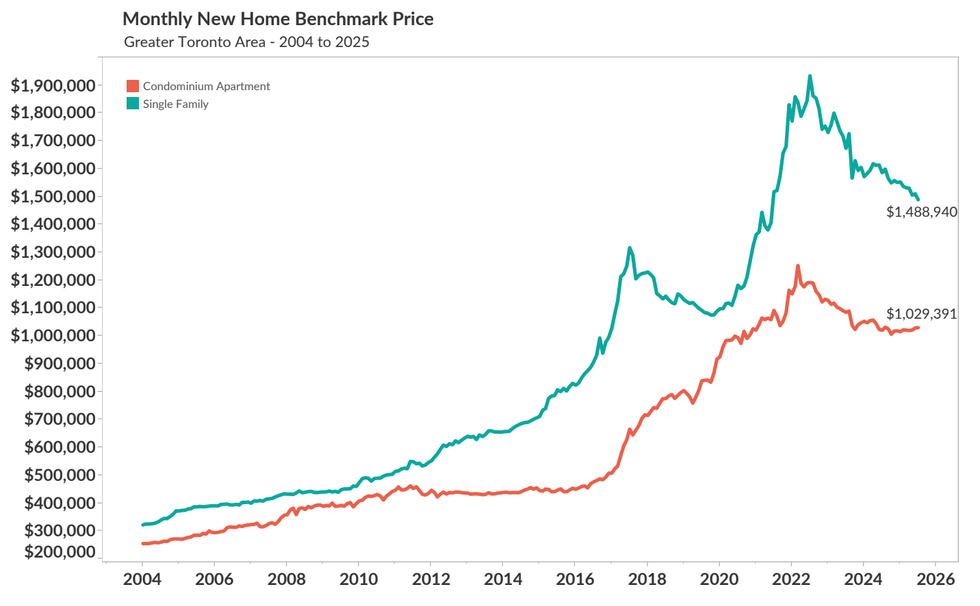

Despite the near-absence of sales in July, BILD reported that the benchmark price for new condo apartments, at $1,029,527, has been unbudging over the last year, while new single-family homes took a 6.1% hit, falling to $1,488,940.