The tale begins with themes you're probably familiar with by now: as a result of COVID-19, Toronto's real estate market saw a springtime 2020 pause in activity that resulted in a summer, fall, and late-year boom. When that boom did arrive, the demand for larger homes saw a rise, as condos couldn't meet the needs of Torontonians spending all their time at home.

But, as non-essential construction projects saw slowdowns, demand started to overpower supply, and home prices soared. Long story short, recent times have been a wild ride.

But what you may have missed, amid all the contemporary drama, is that an undercurrent of home ownership unaffordability has been flowing through Canada for the past decade. According to Point2Homes, over the last 10 years, the country has seen an exponential increase in the share of income needed to afford a property.

As such, monthly mortgage payments have become a heavier financial burden for ever-higher numbers of Canadian homeowners.

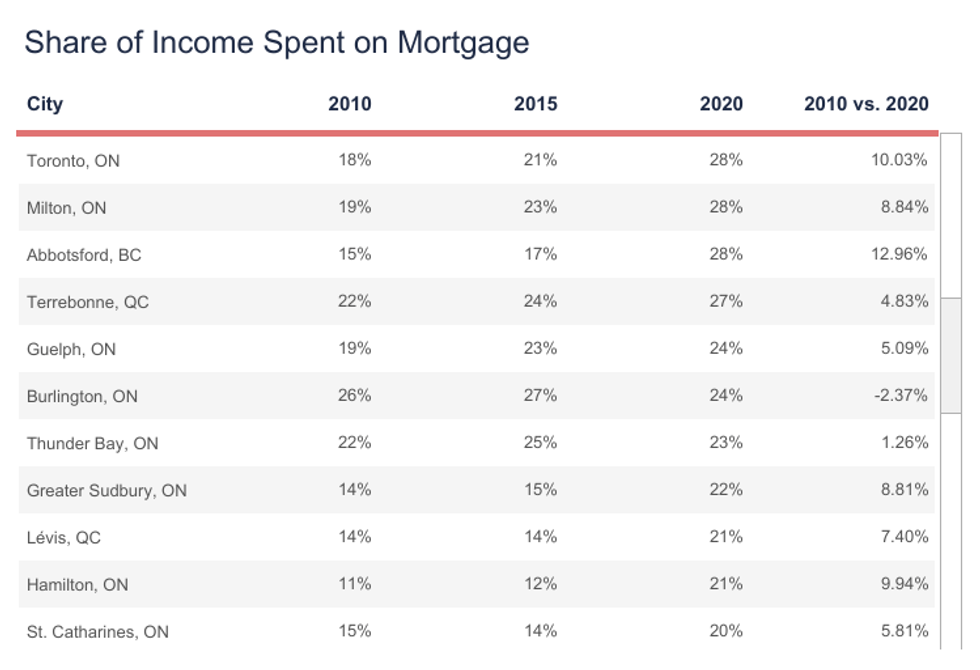

Point2Homes' latest affordability study shows, in fact, homeowners in Toronto spent 28% of their income on mortgage payments in 2020, compared to just 18% in 2010.

READ: Average Home Prices in Canada Now More Than 40% Above U.S. Levels: BMO

"The increase in income is no match for the surging home prices in the 50 most populous Canadian cities," reads the report. "And the disparity between galloping home prices and slower-moving incomes means that the number of unaffordable cities (where homeowners spend more than 30% of their income to cover the mortgage alone) is going up at an alarming rate."

The data shows that over the last ten years, mortgages have become an "increasing financial burden" in 38 of Canada's 50 biggest urban centres; a result of "uneven changes in income and home prices."

A mere two percent increase is all Toronto needs to experience in order to be classified an "unaffordable" city, technically speaking -- though those who live here may argue we already qualify.

"In Toronto, the percentage of income spent on mortgages increased sharply since 2010, as wages could not keep up with surging home prices," says the report. Indeed, the city's home prices increased by 104.6% between 2010 and 2020, while wages grew by a piddly-by-comparison 32.1%.

Looking at the broader Greater Toronto Area, the most unaffordable city in the region is Oakville. Here, homeowners spend 43.8% of their income on mortgages -- a feat that makes the city the third-most cost-burdened in the country.

Other GTA municipalities that fall under the "unaffordable city" category include Richmond Hill (36.3% of homeowner income is spent on mortgage payments), Ajax (36.3%), Mississauga (35.3%), Markham (34.9%), Vaughan (34.9%), and Brampton (34.6%).

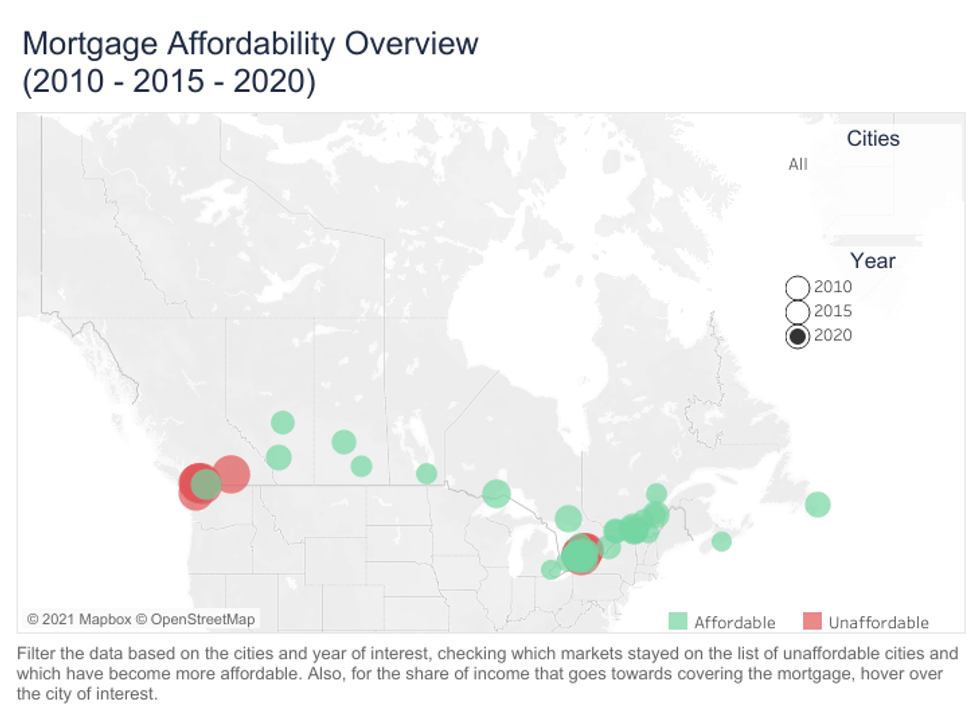

Interestingly, in 2010, only six cities in all of Canada -- included in a Point2Homes analysis -- fit the criteria of "unaffordable." Now, seven exist in Ontario alone, and there are nine others across the country.

The 2010 analysis actually saw three of its six aforementioned cities "toe the line between affordable and unaffordable," with the only markedly unaffordable ones being Oakville (32.8%), Coquitlam, BC (40%), and Saanich, BC (36.1%).

"Fast forward to 2020 and the list is much longer," explains the report. "Moreover, with the least unaffordable market of the 16 taking up 32.2% of homeowners’ median income, all of them are firmly positioned in mortgage-burdened territory."

What's more, all the cities that were deemed unaffordable in 2010 remain stuck with that label in the current report.

And, Richmond and Kelowna BC -- where mortgages took up around 27% of income in 2010 -- now see themselves among the top five most cost-burdened cities in Canada, with mortgage payments representing more than 40% of household income.

While not all of them saw the same steep increase in unaffordability that Richmond and Kelowna did, 38 Canadian cities did experience "deteriorating mortgage affordability" between 2010 and 2020," due to the widening gap between the growth of home prices and incomes."

Again, the speed with which home prices are increasing compared to wages is generally to blame for these transitions, despite record-low mortgage rates.

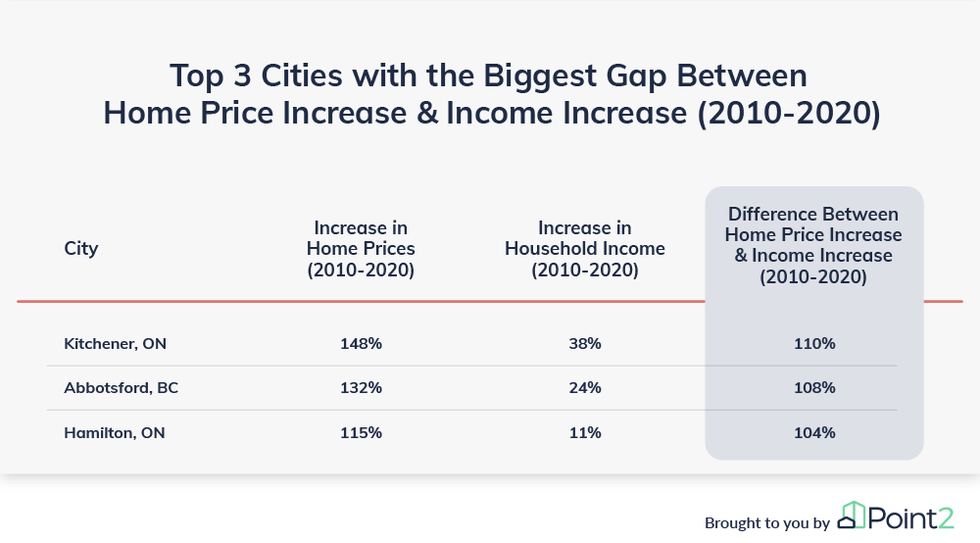

"For instance, of the 50 cities included in the study, 18 markets have seen home prices more than double in the last decade, with Kitchener, ON (148% increase), Abbotsford, BC (132%) and St. John’s, NL (125%) leading the way," says the report.

"Incomes not only didn’t keep the pace, but in some cities, wage growth is far behind home price growth. The city with the most significant household income increase is Edmonton, AB. Here, incomes are 53% higher compared to 2010. The other 49 cities included in the study have seen much more modest wage growth, ranging between 11% and 49%."

In three of these 16 most unaffordable markets -- namely Burnaby, BC, Richmond, BC and Oakville, ON -- homeowners would need to make at least $50,000 more per year in order "to buy a home stress-free" and see their mortgage payments come in "just under 30%" of their income. Specifically, Burnaby owners would need an extra $54,429, Richmond, an extra $55,317, and close to home in Oakville, owners would need to make $51,307 more.

Comparably, affordability "seems more within reach" in the other cities. But, owners who want to cover their mortgage would still need to make significantly more than they currently do, from $12,675 and $16,333 more in Surrey, BC and Whitby, ON, to $45,865 in Vancouver, BC respectively.

On the flip side, however, two Ontario cities hold spots among the top three most affordable of the 50 markets included in the study. Windsor and London both ask less than 12% of homeowners' income for mortgage payments, and those cities trail behind only Halifax, NS, where the average mortgage takes up 10.8% of the median household income.

"In all three cities, incomes have been increasing at a faster pace than home prices in the last decade," the report notes -- a truth that holds in all 10 of Canada's most affordable cities, with the exception of Oshawa.

Burlington, ON, too -- alongside Edmonton, AB -- has recorded faster income growth compared to home prices increases. This does bring to mind, actually, something we once heard about a "Burlington Bonus..."