After economic uncertainty brought on by a trade war with the US quashed much of the rebound initially expected for the first half of 2025, increased home sales in July are indicating that improved affordability may be reopening the door for a substantial number of Greater Toronto Area home hunters.

After an unremarkable spring and early summer that saw GTA home sales and prices fall year over year each month while inventory grew to levels not seen in 25 years, the Toronto Regional Real Estate Board's (TRREB) July data reveals sales ticked up on a seasonally-adjusted basis month over month and were up 10.9% year over year. In total, there were 6,100 home sales recorded last month — "the best home sales result for the month of July since 2021," reads the report.

TRREB President Elechia Barry-Sproule attributes the rise in sales to improved affordability, as home prices have largely flatlined and continue to fall on an annual basis each month, but says more relief is needed.

“Improved affordability, brought about by lower home prices and borrowing costs is starting to translate into increased home sales," said Barry-Sproule. "More relief is required, particularly where borrowing costs are concerned, but it’s clear that a growing number of households are finding affordable options for homeownership."

Just last week, on July 30, the Bank of Canada chose to hold the interest rate for the third time in a row, after seven consecutive rate cuts between June 2024 and March 2025 that brought the policy interest rate from 5.0% to 2.75%. TRREB's Chief Information Officer Jason Mercer further emphasized the need for additional rate cuts, highlighting the potential impact on the greater economy.

“Recent data suggest that the Canadian economy is treading water in the face of trade uncertainty with the United States. A key way to mitigate the impact of trade uncertainty is to promote growth in the domestic economy," said Mercer. "The housing sector can be a catalyst for growth, with most spin-off expenditures accruing to regional economies. Further interest rate cuts would spur home sales and see more spin-off expenditures, positively impacting the economy and job growth."

In the meantime, supply levels continued to climb in July, increasing 5.7% year over year with 17,613 new listings posted. Still, the market tightened last month as the month-over-month rise in home sales was much greater than the rise in listings.

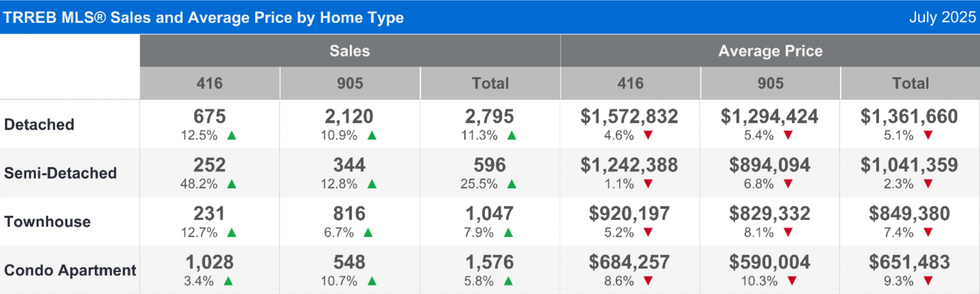

Despite a slight tightening of the market, however, home prices continued to fall in July, with the benchmark home price decreasing 5.4% year over year and the average selling price down 5.5%. The average selling price last month was $1,051,719, compared to $1,101,732 in June and $1,113,116 in July 2024.