New data from TD Bank suggests home prices in Toronto may increase by nearly 8% in the remainder of 2020, in light of the current state of both the economy and the real estate market.

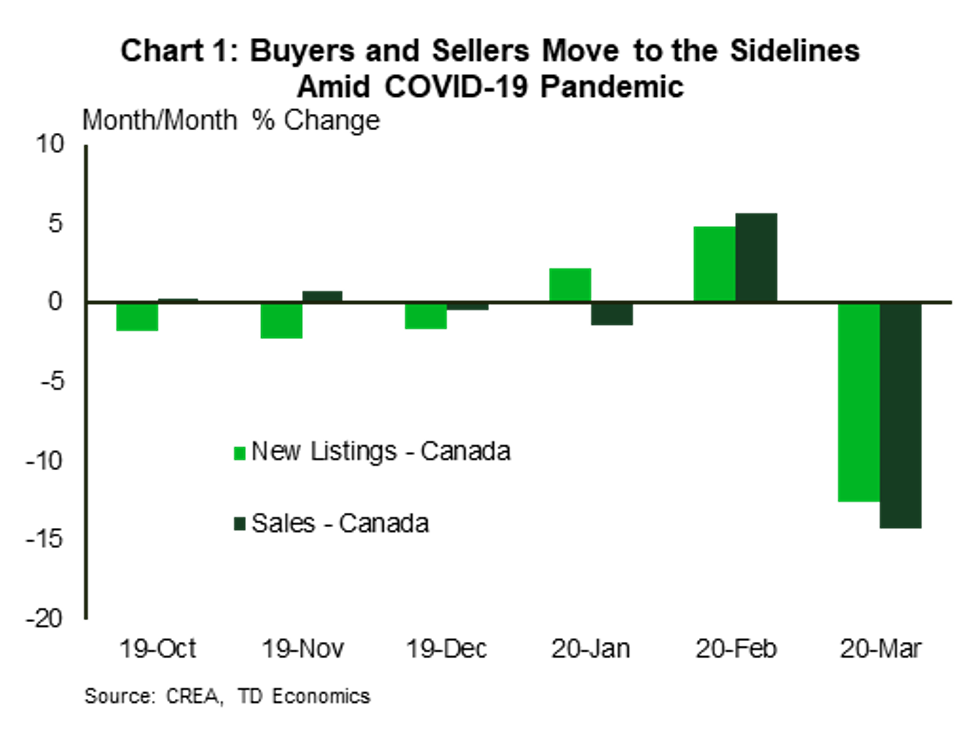

As said by TD Bank economist Rishi Sondhi, Canada had its first "real" taste of the impacts of the novel coronavirus in March despite the strong first half of the month leading up to the new stay-at-home measures. The Canadian market took a dramatic hit and home sales plunged 14% month-over-month, while new listings were down 13% during the same time.

READ: How Much GTA Home Prices and Sales Have Changed During COVID-19

The drivers of the housing demand decline are numerous, with social distancing serving as the "prime culprit," while historic job losses, collapsing equity markets, and stalled population growth added additional pressure.

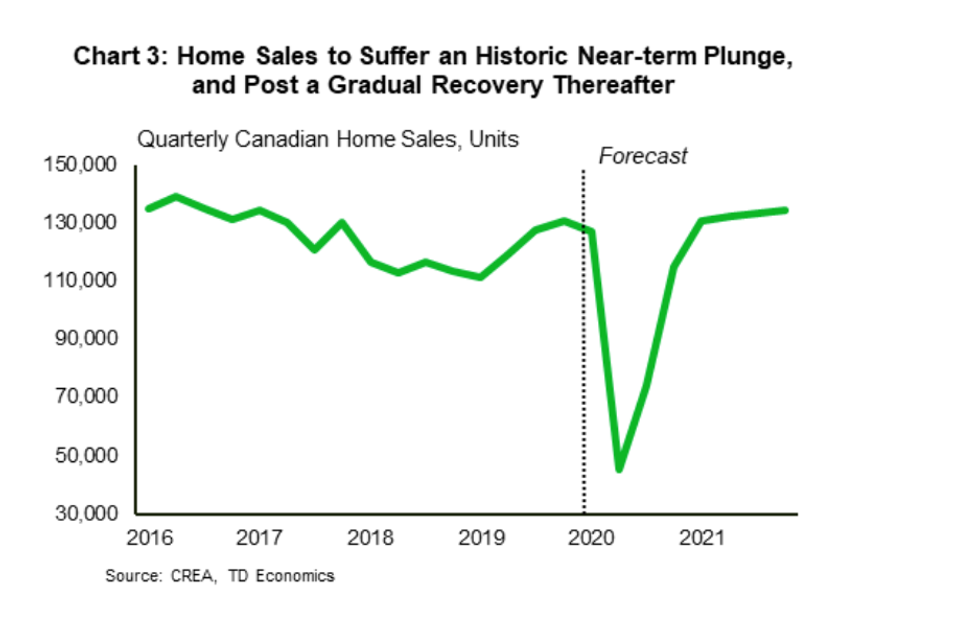

In light of the pandemic, TD economists expect home sales in Canada will remain below their pre-COVID-19 levels for the rest of 2020, with the numbers of transactions expected to plunge in April before gradually recovering in the months to come as the country reopens and social distancing measures ease and workers return to their jobs.

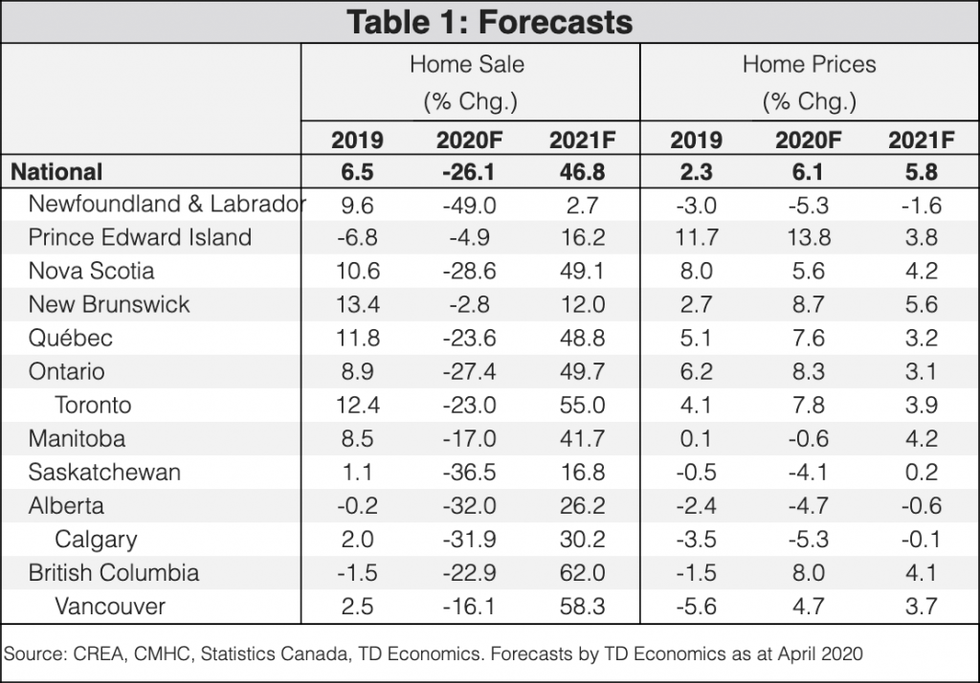

Sales are expected to "retrench" the most in the oil-producing provinces this year, while outsized declines may occur in Ontario, Quebec, and Nova Scotia, where the pandemic has weighed heavily. In contrast, activity should fall by a lesser amount this year in BC, Manitoba, New Brunswick, and PEI, consistent with better COVID-curves.

What's more, TD Bank suggests Canadian home prices will suffer an outsized decline in the second quarter of 2020, after which, the national average home price growth should proceed at a "positive, but subdued pace for the remainder of the year."

Home price growth is projected to hit a national average of 6.1% in 2020, compared to a 2.3% increase last year. Here in Ontario, home prices are forecast to increase by 8.3% in 2020, while Toronto could see an increase of 7.8%, compared to 4.1% in 2019.

TD Bank says Ontario's home price growth will be "flattered by the strong momentum" the market had coming into 2020 and "the solid early-year gains recorded before the pandemic escalated."

It is important to note that previous reporting has forecast Canadian home prices to "lose their momentum", while other reports have suggested home prices in Canada could drop as much as 5% in 2020. What's more, Toronto home prices already dropped 4% in the first half of April.

As for 2021, the bank expects the market will see stronger activity, as housing markets benefit from the pent up demand and low-interest rates, which could result in Canadian sales to climb by 50%, measured by a strong gain in BC, where economic growth is likely to be relatively strong.

Keep in mind that TD said its forecasts are subject to an "extremely high degree of uncertainty."