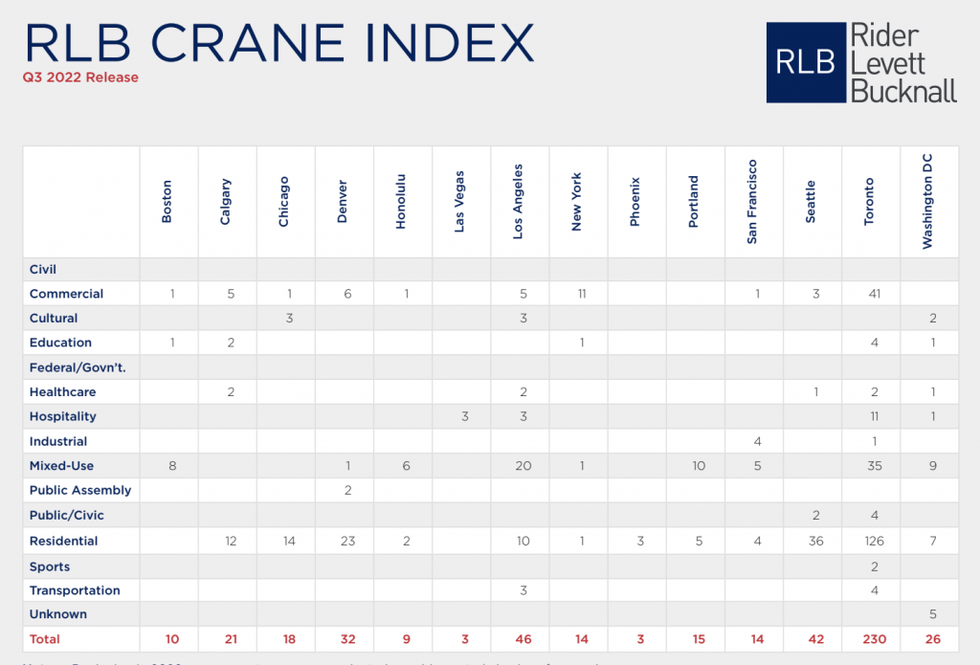

The Greater Toronto Area saw its crane count fall to 230 in the third quarter of the year, down 8.7% from the RLB’s previous ranking. With that said, Toronto still had the most cranes, by far, of 14 major cities across North America. The lion’s share of Toronto's crane count was residential, at 126 cranes.

This is according to the latest Crane Index from Rider Levett Bucknall (RLB), which tracks the number of operating tower cranes in Toronto, Calgary, Boston, New York, Washington, Chicago, Denver, Phoenix, Los Angeles, Los Vegas, San Fransisco, Portland, Seattle, and Honolulu.

“There has been a significant decline in new condo sales and mixed-use projects, as well as staffing challenges related to a strike by Ontario construction workers,” says RLB of Toronto’s crane count decline. “The industrial market continues to be a hub of activity as the GTA’s demand is centered on logistics and distribution, manufacturing, consumer goods and services, and retail/ e-commerce businesses. The Ontario Government Budget promises significant investments in transportation infrastructure, which will benefit the province’s economy.”

According to RLB’s index, Toronto was joined by Calgary, Chicago, Los Angeles, and San Francisco in seeing a decrease in crane count -- although the decreases were relatively nominal. Boston, Denver, Honolulu, Las Vegas, Phoenix, Portland, Los Angeles, New York, and Seattle saw their crane counts increase. Meanwhile, Washington DC’s crane count held steady. The overall crane count saw a slight decline of 0.62%, or three cranes.

“Key market indicators are returning to pre-pandemic levels, demonstrating that the industry appears to be recovering from the impacts of COVID-19,” the report notes. “However, drivers in the market -- including inflation, labor shortage, and supply chain issues -- continue to impact construction, whether it be through cost or schedule. We anticipate the number of cranes to increase going into 2023. Despite volatile market conditions, construction projects will continue to break ground, only at a cost.”

RLB’s latest Crane Index was released in tandem with a Quarterly Cost Report, which revealed that, in the first half of this year, the GTA saw record-breaking investment totals in the commercial real estate market and in residential land, with investments into industrial assets trailing closely behind. The total investment surpassed $19.2B in the first two quarters of 2022, up 41% year over year.