At a press conference on July 22, Ontario Premier Doug Ford stood before a room full of reporters and told them, to scattered applause, that new homes would “pop up like mushrooms everywhere” if the Bank of Canada lowered interest rates. And he was fairly specific about it, saying that this supposed surge in homebuilding would happen if the policy rate was brought down to about 3%.

Ford told press that builders “don’t pull money out of their pocket, they go to the banks and borrow money, and if they can’t get the money at a reasonable rate, it doesn’t happen.”

He’s not wrong, per se — high interest rates have not done developers any favours — but he’s also oversimplifying what is actually a very complex and convoluted matter. In the Greater Toronto Area especially, interest rates are just one factor weighing the business of building down, as anyone with even a pinky toe in the door of new housing development will readily tell you (but more on that later).

“The new build space is largely dead. I mean, that's not a surprise,” Mark Morris, real estate lawyer with LegalClosing.ca, tells STOREYS. “For the past three to four years, projects haven't really pencilled.”

“That's not to say that they didn't pencil three or four years ago while we were in bubble territory — they penciled just fine because people weren't purchasing on fundamentals, they were purchasing on 10% returns per year,” Morris goes on to say. “And when you're doing that, it's a speculative bubble, and people were ready to engage in the speculation of that bubble […] Now, the bubble may have popped, but you're still 10,000 feet above where you should be.”

From the lawyers desk:

Really hard times are starting to hit many primarily in New Build space. Defaults are endless and the pain is real. Assignment market is effectively illiquid. People are dreading closing like the plague. Many are just sitting ducks with no options.

— Mark Morris (Markinmetaform on Threads) (@MarkinMetaForm) August 29, 2024

What’s more, industry stakeholders, Morris included, think that the worst is yet to come. Of the GTA’s new condo segment in particular, experts fear that by 2028, the pre-construction scene will be sparse.

“We were running at an average of 15,000 new condo sales in the GTA for 15 years, and before that, we were in that 7,500 to 10,000 range. But in the years leading up to the pandemic, and particularly in ‘20 and ‘21, we had a huge amount of sales — those are the units we are building now — and then the market fell off in 2022 and hasn't recovered since,” says Jared Menkes, Executive Vice President, High-Rise Residential at Menkes.

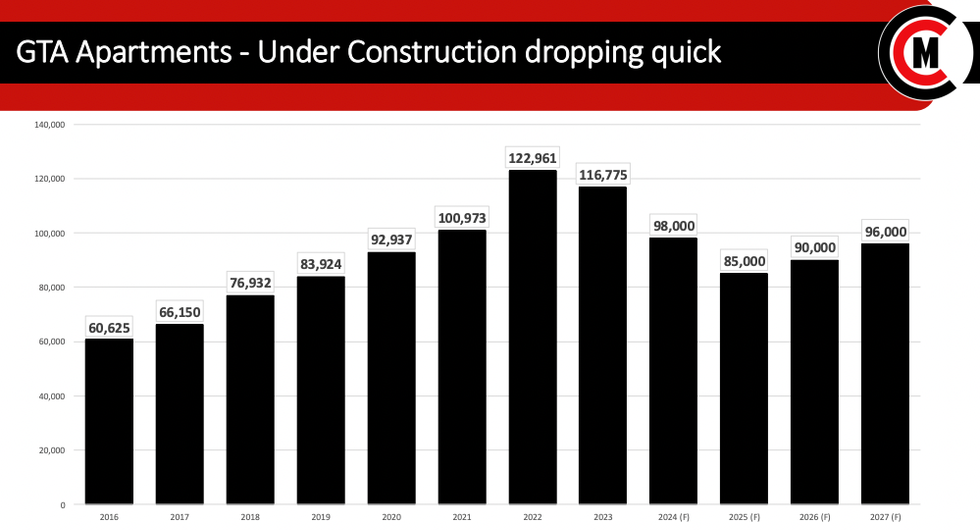

“If you look at the scheduled completions for ‘24, ‘25, and ‘26, you can see they'll probably be the highest on record. But then after that, it just starts to fall off a cliff,” Menkes adds.

He also points out that it takes anywhere from three to five years to build a high-rise condo in the GTA, which means today's sluggishness will haunt the region down the line. “This is not something where you can flick a switch and all of a sudden we have deliveries. We know that if we're not starting anything in ‘25, there [are] going to be no deliveries in ‘28.”

The (New) Condo Conundrum

To understand what may happen in the GTA new condo segment in future, it’s worth taking stock of what’s happening right now (or at last count). Research and consultancy firm Urbanation is a good source for this kind of data. Although Urbanation President, Shaun Hildebrand, tells STOREYS that the latest iteration of the data won’t come out until October, the firm’s latest data release, published in July, shows that new condo sales in the GTHA have sagged to a 27-year low.

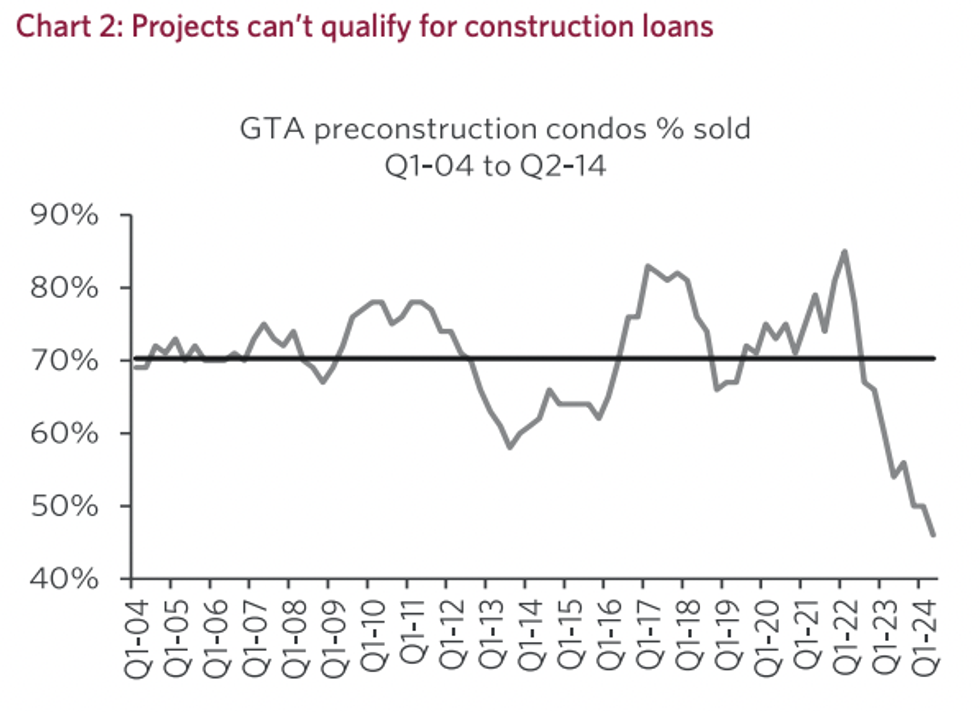

Meanwhile, the percentage of pre-construction condos that are pre-sold has sunk to more than 20-year low of under 50%, according to a July report from CIBC’s Benjamin Tal and Urbanation’s Hildebrand. “Without at least 70% pre-sales, a project can’t begin construction, a fact that is working to dramatically slow down the supply pipeline,” it says. “This reality will result in a sharp pull back in completions and a stagnating housing stock in the coming years, which is sure to make the affordability situation even worse.”

“We're seeing a big, big shift in investors that typically would buy condominiums to rent out,” explains Ray Wong, Vice President, Data Solutions Client Delivery at Altus Group. “Especially based on where the rents are, sometimes they're seeing a negative return on investment.”

As Wong touches on, the lion's share (77%) of GTA condo investors were cash flow negative in 2023 as their monthly mortgage dues outpaced rental income, according to the aforementioned report from CIBC and Urbanation. The report underlines that many of these investors haven't seen a profit from their income properties since 2021-2022 (which is more than enough to discourage prospective condo investors as well).

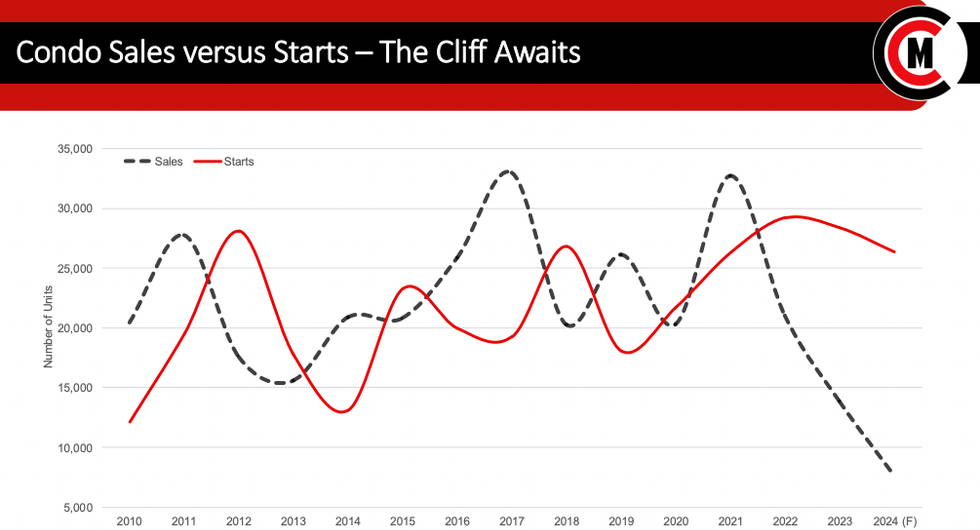

Marlon Bray, Executive Vice President at Clark Construction Management, is well-versed in what makes the GTA’s new condo segment tick. Based data he’s compiled, which draws from research from Canada Mortgage and Housing Corporation and Altus Group, condo sales across the region started to sharply diverge from condo starts just before 2022, and the gap between the two has only widened in the years since.

“[This year] is probably going to be the worst on record, especially for new condo sales. The entire market’s dropped off,” says Bray, pointing to the fact that there were around 30,000 sales recorded in 2021, 20,000 in 2022, and 14,000 last year, in 2023.

“We’re basically on three years of declining sales. So the number of sales are dropping, and that will then eventually reflect a drop in housing starts,” he adds. “The cliff awaits […] I think next year we'll probably hit a low of 80,000 to 85,000 units under construction, which basically means a 30% drop-off in units, and that could be even lower. [It] depends on when the condo market recovers, and right now, no one knows.”

Bray points to the BoC’s barrage of interest rate hikes — which took the policy rate from 0.25% to 5% over a two-and-a-half year course — as the “straw that broke the camel’s back” for many developers who have had to fold on projects (or fold altogether). And that’s to say there’s so much more at play here that’s putting a damper on the development sector’s ability to bring the housing the GTA so sorely needs from concept to completion.

“It’s All Politics”

Earlier this year, on June 6, the City of Toronto increased development charges on Toronto condos as a result of Bill 185. They made this move quietly, so to speak, and on the heels of a 20.7% increase on May 1.

Matt Young, President and CEO of Republic Developments, told STOREYS at the time that to his understanding, much of the industry was “caught off guard” by the sudden increase, and took to socials to crunch some numbers. By his calculation, DC rates were up a whopping 42% between August 2023 and June 2024. He also pointed out that development costs for a one-bedroom condo have increased from $37,081 in August 2023, to $44,774 in May 2024, to $52,676 in June 2024.

“With development charges, it became a runaway train, and governments aren't particularly good at throttling back on stuff. I've talked to some politicians who have said, ‘you're right about development charges, they are unfair, but where are we going to get the money?’ And I said, ‘well, we're not selling anything, so you're not getting the money anyways,’” Richard Lyall, President of the Residential Construction Council of Ontario, tells STOREYS. “Look, a million dollars’ worth of new housing and the GTA, you're talking about $310,000 — 31% in taxes, fees, and levies. That's crazy. There's no other way to put it. No other jurisdiction except for southern British Columbia — they're at 30% — does that.”

What it reads as is a disconnect between what government is doing and what the development sector actually needs right now. This is a criticism that comes up often amongst sector stakeholders.

From less than 1 year ago, rates are up 42%. Or over 15k for a 1 bed unit and nearly 24k for a 2 bed unit pic.twitter.com/PeldTqA0YZ

— Matt Young (@MYoungTO) June 10, 2024

“Different levels of governments aren't aligned, and there's no mandate in government saying that housing supply is a priority, so any new measure by any level of government or any area of government that could increase costs has to be reviewed against the priority of supply,” says Lyall. “So, we're dealing with a situation where the government does one thing that will help a bit — for example, there's a new consultation on the accessory units, that kind of thing — but then you've got some other measure that actually sort of factors that out. So we're no further ahead.”

“It's all politics,” says Bray, who recently wrote an article for STOREYS on this exact topic. “Governments don't care about solving the housing crisis, there’s zero evidence of any intent [...] They’ve basically surrendered to NIMBYism at the provincial level, and they've 100% of surrender to NIMBYism at the municipal level. And because of that we're not going to get the densities we need, the red tape isn't being cut, the province actually walked back on the freezing of DCs. In essence, all hell has been released; we're in a housing crisis, and we're going to nowhere. We might even be going backwards.”

Trouble Ahead

In case it’s not already abundantly clear, Toronto’s new condo market is in trouble, and without the right type of intervention from government — more specifically, intervention geared at reducing the mammoth costs associated with building — many experts believe it's only poised to get worse. And that’s not just a problem for developers, but for everyone, warns Morris.

“Just think about the fact that Ontario's industry is pretty much driven by the building industry. Every crane that goes down is 500 jobs lost, that's the estimate. We used to have more cranes than anywhere else in North America, and they're going down massively,” he says. “If you lose 500 jobs over and over and over and over again, what you eventually have is less buying power in the overall consumer economy, and then we have the beginnings of recession.”

“I think there really is going to be a crisis. You don't need a crystal ball,“ Menkes adds. “This is a slow-moving ship, you can see exactly what’s happening. No more construction starts, deliveries will end, and there will be no new product. And I think there’s a real concern that you’re going to see double-digit rent growth, double-digit growth on sales pricing, and [housing] is going to become unaffordable again.”

- Gap Between Population Growth And GTA Housing Stock At 50-Year High ›

- More Than 75 New Condo Projects On Hold In GTHA Amid “Dislocated” Market ›

- Most Toronto Condo Investors Are Cash Flow Negative ›

- Toronto Rental Starts Slashed In Half, Says CMHC ›

- 65% Of Small Toronto Condos Are Investor-Owned ›

- 33 Condo Projects Changed To Rental, Cancelled, In Receivership Since 2022 ›

- Average GTA Condo Prices Dropped By 23K YoY In Q3 ›

- Ontario Homebuilding Lagged Behind Other Provinces For 6 Years ›

- Toronto Condos At 60% Of Inventory, Leaving Future Supply In Trouble ›

- Is It Time To 'Buy The Dip' On Investment Condos? ›