Fact: living in Toronto is expensive. Exactly how expensive depends on where you live in the city and what you live in -- obviously. But new data from Zoocasa shows just how much prices for apartments and single-family homes have fluctuated over the past five years and it's safe to say, prices have definitely gone up.

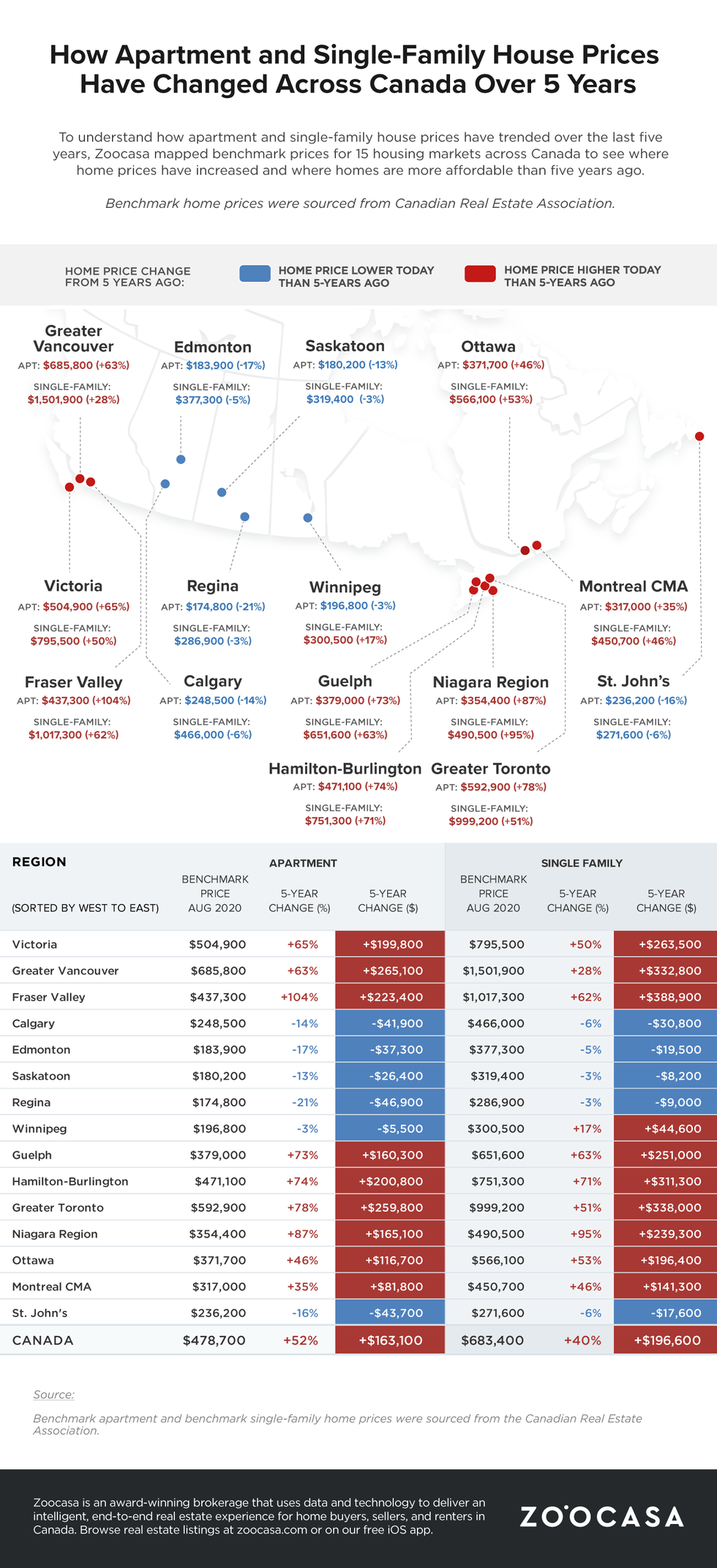

In a new report, Zoocasa looked at whether home prices have grown or contracted in 15 Canadian markets compared to 5 years ago by reviewing benchmark prices for apartments and single-family houses with data from the Canadian Real Estate Association (CREA) from August 2020 and August 2015.

READ: Toronto Sees Record-Breaking August as Home Prices Soar 20%

In Zoocasa's analysis, benchmark apartment prices rose over 50% in 7 of 15 markets over the past 5 years -- the majority of which were in Southern Ontario. However, Fraser Valley, BC saw the highest 5-year increase overall, with prices rising 104%. What's more, 7 out of 15 markets included in the analysis also noted a 50% or higher increase in the benchmark price for single-family houses, with the Niagara Region leading the pack.

On a local level, prices in Toronto have seen substantial increases, with apartment prices rising 78%, bringing the average price in 2020 to $592,900. Prices for single-family homes in the area rose by 51% to reach an average of $999,200.

Across the region, Niagara led price growth in the area for apartments, with the benchmark price growing 87% to $354,400. This was followed by Toronto, then Hamilton-Burlington, where the price rose 74% to $471,100, and finally Guelph, where there was a 73% increase in the benchmark apartment price bringing the 2020 average to $379,000.

As for single-family homes in the analysis, the Niagara Region experienced the highest growth -- the price almost doubled -- with an impressive 95% increase in 5 years to reach $490,500 in 2020. This was followed by Hamilton-Burlington with a 71% increase, Guelph with 63%, Fraser Valley with 62%, Ottawa with 53%, and Victoria with 50%.

Furthermore, the analysis revealed that Prairie markets (Calgary, Edmonton, Regina, Saskatoon, and Winnipeg) are some of the few regions where the benchmark apartment and single-family house is more affordable today than it was 5 years ago.

Zoocasa's analysis follows national home sales and listings continuing to climb in August, as some of the pressure from pent-up demand was released this summer when pandemic restrictions eased. In turn, buyers continued returning to the market with refocused housing priorities -- with a growing number beginning to look to suburban and rural markets in search of more space relative to what’s available in denser urban cities.

However, despite the surge in demand, the Canada Housing and Mortgage Corporation (CMHC) recently reiterated their forecast that home prices are likely to dip by as much as 18% in the coming months -- citing pandemic-induced unemployment and slower in-bound migration weighing on demand, particularly in metropolitan cities like Toronto and Vancouver. In turn, RE/MAX called CMHC's prediction "fear-mongering."

You can read Zoocasa's full report here.