Several months have now passed since the official sales and investment solicitation process (SISP) for The One concluded and Tridel has already been chosen to complete the troubled project, but that did not stop a mysterious entity from recently submitting a bid to buy the project that was started by Mizrahi Developments.

The sales process for The One — the 85-storey mixed-use tower set for 1 Bloor Street West in Toronto — was launched in June 2024 and concluded just before the end of the year. It returned no bids to buy the project outright, thus the court-appointed Receiver selected Tridel's bid to complete the project. Since then, Tridel, the Receiver, and the senior secured lender (KEB Hana Bank) have been in the process of finalizing the contract and transition of The One to Tridel.

Both were approved by the court on April 22 along with an application to convert the receivership proceedings into creditor protection proceedings under the Companies' Creditors Arrangement Act (CCAA), but only after the court hearing was delayed from the original date of April 17, as a result of the new bid that emerged.

The Bid

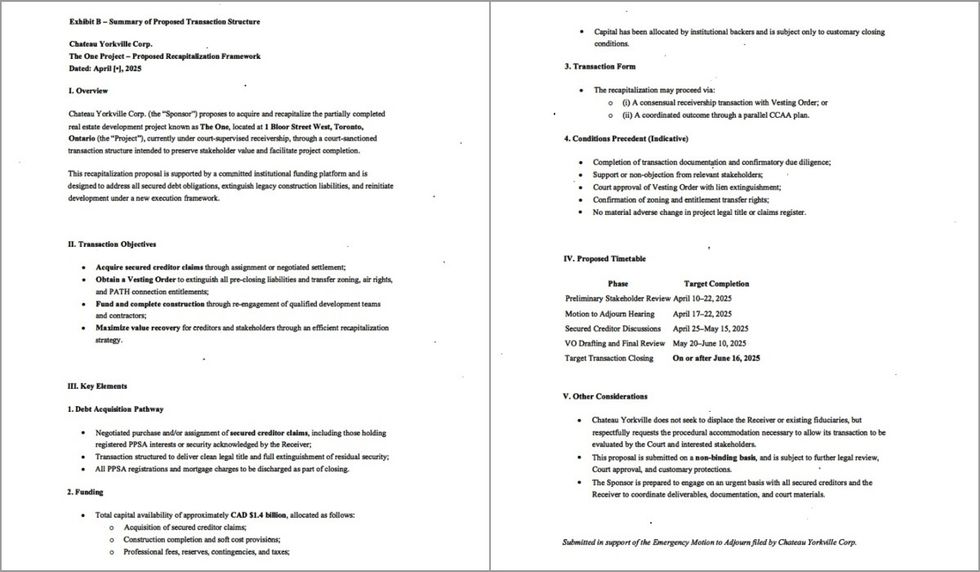

According to new court documents, the bid was submitted by an entity na med Chateau Yorkville Corp. (CYC) and led by Antony De Francesco, who identified himself in an affidavit dated April 17 as the President, Director, and shareholder of the entity, which De Francesco describes as "a Canadian entity incorporated to lead the acquisition and recapitalization of the Project through a market-based transaction framework."

De Francesco said his team "includes infrastructure and investment professionals with experience in cross-border restructuring and court-supervised asset recovery" and that they have "received confirmation of institutional financial support in an amount exceeding CAD $1.4 billion" that is "intended to be deployed in connection with the proposed acquisition, restructuring, and redevelopment of the Project."

"The availability of this capital is not contingent on any secondary market financing or speculative condition," he said. "It has been designated for this Project and is subject only to execution of customary agreements and standard closing conditions. [...] Chateau Yorkville is not seeking to delay or frustrate the CCAA proceeding, but rather to provide the Court and the Receiver with an opportunity to consider a credible, fully-funded alternative that could materially enhance creditor recovery and preserve the integrity of the development."

In a terse response dated April 21, the Receiver — Alvarez & Marsal — shut down the bid, saying "CYC is unknown to the Receiver, the experienced real estate professionals at JLL, or the Senior Secured Lenders" and that there "is no evidence that CYC has any assets."

"The Project is among the largest and most complex mixed-use developments in Canada," said the Receiver. "Few entities have the financial resources and expertise required to complete it. There is no evidence — and no reason to believe — that CYC is one of those entities. CYC has not even tried to prove that it is capable of acquiring and completing the Project. There is no evidence that CYC has any assets or relevant experience."

"CYC claims to have secured financing, but there is no way to verify whether the financing exists because CYC has redacted the name of its alleged lender," the Receiver added. "The financing CYC claims to have secured is, in any event, conditional. CYC has not proposed a specific transaction and there is no evidence, or reason to believe, that it is capable of completing any transaction involving the Project."

Sculptor Capital Management

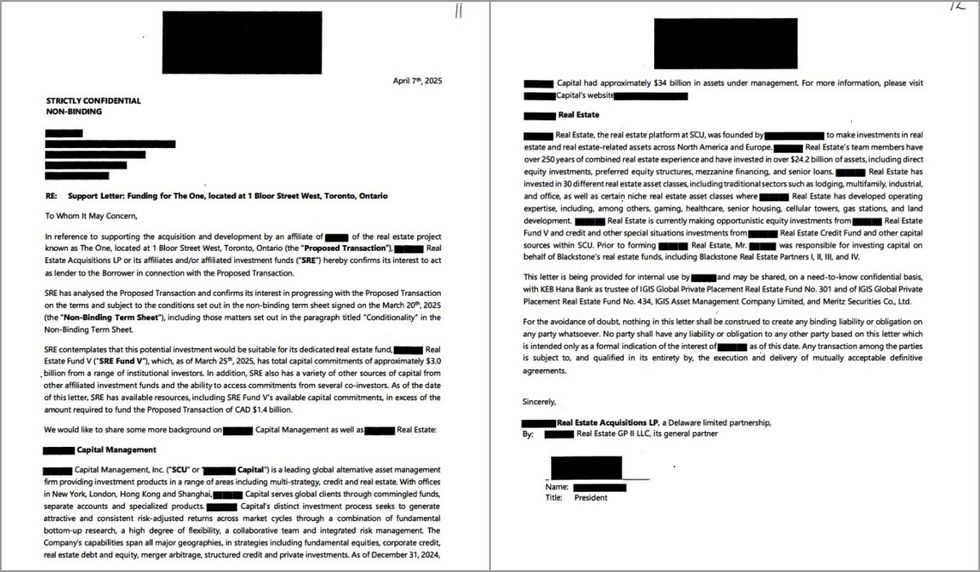

The redaction the Receiver is alluding to occurred in a letter of support that Chateau Yorkville Corp. included alongside its filing. Although the two-page letter includes many redactions, STOREYS has identified the lender as New York-based Sculptor Capital Management.

The first word of the lender's name is redacted, but the remaining two words — Capital Management — are not and the abbreviation of the company — SCU — is also not redacted. The letter also notes that the company has offices in New York, London, Hong Kong, and Shanghai, which are the four offices listed on Sculptor Capital Management's website. The letter also notes the company has $34 billion in assets under management as of December 31, 2024 and that their real estate arm has invested over $24.2 billion in assets across 30 different asset classes. All three numbers are identical to those listed on Sculptor Capital's website. Furthermore, the letter notes that the company has an affiliate real estate investment fund called SRE Fund V, which the City of San Francisco identified as Sculptor Real Estate Fund V in a February 2025 document.

It's unclear whether the Receiver (now the Monitor, under the CCAA proceedings) attempted to identify the lender and whether or not the letter CYC provided is authentic. STOREYS reached out to Sculptor Capital on April 23 asking the company to confirm the authenticity of the letter, but has not received a response as of publishing.

Regardless, Alvarez & Marsal said that the $1.4 billion bid "is nowhere near sufficient to satisfy both the $1.2 billion minimum bid threshold established under the SISP and the cost of completing the Project." Chauteau Yorkville asked the court to delay the CCAA application hearing until June 16, which Alvarez & Marsal said would "harm the project."

"CYC's 'proposal' does not come close to delivering the kind of comprehensive solution for the Project that the Tridel Transaction represents and is ready to provide, as soon as it is approved by the Court," they said. [...] The Tridel Transaction must be approved in a timely way so that Tridel can assume its role before SKYGRiD's construction management contract ends. Moreover, a number of key Project-related decisions must be made in the near future to avoid schedule delays, and Tridel must be in place to assist with those decisions."

Critically, the senior secured lender in insolvency proceedings usually has discretion when it comes to transactions, regardless of whether or not thresholds are met, and Alvarez & Marsal say that KEB Hana Bank is opposed to CYC's bid.

After a brief delay from April 17 to April 22, the court approved the CCAA application as well as the contract transaction to Tridel, and Tridel will become project manager, construction manager, and sales manager of The One effective May 1.