A bit over a decade after the Hudson's Bay Company (HBC) and Toronto-based RioCan REIT (TSX: REI.UN) formed their joint venture entity, the historic retailer is liquidating and the large REIT is taking a $208.8 million loss in its investment, according to Q1 2025 results published by RioCan last night.

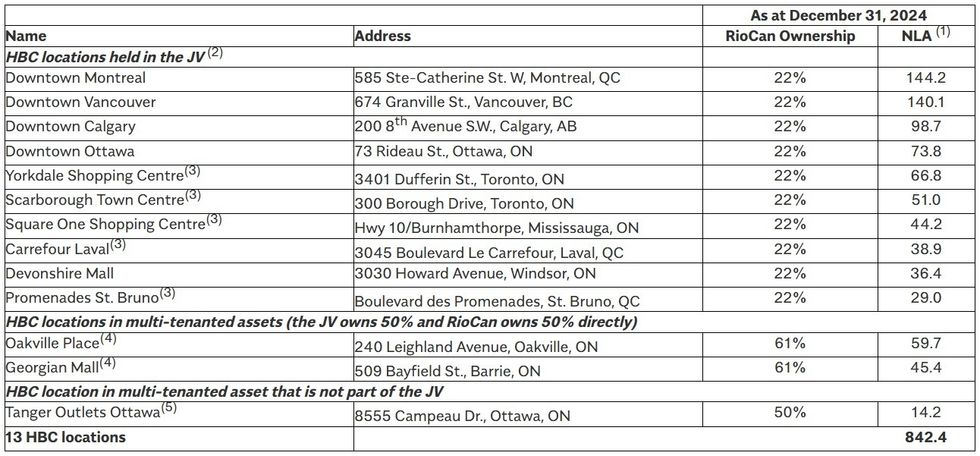

As previously outlined by STOREYS, RioCan and Hudson's Bay announced their joint venture in February 2015, with HBC contributing 10 properties it owned and RioCan contributing 50% stakes in two malls it owned and a cash contribution.

The initial contributions resulted in HBC holding a 79.8% stake and RioCan holding a 20.2% stake in the JV. As of March 7, 2025, when Hudson's Bay filed for creditor protection under the Companies' Creditors Arrangement Act (CCAA), the split was 78.0136% and 21.9864%.

After transferring the properties to the joint venture, the JV entity then leased the properties to Hudson's Bay to operate its stores and the JV became "Hudson’s Bay’s primary real estate subsidiary and an integral part of Hudson’s Bay Canada," according to HBC.

As of December 31, 2024, RioCan's stake in the joint venture had a valuation of $248,979,000 and represented 3.3% of RioCan's total equity. As of March 31, 2025, the valuation is down to $41,406,000 and represented 0.6% of RioCan's total equity.

"Total RC-HBC JV Valuation Losses of $208.8 million are included in net loss for the three months ended March 31, 2025 and are based on management's best estimate using the information available to the Trust as at March 31, 2025 to reflect the assumption of re-leasing the RC-HBC JV's investment properties and finance lease receivables to new tenants at market rents below existing rents at sole tenant locations," said RioCan in its Q1 2025 financial report.

"The valuation losses include a $152.5 million fair value loss on investment properties, a $24.5 million provision for expected credit losses on finance lease receivables, a $23.3 million write-down of straight-line rent receivable at RioCan's 22% proportionate share and an impairment loss on RioCan's carrying value of the RC-HBC JV of $8.5 million," the REIT added.

In addition to the equity loss, RioCan said that it was revising its previously-disclosed funds from operation (FFO) per unit guidance range of $1.89 to $1.92 down to $1.85 to $1.88 as a result of the expected lost FFO from the RioCan-HBC joint venture, after accounting for development cost savings.

In the early days of the Hudson's Bay's creditor protection proceedings, a dispute arose between the two joint venture partners over rent payment. As part of the creditor protection that it secured, HBC was allowed to stop paying rent to the JV at the locations the JV held a freehold interest in. RioCan challenged this, calling it "unprecedented" and arguing that HBC should have to honour its full contractual obligation.

However, the two sides eventually reached an agreement that would see HBC pay the JV $7.0 million of the approximate $10.0 million in rent it owed per month, with the remaining amount accrued via a charge registered against HBC that ranks ahead of HBC's pre-filing creditors.

In addition to being a co-owner and co-borrower with Hudson's Bay, RioCan also acted as a guarantor in some instances, including guarantees to third-party lenders on two of the JV's mortgages.

"In connection with the refinancing of the RC-HBC JV's Yorkdale Shopping Centre head lease, RioCan provided a 100% guarantee on the $75.0 million mortgage, inclusive of RioCan's 22% interest," according to the REIT. "In connection with the refinancing of the RC-HBC JV's Downtown Ottawa property, RioCan provided a $12.3 million guarantee, equal to its ownership percentage of the underlying first mortgage in the RC-HBC JV."

RioCan says that in exchange for those guarantees, it received security interests in other assets of the JV and the current estimated fair value of those interests supports the full recovery of any potential payments made under the guarantees.

As a result of HBC's filing, some of the JV's debt is currently in a technical default, but RioCan says "the debt within the RC-HBC JV continues to be serviced and is currently up to date."

"The Trust continues to pursue all available business and legal avenues, and will leverage its extensive leasing and development capabilities to achieve the best possible outcome for each of the properties within the RC-HBC JV," it said.

For RioCan, the situation with Hudson's Bay is reminiscent of another large retail insolvency that impacted RioCan. After entering Canada in 2011 by buying Zellers' leases (from HBC), Target Canada filed for CCAA creditor protection in January 2015 before officially closing all stores in April 2015. At the time, Target was leasing 26 locations from RioCan and the entanglement ended with Target agreeing to pay RioCan $132 million to get out the leases.

- Cracks Emerge In RioCan And Hudson’s Bay Joint Venture Over Unpaid Rent ›

- Inside Hudson's Bay's "Fully Intertwined" Relationship With RioCan ›

- Primaris REIT To Repurpose Hudson's Bay Stores That Saw No Bids ›

- RioCan Announces $173M In Sales To Killam, Boardwalk REIT ›

- RioCan Demands Payment From Hudson’s Bay, Files for Receivership of Joint Venture ›

- RioCan Eyeing Buyout Of Hudson's Bay From Georgian Mall, Oakville Place ›

- RioCan Bids $141M To Buy Out HBC JV From Georgian Mall, Oakville Place ›