There was little reprieve for Canadian renters in 2023, as tight supply-demand conditions pulled vacancy down and prices up. This is according to new data from Canada Mortgage and Housing Corporation (CMHC), which highlights that rental affordability was grim across the country, but grimmer still in Toronto.

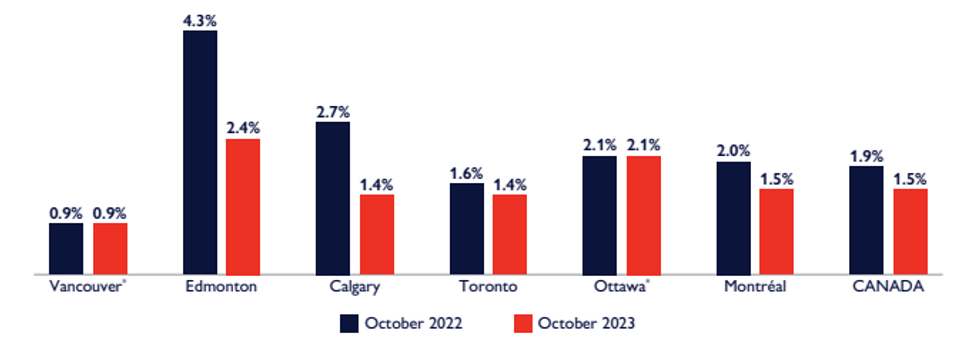

In its annual rental market report, published Wednesday morning, CMHC reveals that vacancy for two-bedroom purpose-built rental units dropped to a “new low” (or at least, the lowest the metric’s been since the government agency began tracking the data in 1988) of 1.5% by October 2023.

“Strong immigration and employment growth pushed up rental demand at the national level,” CMHC explains. “As for supply, it increased again, but not at a strong enough pace to keep up with rental demand.”

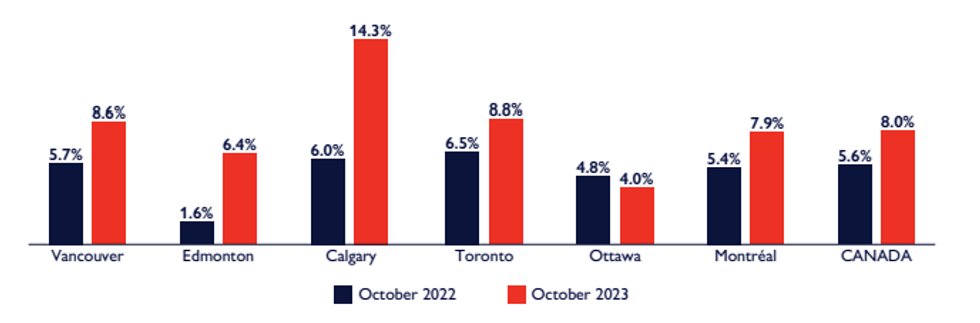

At the same time, average rent growth for those same units crept up to a “new high” of 8%, according to the report, bringing the average rate to $1,359. That rate of growth well outpaced the 1990-to-2022 average of 2.8%, as well as the rates of inflation (4.7%) and wage growth (5%).

“With high inflation and rents growing faster than incomes, it’s understandable that many households have had more difficulty paying rent… As a result, nationally, the share of purpose-built rental units in arrears increased from 6.5% in 2022 to 7.8% in 2023,” CMHC also notes.

“Among major centres, Toronto had the largest increase in arrears. This left its arrears rate (19.6% of the rental universe) at over twice the national average (7.8%). Vancouver (4.1%), Montréal (4.4%), and Ottawa (5.9%) also had higher arrears rates, but they remained well below Toronto’s rate.”

CMHC Lead Toronto Economist Jordan Nanowski tells STOREYS that cases of rent arrears have surged from around 13% just a few years ago. He also points out that this is the first year data on rent arrears has been included in CMHC's annual rental market report (although the government agency has been publishing data on arrears since 2020).

“It is worth noting though that, while we're seeing higher rental arrears, those make up a small percentage of the total rents collected by rental providers. So in Toronto, it's estimated that about 2.6% of rents were not collected due to rental arrears. While that number does sound high, it's not having a significant impact on rental housing providers,” he adds.

Although there’s no disputing that housing affordability was squeezed across all Canadian markets this past year, Nanowski underlines the “hardships” facing Toronto renters in particular. Beyond the data on rent arrears, Nanowski says that the market is tightening “at a much stronger pace” than what's being observed nationally.

CMHC’s data shows that the vacancy rate for purpose-built rental apartments in Toronto dropped down to 1.4% last year, bringing the metric in line with its pre-pandemic level. Meanwhile, rent growth for those same units clocked in at close to 9%, bringing the average rate to $1,940.

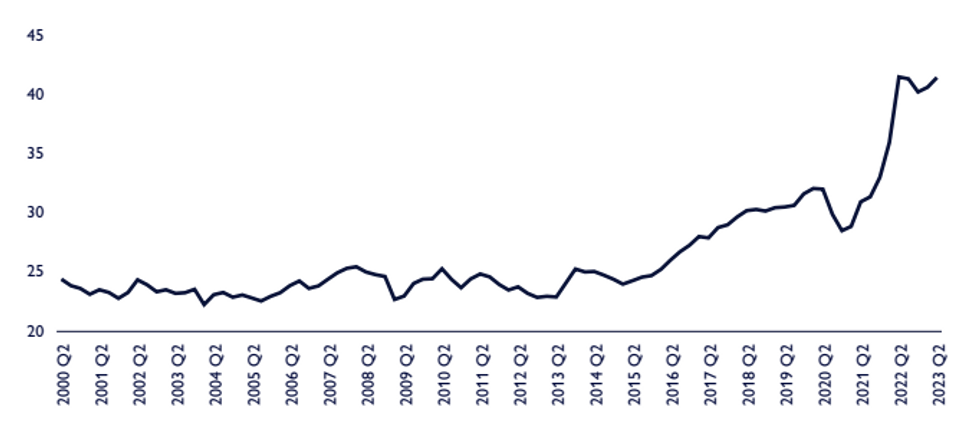

Immigration certainly drove the market in 2023, says CMHC, however, the agency emphasizes that the deterioration of homeownership was also a big-ticket factor.

“In recent years, it has become much harder to carry the cost of a home. In the second quarter of 2023, monthly housing expenses, if buying a median-priced condominium, were more than 40% of the region’s median gross household income,” says the report. “These expenses, as a share of income, were at their highest level on record due to higher mortgage rates. Reduced mobility from renting to homeownership in 2023 was evidenced by lower turnover and weak home sale volumes throughout the year.”