Despite the fact that Canadians interact with real estate every day, it can be perplexing to experience the market firsthand. And with high stakes associated with real estate dealings, it’s not uncommon -- or unfounded -- for consumers to feel wary.

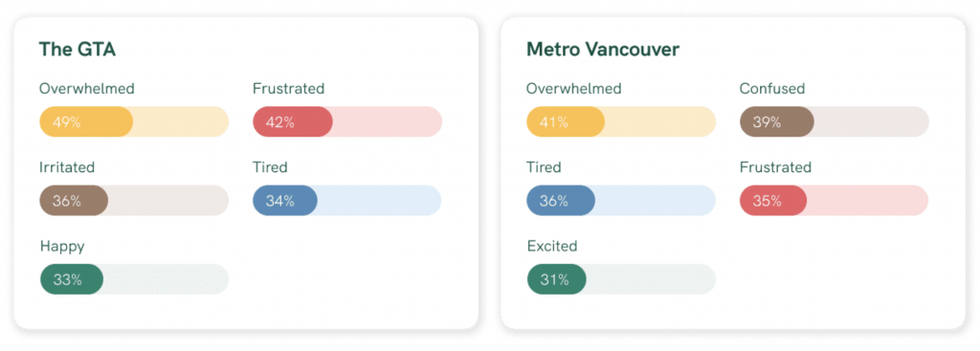

In fact, a clear majority (69%) of homebuyers and sellers in Canada’s most overvalued markets are reportedly stressed out by the real estate process. This is according to real estate brokerage Properly.

Properly's findings are certainly not a one-off. Real estate conditions have jumped from one extreme to the next this year -- chipping away at any sense of certainty -- and just a few weeks ago, Bloomberg reported a fifth-straight week of sinking consumer confidence, attributed largely to a “sharply deteriorating outlook for the nation’s housing market."

Cam Forbes, a Toronto-based broker and Chief Operating Officer at RE/MAX Realtron, echos the sentiment that consumers -- buyers and sellers in his network -- are facing a variety of stressors and are reluctant to make major moves.

“In this market, there's more uncertainty, no doubt about it,” he says. Sellers are routinely seeking reassurance about prices -- “they’re asking ‘am I selling too low?’ or ‘am I being taken advantage of?’” -- while buyers are concerned about the dramatic increase in mortgage rates.

Often, Forbes finds that consumers are more confused by the real estate process than anything else, particularly when it comes to some of the larger forces affecting real estate.

“The average consumer is not an expert in real estate,” he says. “I find most people are not really knowledgeable about what interest rate increases mean, for instance, or what’s going to happen with prices.”

These are precisely the types of sentiments being captured by Properly's Real Estate Therapy tool, which the proptech company and brokerage launched in October.

Real Estate Therapy is an anonymous public forum with real estate experts on the backend. Users can plug in a real estate query, scroll down, and stay tuned (it can take up to a few days) for a jargon-free answer with links to additional resources.

However, anyone using Real Estate Therapy should bear in mind that Properly currently operates in the Greater Toronto and Metro Vancouver areas, so any questions that might be specific to another market might be better answered by a local expert.

Properly tells STOREYS that the most commonly asked questions from buyers have to do with affordability -- think ‘how much do I need for a down payment?’, ‘how much are closing costs?’, ‘are fixed or variable rate mortgages better?’ -- and given what Canadians are up against, it’s not hard to see why.

"For buyers in the market today, a very obvious stressor is the impact that interest rates are having on affordability. A buyer who may not have purchased yet, but planned to at the beginning of 2022, has seen their affordability change six times over the past six months,” says Rahim Jaffer, a real estate agent with Properly.

And the growing burden of affordability is reflected in Properly’s backend data. Following the most recent rate announcement, which saw the Overnight Lending rate hiked 50 basis points to 3.75%, Properly observed a spike in activity on the Real Estate Therapy forum.

“Another stressor would be the notion that, in a declining market, it is difficult to know whether the home you purchase may be worth less a month from today.”

Jaffer adds that for sellers, the points of contention "appear to be more emotional in nature. Their homes are not selling as fast as their neighbours did in early 2022, and for slightly less.”

Forbes notes that while these concerns are certainly valid, there is usually a flip side worth considering.

“For example, if you sell your home for less than the peak of the market, that's okay, because you're also going to buy less than the peak in the market,” he says. This is also a good environment for sellers to trade up. “Those who are moving from a smaller home to a bigger home, there actually at an advantage now because the difference between the home they're selling and the one they’re buying is less. It's actually a smaller gap.”

It’s these types of concerns he urges buyers and sellers to put to rest with the help of a real estate professional.