Prepayment Penalty

Understand what a prepayment penalty is in Canadian real estate, how it’s calculated, and how to avoid costly surprises when ending a mortgage early.

May 22, 2025

What is a Prepayment Penalty?

A prepayment penalty is a fee charged by a lender when a borrower pays off all or part of their mortgage before the end of the agreed term.

Why do Prepayment Penalties Matter in Real Estate

In Canada, many mortgage agreements — especially fixed-rate contracts — include clauses that penalize borrowers for paying off their mortgage early. This could happen through refinancing, selling the home, or making large lump-sum payments outside the allowed annual prepayment limit.The penalty is usually calculated as the greater of:

- Three months' interest, or

- An interest rate differential (IRD), which compares the contract rate to current rates over the remaining term

Prepayment penalties can amount to thousands of dollars and often surprise borrowers who are unaware of the clause. Understanding the details in your mortgage contract can help you plan refinancing or selling without incurring unexpected costs.

Borrowers looking for flexibility may consider mortgages with prepayment privileges or lower penalties, and should always confirm the specific terms with their lender before signing.

Example of a Prepayment Penalty in Action

A homeowner with a fixed mortgage rate of 5% breaks their mortgage two years early. Because current rates have dropped to 3%, they owe a $7,000 prepayment penalty based on the IRD.

Key Takeaways

- Charged when paying off a mortgage early.

- Most common with fixed-rate mortgages.

- Can be calculated as three months’ interest or IRD.

- May apply when selling, refinancing, or renewing early.

- Important to review penalty terms before signing.

Related Terms

- Mortgage Term

- Refinance

- Porting a Mortgage

- Early Renewal

- Interest Rate Differential (IRD)

205 Queen Street, Brampton/Hazelview

205 Queen Street, Brampton/Hazelview

Christine Boyle and Gregor Robertson. (Government of British Columbia)

Christine Boyle and Gregor Robertson. (Government of British Columbia)

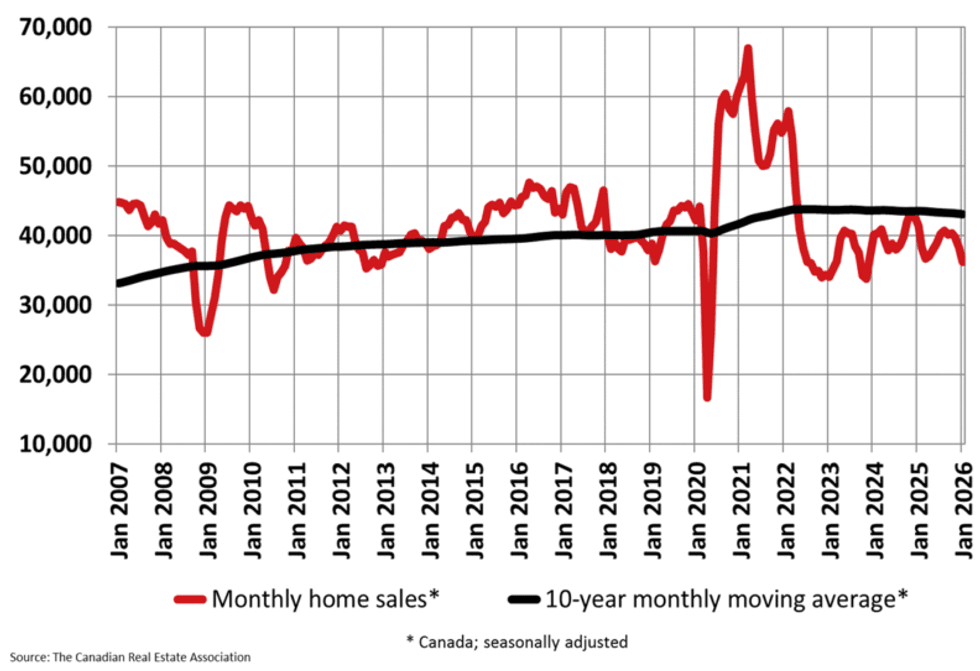

CREA

CREA