Pre-Approval Letter

Understand what a pre-approval letter is in Canadian real estate, what it includes, and how it helps buyers make competitive offers.

May 22, 2025

What is a Pre-Approval Letter?

A pre-approval letter is a document issued by a lender that states a buyer has been conditionally approved for a mortgage up to a specified amount, based on a preliminary review of their financial profile.

Why Do Pre-Approval Letters Matter in Real Estate?

In Canadian real estate, a pre-approval letter helps buyers prove their seriousness to sellers and strengthens their offer in competitive markets. While it’s not a final loan commitment, it provides a detailed snapshot of the buyer’s borrowing power.

Pre-approval letters typically include:- Maximum loan amount

- Estimated interest rate and term

- Conditions (e.g., property appraisal or documentation)

- Validity period (usually 60–120 days)

Having a pre-approval letter can speed up the closing process and reassure sellers that the buyer is financially qualified.

Understanding the role of a pre-approval letter helps buyers shop within their budget and act quickly on desired properties.

Example of a Pre-Approval Letter in Action

A buyer presents a pre-approval letter showing they are approved for up to $750,000, giving the seller confidence to accept their offer.

Key Takeaways

- Confirms preliminary mortgage approval.

- Strengthens buyer credibility.

- Based on credit and income review.

- Contains loan amount and terms.

- Not a final commitment.

Related Terms

- Mortgage Pre-Approval

- Conditional Approval

- Mortgage Qualification

- Interest Rate

- Financing Condition

Toronto condos

Toronto condos  Toronto purpose-built/Shutterstock

Toronto purpose-built/Shutterstock

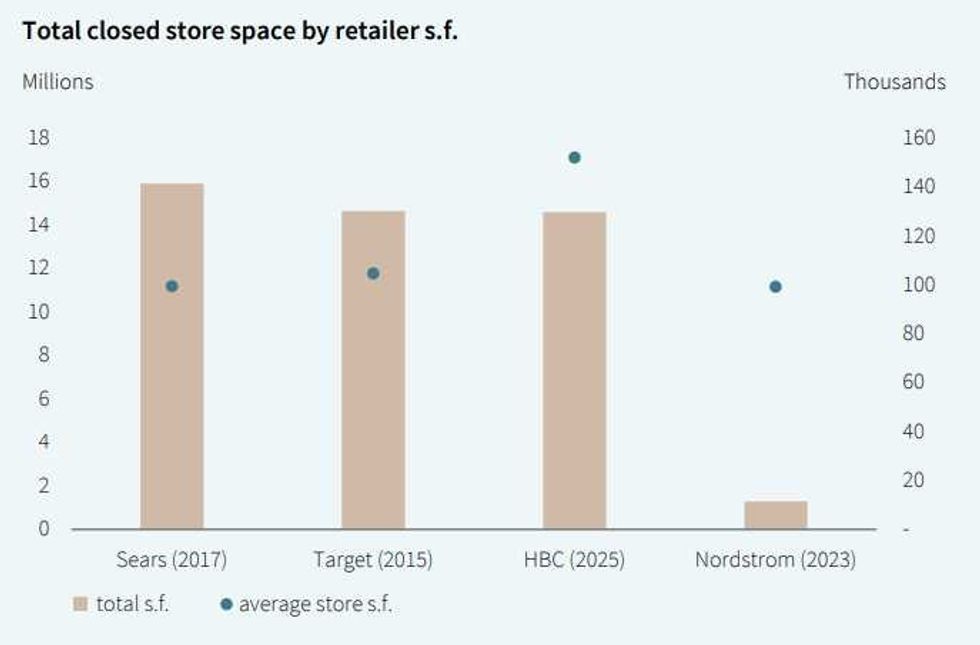

Hudson’s Bay vacated about as much space as Target did in 2015. (JLL)

Hudson’s Bay vacated about as much space as Target did in 2015. (JLL)