As home prices remain sky-high and largely unattainable in many parts of Ontario, countless homebuyers are turning their sights to more affordable cities in other parts of the country. But there are still are some urban regions in Ontario that are relatively affordable. Case in point: the nation’s capital.

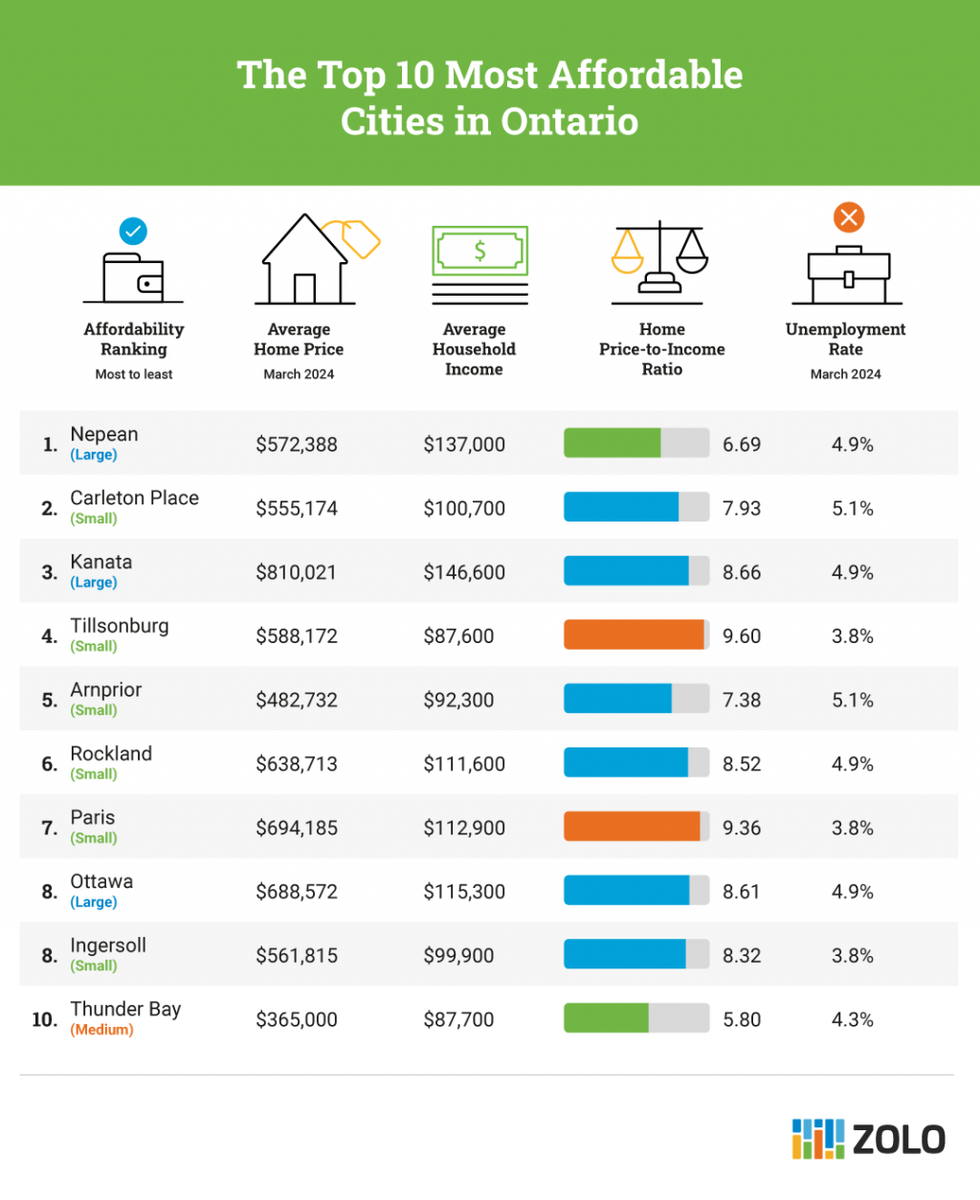

According to data from real estate market place Zolo, the Ottawa region includes 50% of Ontario’s 10 most affordable cities. Zolo examined 97 small, medium, and large cities in Ontario and ranked them according to affordability, taking into account average home prices, incomes, population growth, and unemployment rates.

According to the findings, Nepean, Carleton Place, Kanata, Rockland, and Ottawa all occupy the top ten spots, with designation of the most affordable city going to Nepean. Here, the average home price is $572,388, the average household income is $137K, resulting in a home price-to-income ratio of 6.69. The unemployment rate is also just 4.9%.

In Carlton Place, the second most affordable city, the average home price was slightly lower at $555,174 (but the home price-to-income ratio was slightly higher).

“Ottawa is not only a steady market, but it’s a very affordable market compared to other large metropolitan areas,” says Ottawa realtor Anita DeVries Bonneau. “Ottawa proper and the surrounding area are considered affordable places to live.” This is especially true compared to the notoriously pricey Greater Toronto Area (GTA).

Ottawa realtor Matthew Mercier-Burns says that he’s seen an increase in Ottawa region buyers who have relocated from the GTA in favour of more affordable pastures (and, perhaps, a change of pace). “Toronto buyers are our favourites, because they come in here and give us full asking,” says Burns. “If they can get $1M to $1.2M for their townhouse in Toronto, and one in Ottawa for $750K all dolled up, they’re pretty happy.”

Burns says the Ottawa region is an appealing one on the lifestyle front. “It’s a smaller and quieter city, you don’t have to compete to get into schools,” says Burns. “Transportation is easy; everything is 20 minutes away in Ottawa.” (Sounds like a dream compared to Toronto and its rampant traffic and congestion).

The Time To Act Is Now

If you’re looking at Ottawa, the time to get in is now. Or at least, in the not-too-distant future. “There’s a saying in real estate world that the time to buy was yesterday,” says Burns. That’s not to say that the Ottawa market isn’t experiencing a more subdued market as of late, like the rest of the country. But buyers appear to be slowly coming off the sidelines.

“We noticed an increase in new listings this spring because sellers’ confidence has returned,” says DeVries Bonneau. “Now, the confidence of buyers is starting to [return] as well with the recent interest rate cut. We’re seeing buyers come off the sidelines daily. We don’t have a crystal ball, but if there are further rate cuts in the coming months, things are going to really take off. For buyers who have sat on the sidelines for the past 14 months, it will be a good time to buy.”

Burns, too, has seen more activity in the market lately. “There were a lot more people on the fence this year,” says Burns. “But, with the interest rate drop, a bit of buyers' confidence is coming back and we’re seeing more buyers come to the market now. The condo market is still very slow. But Richmond, Carlton Place, and Kemptville are all very active because you can get a lot more for your money. Stittsville and Orleans are also popular.”

DeVries Bonneau also references the Kemptville area, located south of Ottawa, as an increasingly desirable place to call home. “A of people are living there and commuting to downtown Ottawa with ease because the 416 highway is right there,” says DeVries Bonneau. “Mattamy has a new development called Oxford Village that’s quite popular. Kemptville is also creating an expansion of Country Road 42, which will make commuting easier for residents going to Ottawa. I think the southern Ottawa region will be increasingly coveted.”

DeVries Bonneau says she’s seeing a demand in Ottawa’s surrounding rural areas, “which are also affordable, and where you can relatively easily commute to Ottawa proper,” she says.

Waterfront real estate is also about to have a moment, says Burns. “This is a big city for cottaging,” says Burns. “Government employees are going back to work for three days a week in September, something that will cause a real estate shift. We’ll see more cottages up for sale from people who moved there full-time during the pandemic, so it will be a good time to buy a cottage.”

When it comes to housing stock, Burns bungalows are currently hot in the Ottawa region – especially when it comes to Baby Boomers looking to downsize. “A lot of Boomers are moving out of their big homes and into bungalows,” says Burns. “A lot are renting as well.”

Will Ottawa Remain Affordable?

While the Ottawa region may be affordable now, however, Burns says he doesn’t expect it to stay that way.

New data from the Municipal Property Assessment Corporation reveals that homes valued between $500,000 and $750,000 now account for 43.2% of Ottawa's properties – the largest proportion of Ottawa’s real estate market – while only 19% of homes are valued under $500,000.

With that said, DeVries Bonneau expects the Ottawa real estate market to remain relatively affordable compared to other urban centres in Ontario. “Ottawa has been an affordable area for a long time,” says DeVries Bonneau. “And when you had all the fluctuations in the Toronto market, it remained quite steady and stable.”

The Ottawa region is doing relatively well on the housing supply front, and has been celebrated for its ability to “get shovels in the ground,” as they say. In April, Ottawa received over $37.5M from the Ontario government for nearly reaching its provincially mandated housing target for 2023.

“Ottawa is building as fast as it can,” adds Burns.