As the old saying goes, "what goes up must come down," and it appears this might be the case for Canada's red-hot housing market. While home prices continue to soar, the rising resale activity seen through 2021 slowed in April, suggesting that moderation may be coming.

RBC economist Robert Hogue says this may be an early sign that some buyers are reaching their limit when it comes to engaging in fierce bidding wars, as soaring property values have significantly raised the bar for those contests.

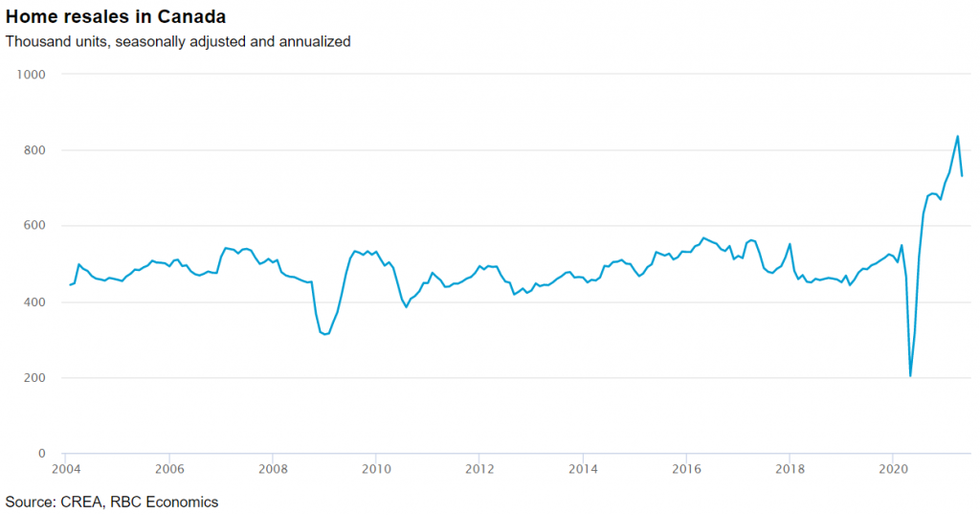

After successively setting new record highs through the fall and initial months of 2021, home resales had little upside left, falling 12.5% to 731,600 units month-over-month in April.

Hogue says robust winter activity likely altered the traditional seasonal pattern, bringing forward action that would have taken place in the spring.

READ: Latest National Housing Data Confirms Market is Taking its Foot Off the Pedal

While national home resales declined overall, Hogue says, "the picture was far from even last month."

Home resales in the more affordable and less overheated markets barely pulled back or even increased, especially in parts of Atlantic Canada, the Prairies, and Quebec. Resales in Alberta and New Brunswick, for instance, rose 3.9% and 2.6% month-over-month, respectively, while they fell just 2.4% in Quebec.

Most of the drop took place in southern Ontario and British Columbia, where earlier advances had been powerful.

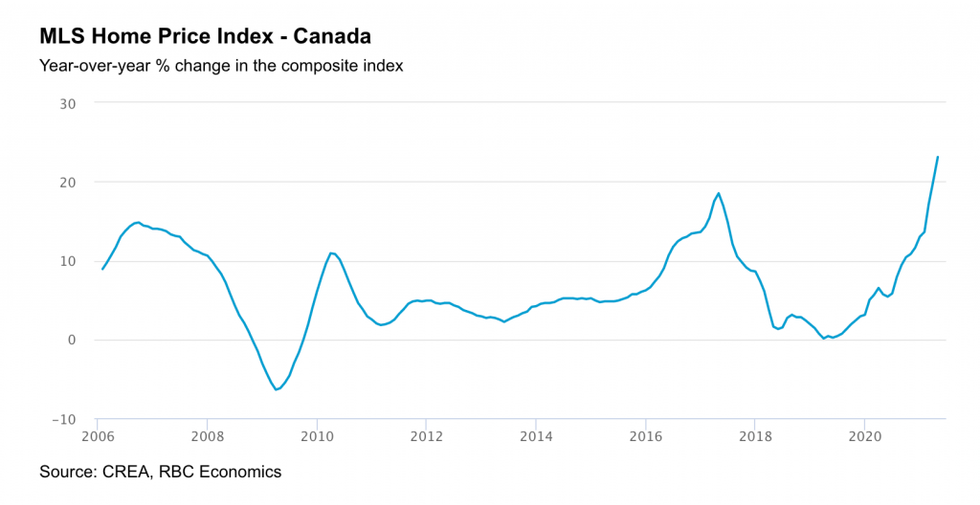

In light of this, home prices continue to rise, and despite easing in the past three months, demand-supply conditions remain incredibly tight, sustaining intense upward price pressure.

Canada’s composite benchmark price (MLS Home Price Index) rose another $17,000 (2.4%) to $731,600 between March and April, pushing up the increase to $135,000 (23.1%) since April last year.

Hogue says housing trends in Ontario continue to dominate the national story, though prices continue to climb "briskly" in most other markets, both big and small.

Ontario’s cottage country is seeing tremendous competition among buyers with property values in Southern Georgian Bay (up $36,400 month-over-month), Kawartha Lakes (up $27,700), and Lakelands (up $26,600) recording some of the larger gains nationwide in April.

Small southern Ontario markets are also up, like Woodstock-Ingersoll ($23,400), Brantford ($21,300), and Ottawa ($23,000).

Hogue says buyers are also paying materially more in British Columbia, including in the Fraser Valley, where prices are up $32,200 month-over-month and Victoria is up $22,200.

While these markets saw notable month-over-month increases, the dollar figures were less dramatic in other markets across Canada, though Hogue says they point to further widespread acceleration. This includes the Prairies where prices in Calgary, Edmonton, Saskatoon, and Winnipeg have really "taken flight" since the start of this year.

While home prices continue on their upward trajectory, Hogue says there is "plenty of room" for resale activity to ease further in the months to come while remaining "historically vibrant."

"We expect a gradual rise in longer-term interest rates, deteriorating affordability, mortgage stress test tightening, and the resumption of office work to cool demand down a few degrees," said Hogue.

At the same time, soaring prices could also attract more sellers, says Hogue, as this combination "would ease the extreme imbalance that has characterized the market since last summer."

If this scenario were to occur, Hogue says it would set the stage for moderation in the rate of price increases later this year.

"In the meantime, though, prices are likely to keep rising rapidly," added Hogue.