*Editor's note: The previous version of this story incorrectly stated prices had fallen for the third straight month, not the second. This story has since been corrected.

The scales are tipping ever closer to balanced territory in housing markets across Canada as rapidly rising borrowing costs have impacted homebuyer behaviour and purchasing power.

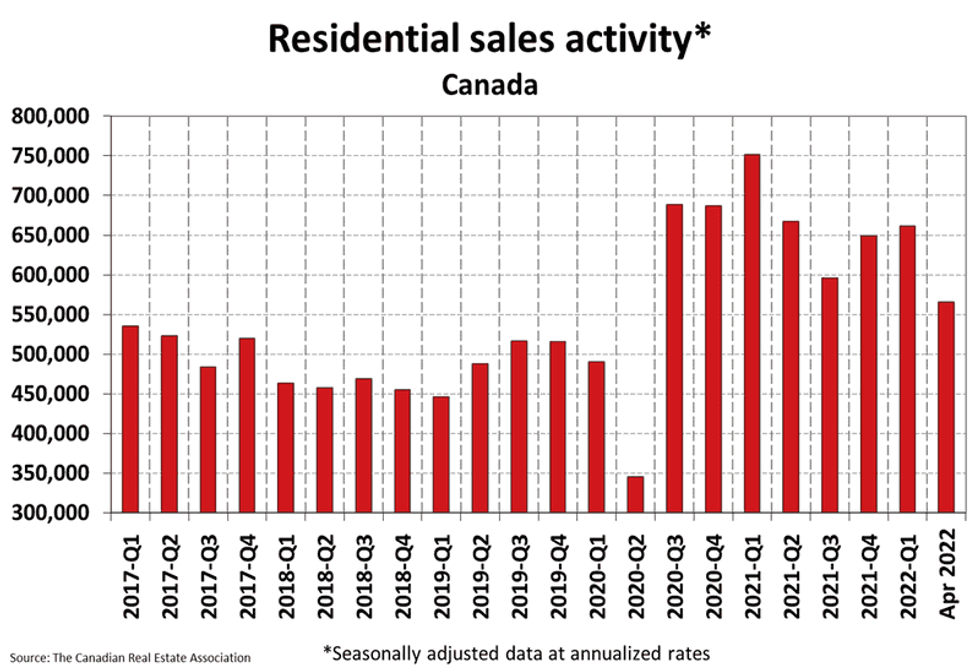

The April numbers from the Canadian Real Estate Association reveal home sales fell by 25.7% from the previous record-breaking year -- down 12.6% from March alone -- marking the slowest month seen since the summer of 2020 with sales down in 80% of local markets. However, CREA points out, the market remains quite hot from a historical perspective, as the third-busiest April on record.

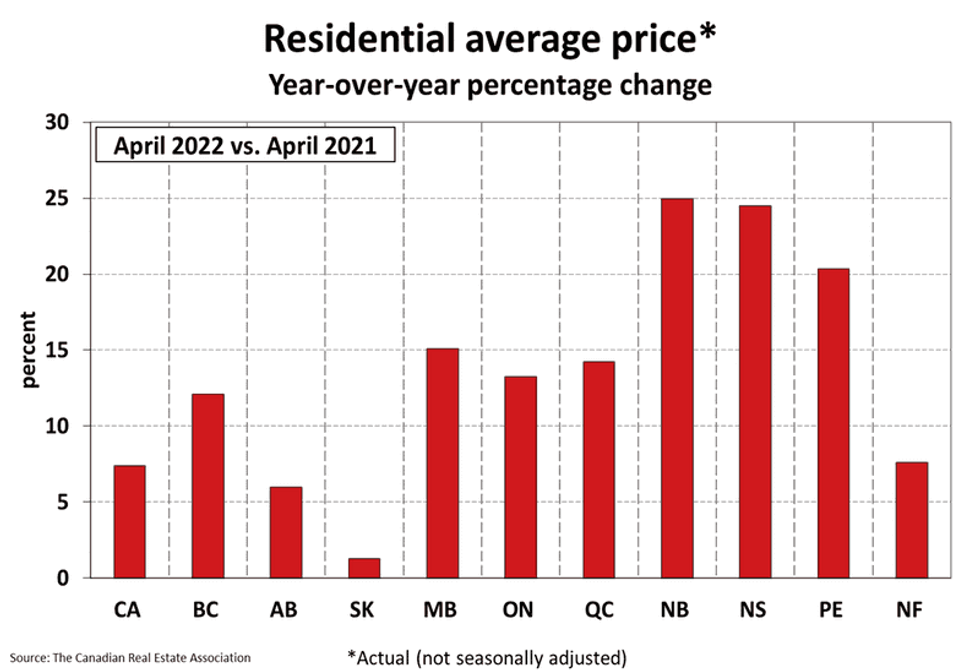

On a monthly basis, average home prices are down 6.2% to $746,000. While still posting a 7.4% year-over-year gain, it is clear the blistering pace of growth has chilled; the MLS Home Price Index, which tracks the most typical type of home sold, dipped on a monthly basis for the first time this year, down 0.6% from March. Annual growth is up 23.8%, but that’s considerably softer than the record 29.2% spike recorded as recently as February.

CREA notes that price trends were uneven across the country, with Ontario an especially mixed bag as some local markets saw gains, some declines, and others remaining flat. The prairies experienced modest increases, with Atlantic Canada still posting strong gains.

“Following a record-breaking couple of years, housing markets in many parts of Canada have cooled off pretty sharply over the last two months, in line with a jump in interest rates and buyer fatigue,” said Jill Oudil, Chair of CREA. “For buyers, this slowdown could mean more time to consider options in the market. For sellers, it could necessitate a return to more traditional marketing strategies.”

The cost of both fixed and variable mortgage rates have been on the rise of late. The latter has been hiked higher in recent months by the Bank of Canada -- bringing consumer lenders’ Prime rate to 3.2% -- with several more increases on the horizon this year. Discounted fixed mortgage rates from the big six banks all hit the 4.39% range last week as five-year Government of Canada bond yields spiked to a new decade high.

That the cost of borrowing has risen so quickly is the main hurdle facing today’s homebuyer says Shaun Cathcart, CREA’s Senior Economist, as borrowers grapple with tougher stress test criteria and reduced budgets.

READ: OSFI May Be Considering Lowering the Mortgage Stress Test Rate

“After 12 years of ‘higher interest rates are just around the corner’ here they are. But it’s less about what the Bank of Canada has done so far,” he says. “It’s about a pretty steep pace of continued tightening that markets expect to play out over the balance of the year, because that is already being factored into fixed mortgage rates. Of course, those have, for that very reason, been on the rise since the beginning of 2021, so why the big market reaction only now?

"It’s likely because typical discounted 5-year fixed rates have, in the space of a month, gone from the low 3% range to the low 4% range. The stress test is the higher of 5.25% or the contract rate plus 2%. For fixed borrowers, the stress test has just moved from 5.25% to the low 6% range -- close to a 1% increase in a month! It won’t take much more movement by the Bank of Canada for this to start to affect the variable space as well.”

According to analysis from Robert McLister, Mortgage Strategist at MortgageLogic.news, five-year preferred fixed rates have increased 130 basis points from the all-time low of 1.84% in November 2020; a borrower getting a mortgage rate of 4.24% today will pay $11,328 more in interest expenses per $100,000 of mortgage over a five-year period.

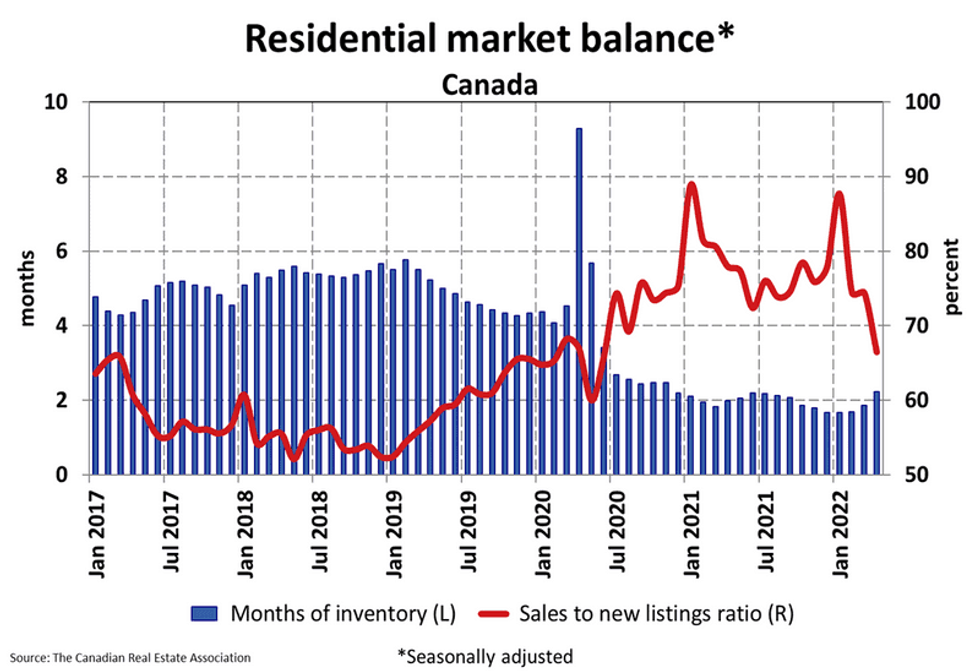

The silver lining to the market’s slowdown, however, are slightly saner buying conditions. The number of new listings brought to market slipped 2.2% from March -- but as that was well outpaced by the decline in sales, that’s effectively pulled the sales-to-new-listings ratio (SNLR) down to 66.5%, the lowest since June 2020. This can still be considered a sellers’ market from a national perspective, but indicates balance is returning at the local level; just over half of markets could be considered as such, with the remainder experiencing sellers’ conditions.

The market is also enjoying a badly-need influx of overall supply, with months of inventory now sitting at 2.2 -- up from the record low of 1.6 seen during the first few months of 2022, though still well below the long-term average of 5 months.