It appears the effects of rising interest rates have made their way to the pristine shores of Muskoka, as sales of both waterfront and non-waterfront properties have chilled compared to last year.

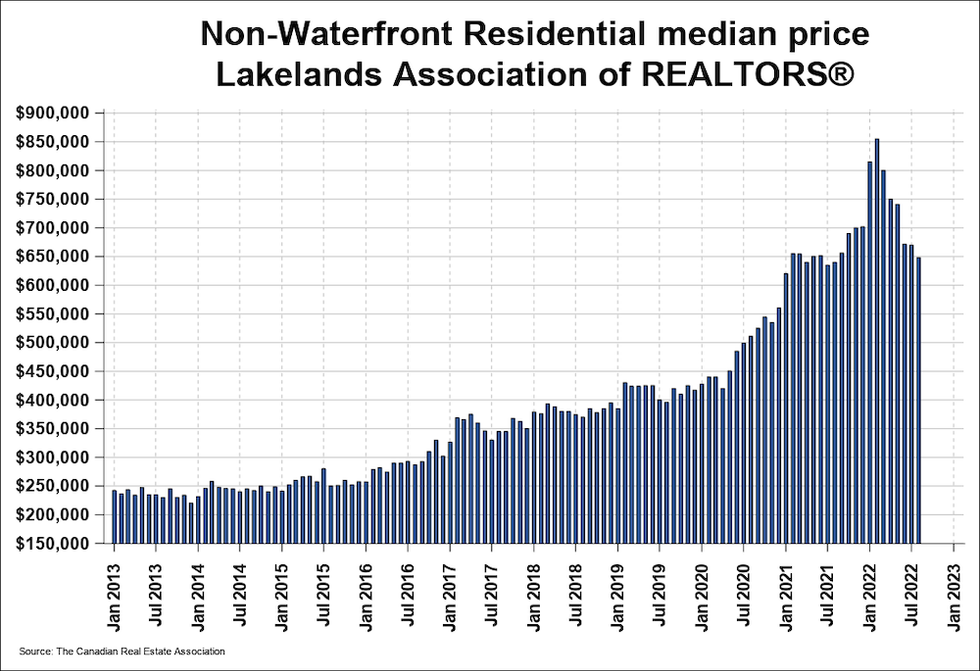

According to the August data from the Lakelands Association of REALTORS, as reported by the Canadian Real Estate Association, a total of 355 non-waterfront residential properties sold last month, a “substantial reduction” of 41% compared to the same period in 2021. That comes in 39.8% below the five-year average, and 38% below the 10-year average, the association notes.

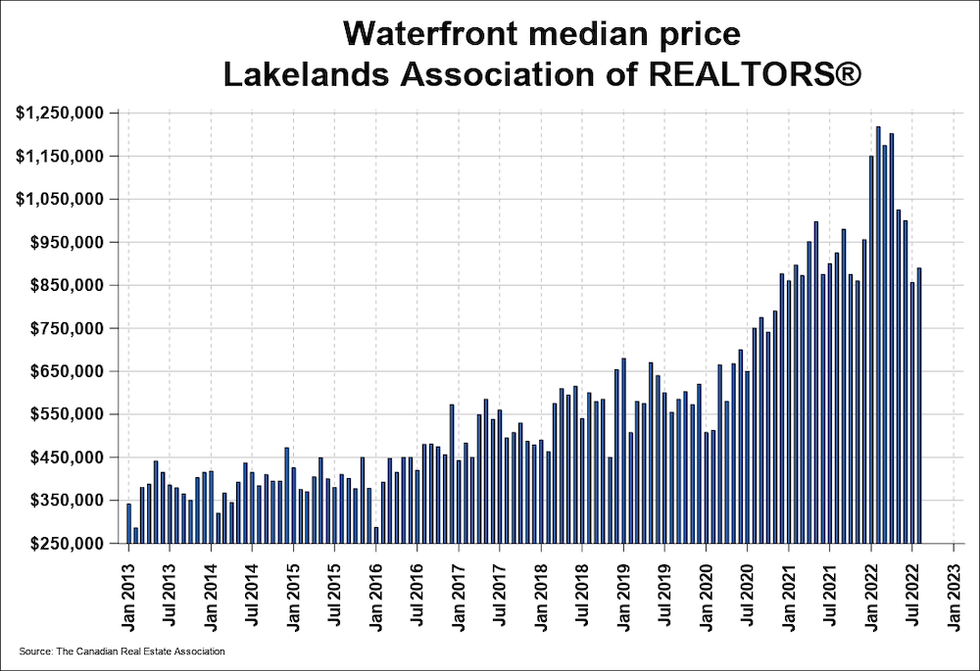

Meanwhile, waterfront property sales totalled 141 units, down 43.8% year over year, and marking a 41.1% deviation from the five-year average, and 42.3% below the 10-year average.

Year-to-date, non-waterfront sales have totaled 3,404 units, while a total of 884 waterfront properties have sold, marking YoY decreases of 33.7% and 46.5%, respectively.

READ: Muskoka Real Estate Market Continues to See a Correction

However, despite the headwinds facing the Muskoka housing market -- namely recent rate hikes from the Bank of Canada and a recovery in supply levels -- cottage country prices have remained relatively stable. The median price for residential non-waterfront property sales was $648,000, up 1.3% year over year (YoY), and $747,074 year to date, an increase of 14.9%.

While price growth was slightly softer in the waterfront segment with a median price of $890,000 -- a YoY decline of 3.8% -- that’s a fairly modest dip, given how steeply sales have slid.

“Waterfront property prices are generally holding value despite overall market corrections affecting other real estate sectors like non-waterfront,” said Ross Halloran, Broker and Senior VP Sales, Halloran & Associates, Sotheby’s International Realty Canada.

The total dollar value of all August waterfront sales came to $171.7M, a considerable reduction of 45.5% from last year.

“Indeed, given there were almost 50% fewer transactions in August 2022 over August 2021, and most sales saw a discount from the list price, the list price to final sale price ratio dropped from 104% of ask price at the end of April 2022 to the pre-pandemic level of 96% in July,” Halloran says.

However, the more comprehensive year-to-date metric reveals overall price growth, with waterfront homes fetching a median price of $1,025,000, up 13.3% from the first eight months of 2021. That these values have actually increased are due to the “historically high performance” the market witnessed in the first five months of this year, Halloran clarifies.

As well, the MLS Home Price Index (HPI) -- a metric that more accurately tracks home prices than the average or median -- clocks the benchmark for the total Lakelands region at $725,400, a YoY gain of 6.5%.

Split out by home type, single-family homes came to $746,200, an increase of 6%. Townhouse/row units experienced the greatest increase in value, rising 14.2% to $657,900, while benchmark apartment prices rose 14% to $512,500.

It appears Muskoka property values are showing resilience in the face of tougher borrowing costs, more of which are set to come this fall.

This article was produced in partnership with STOREYS Custom Studio.