One in four homeowners in King, Ontario, owns more than two homes, according to recent data released by the Canadian Housing Statistics Program (CHSP), which is part of Statistics Canada. King has the most owners of two or more properties in the Greater Toronto Area, at 26.2%, according to data from 2019.

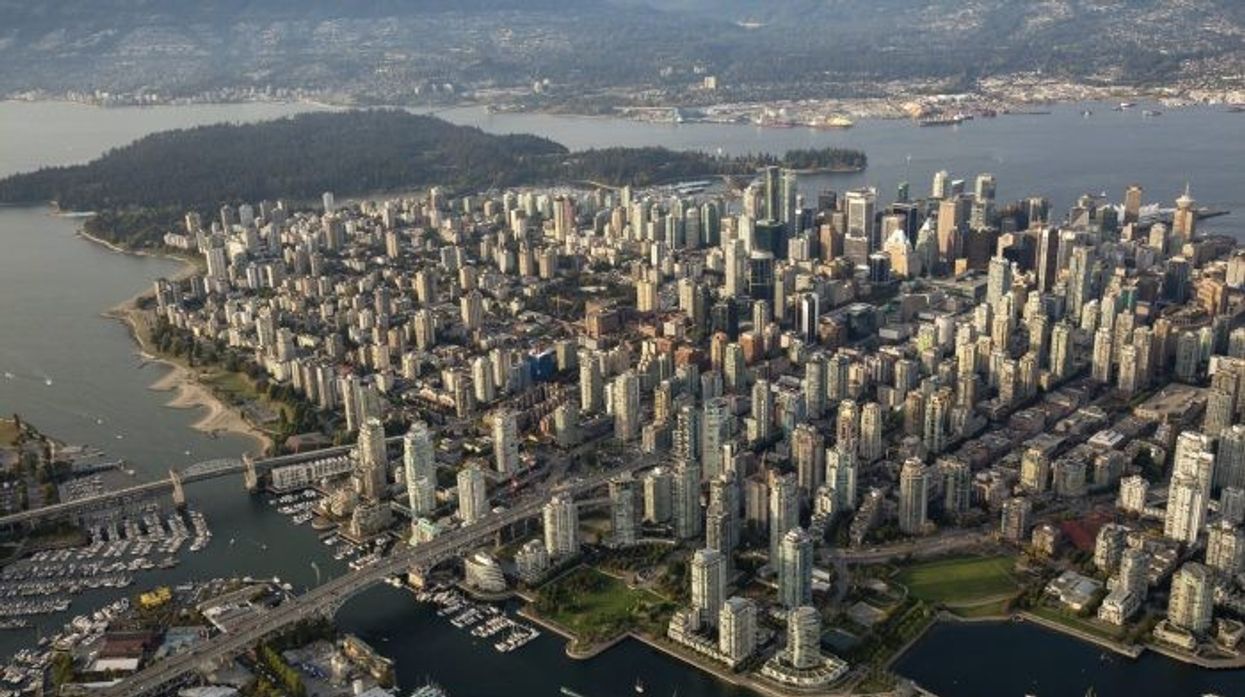

In Toronto and Vancouver in particular, residents are snapping up homes as investments to grow their wealth, a growing trend in major cities in recent years that’s caused concern among some housing experts who see such activity as widening the wealth gap.

There is a relationship between a homeowner’s rate of multiple home ownerships and the average sale price in the region that they live. In King, with its large estate style homes, it has the highest average sale price in the Greater Toronto Area at close to $1.9 million. According to Realosophy data, the average house price in the neighbourhood of Rural King is higher, at $2.2 million. Meanwhile, Orangeville, for example, has a low rate of multiple homeownership at 9.3%, and it also has a relatively low average house price, at $786,219, according to the Toronto Region Real Estate Board.

“The York region tends to have the higher home prices, and out of the region, King feels more rural for sure, because the lots are bigger, the properties are bigger, and it’s not a bunch of tiny subdivisions,” says John Pasalis, founder and president at Toronto’s Realosophy brokerage, which also does analysis. “And I think that is what has made it more attractive for a lot of people who want bigger homes and bigger lots. That’s what is driving a lot of that in those areas.”

The second highest rate of multiple home ownership (MHO) is in Richmond Hill, where 21.8% own more than two houses. The average sale price is $1.4 million, according to Realosophy. Overall, the York region MHO rate is higher than in Toronto, where 17%t of homeowners own more than two homes and the average sale price is just over $1 million.

The statistics exclude owners who are non-residents of Canada, so the report only refers to domestic ownership.

The numbers cannot explain what property owners are doing with the homes that they do not live in, but what is known is that the majority of multiple homeowners live in Toronto and Vancouver census areas. The total number of multiple owners in Ontario is 835,175 residents, three times higher than the number in BC. In BC, however, the value of holdings is higher. In Toronto, about 36% of the MHO group own two detached houses. As well, nearly half of the Toronto area multi-homeowners owned properties within the same area, indicating that these are not cottages or recreational properties.

The findings underscore what has been long suspected -- the creation of wealth from real estate ownership. The CHSP data found that MHOs live in more expensive homes. “It shows that the more properties owned, the higher the median assessment value of the owner’s usual residence,” said the StatCan report. For example, in Toronto, the owner of three properties lives in a house with a median assessed value 35% higher than the home of a single-property owner.

Pasalis believes their wealth is a combination of higher income and higher net worth due to property ownership. A house that doubles in value in a decade enables the average income homeowner to borrow against it and put $150,000 down on a condo.

“I’m not surprised the highest share were in areas like the York region, to be honest. Other areas, like Richmond Hill and Markham, demographically they are quite different and they are also very wealthy.“

He says there are a lot of investors in the region.

“Whereas Durham, for example, you don’t see a lot of investors in Durham. It’s also less affluent, so your property is not worth as much. If you bought your home in Durham for $400,000 10 years ago and it’s worth $800,000 today there’s less to leverage.”

The new data, based partially on income tax returns, enables policy makers to make decisions around future housing issues.

Pasalis believes if there are changes, property owners would be protected from any tax increases, such as the removal of the capital gains exemption on their principal residence, a gain that is taxed in the US.

“I think 100% they will continue to favour home owners,” says Pasalis. “In Canada, you can have a capital gain of $2 million on your principal residence and it’s entirely tax-free. I don’t see them making changes like that, and I don’t see our government changing anything relating to investment, because it seems like they are leaning on investors to drive a lot of the new construction, and a lot of our new construction builds are financed from investors, right?

“And in Toronto it’s probably more domestic investors than it is foreign, just anecdotally. It might be different in Vancouver. Certainly there’s foreign capital flowing in, but I suspect it’s predominantly domestic investors.”