Almost exactly one month after the Metrotown Place office towers owned by Slate Asset Management were placed under receivership on July 8, the sales process has begun, according to a sales brochure obtained by STOREYS.

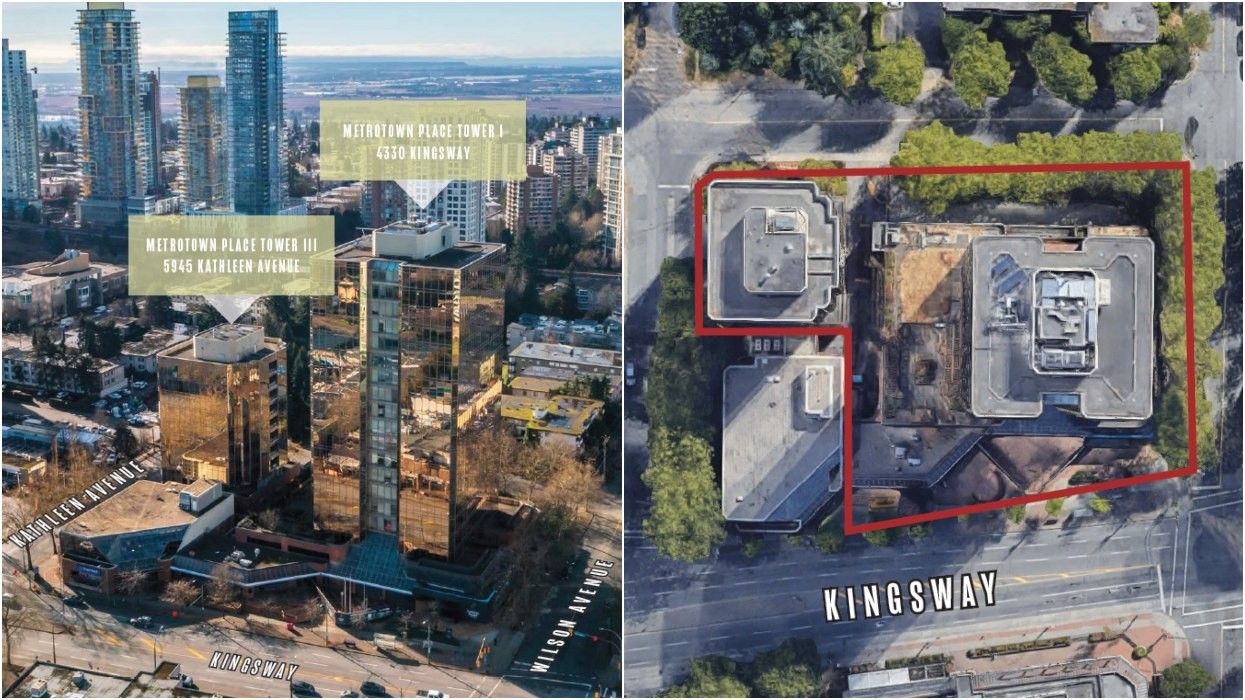

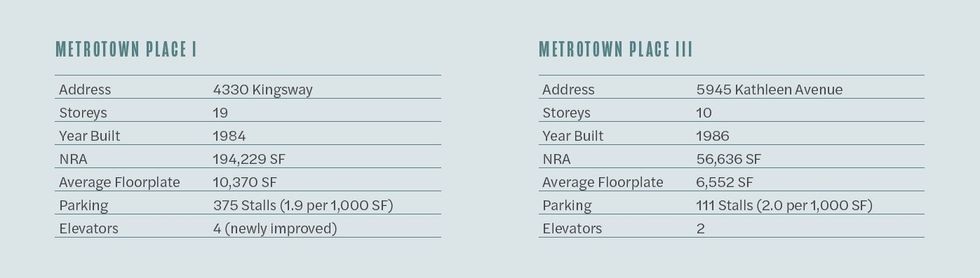

The Metrotown Place property consists of the 19-storey Tower I at 4330 Kingsway and the 10-storey Tower III at 5945 Kathleen Avenue. Adjacent to both towers is also a two-storey commercial building at the intersection of Kingsway and Kathleen Avenue — 4370 Kingsway — that's occupied by an RBC and not included in the receivership proceedings.

Metrotown Place is located in the development hotspot surrounding the Metropolis at Metrotown shopping centre in Burnaby. Among others, the office complex's neighbours towards the south include three high-rise residential towers developed by Bosa Properties, while its neighbour to the east is an Esso gas station that's slated for redevelopment by Keltic Development (who purchased it from Bosa Properties).

The Metrotown Place office towers are legally owned by SCREO I Metrotown Inc. and beneficially owned by SCREO I Metrotown LP, which is itself owned by Toronto-based Slate Asset Management, founded by UBC graduate Blair Welch and his brother Brady Welch in 2005.

The Receivership

As previously reported by STOREYS, the application to appoint a Receiver over the property was initiated by the United States Life Insurance Company in the City of New York (known as American General Life Assurance outside of New York) and the American Home Assurance Company, both of which are wholly-owned subsidiaries of Corebridge Financial.

The receivership application was pertaining to a loan agreement the parties entered into in March 2019 for the principal amount of $88,308,000 that Slate Asset Management used to acquire the property and commence with its redevelopment plans, which were to renovate and convert the property into a new strata office complex called Capital Point Metrotown. As first reported by STOREYS in May 2023, the project was quietly cancelled, with Slate confirming that they had terminated all purchase agreements and refunded deposits.

According to court documents, Slate had secured an extension agreement with the lenders that extended the maturity date of the loan from April 1, 2022 to September 1, 2023, after the company said it would be unable to pay the loan. As part of the extension agreement, Slate also had to formulate a sale or realization process satisfactory to the lenders by February 1, 2023. Slate was unable to do so until July 2023, then failed to make an interest payment on August 1, 2023, defaulting on the loan agreement.

Slate eventually retained Cushman & Wakefield to list and sell the property, who found an interested buyer with a proposed transaction set to close in Q2 2024. As a result of this, the lenders entered into a forbearance agreement with Slate to allow them to pursue the proposed transaction. However, the transaction ultimately fell through after the buyer asked for the diligence conditions waiver deadline to be extended to Q3 2025.

The lenders subsequently initiated the receivership proceedings, which was granted by the Supreme Court of British Columbia and came into effect on July 8, with the outstanding amount of debt at $48,962,830.73 as of June 20.

Metrotown Place

The property has been listed for sale by Carter Kerzner, Tony Quattrin, Vincent Minichiello, Jim Szabo, and Luke Gibson of CBRE, many of whom have handled many other high-profile court-ordered sales, including the site of a planned 55-storey tower in Vancouver and the site of a planned 67-storey tower in Surrey.

The listing is not currently public on CBRE's website. A copy of the sales brochure was provided to STOREYS by a source with no involvement in the receivership proceedings.

CBRE has listed the property without an asking price. BC Assessment values the property at $87,760,000, but it remains to be seen whether the property can secure that kind of price.

Originally constructed in the mid-1980s, the towers were once home to the Metro Vancouver Regional District, who relocated in 2015 to the nearby Metrotower III it purchased for $205M. Since Slate Asset Management began its redevelopment plans, the towers have been vacant, which means the property produces no income — oftentimes a key cause of insolvencies.

The vacant nature can potentially be a positive for some, however.

"Delivered vacant, the Property provides an excellent opportunity for an office user requiring substantial scale to own and occupy the existing two office towers, creating a campus-style business environment," CBRE says in its sales brochure.

There also continues to be plenty of uncertainty in the office market across Metro Vancouver, with developers hesitant to carry too much office space. Nearby, Anthem Properties recently sought out permission to potentially convert the seven-level office podium within its 66-storey Citizen tower into hotel use.

On the other hand, the 1.550-acre property also has redevelopment potential, which could boost its value.

"Metrotown Place I & III are currently zoned as CD, and have been designated as part of the high-density Metro Downtown neighbourhood by the recently approved Metrotown Downtown Plan," says CBRE, who adds that the proposed zoning for the site allows for a total buildable density of up to 14.30 FSR.

"Metrotown Place presents investors with a flexible acquisition opportunity to either (1) own and occupy the existing office towers; (2) redevelop the Site into significant mixed-use residential density; or (3) pursue a combination of both preserving one existing office tower and redeveloping the other."

The sale of Metrotown Place will require final approval from the Supreme Court.

- Site Of Foreclosed 67-Storey AimForce Project In Surrey Listed For $75M ›

- After Receivership, Planned 55-Storey Tower Site In Vancouver Put Up For Sale ›

- Richmond Hill Mortgage Lender Placed In Receivership Amid $10M Debt ›

- Chard Buys Site Of 55-Storey Vancouver Project In Receivership ›

- Slate Ending Management Agreement With Slate Office REIT, Welchs Leave Board ›

- Slate Office REIT Sells Woodbine & Steeles Corporate Centre For $39M ›