As more and more members of the general public become increasingly aware of the high amount of development cost charges (DCCs) that developers have to pay, and then pass on to end users, scrutiny of these government fees has also increased.

In Ontario, a group of prominent developers formed the Coalition Against New-Home Taxes this summer, targeting these government DCCs and pledging to cut their prices dollar for dollar if governments cut their DCCs.

Here in Vancouver, a group of our own prominent developers also recently launched a campaign of their own against DCCs, sending a series of letters to the Metro Vancouver Regional District targeting the regional DCCs that are set to increase on January 1, 2025 (and then again in 2026 and 2027).

Currently, the assortment of government fees are estimated to account for 30% of project budgets — a number that was under 15% as recently as 2020, according to Wesgroup, the developer who led the charge in the letter-writing campaign.

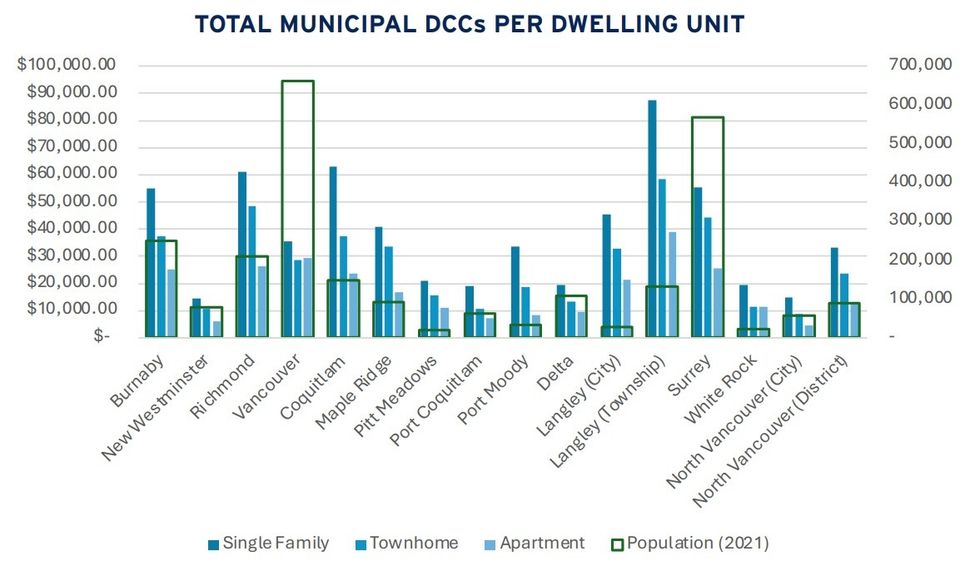

The DCC rates vary from jurisdiction to jurisdiction, however, and some of the differences in rates may be larger than what one might expect. This week, Homebuilders Association Vancouver (HAVAN) published a report focused on these government development fees and concluded that the "difference in averages shows the disparity across the region in DCCs, with larger population centres tending to charge higher fees."

Referencing the DCC rates published on municipal government websites and using population data from the 2021 Census, HAVAN found that the Township of Langley has the highest DCC rates of Metro Vancouver's major municipalities, across all three property types — single-family homes, townhouses, and apartments.

In the Township of Langley, the average amount of DCCs for single-family homes was around $87,000 per unit, which was more than $20,000 higher than the City of Coquitlam's $62,000, the next-highest. Some, however, may not view this as a negative, as charging high amounts of DCCs on single-family homes can potentially be considered a way to discourage new construction of single-family homes.

However, unfortunately for builders in the Township of Langley, their DCCs for townhouses were also the highest of the municipalities included in the report, coming in at around $59,000 per unit. The second-highest was the City of Richmond's $49,000 per unit.

For apartments, the Township of Langley was again found to have the highest average DCC rates, which can often vary from neighbourhood to neighbourhood within the same municipality. On average, the Township charged a DCC rate of around $39,000 per unit — a total of $3.9 million for a 100-unit apartment building, in other words. The second-highest was the City of Vancouver's average of $29,000.

Local governments regularly increase their DCC rates for reasons such as accounting for inflation or accounting for their own budgetary changes, and again the Township of Langley stands out. In their report published this week, HAVAN found that the Township's DCC rates increased by 81.19% for single-family homes, 79.15% for townhouses, and 46.11% for apartments since HAVAN's last report (in June 2023).

In the City of Vancouver, the DCC rates increased by 20.45% for single-family homes, 20.39% for townhouses, and 20.37% for apartments in that same time span. In the City of Coquitlam, DCC rates only increased by 4.5% across all three property types, although many of its average rates were already higher than those of Vancouver.

HAVAN's 2023 report focused on just four municipalities, the last of which was the City of North Vancouver, whose DCC rates saw no change over the past year.

Cities across Canada continue to face significant growth and thus need to continue delivering infrastructure to support that growth. However, many governments have limited budgets and thus turn to DCCs as a way to fund their infrastructure projects, as the alternative solution is raising property taxes, which is a more politically-dangerous move.

"Many municipalities across the province face significant development pressure, which requires the expansion of existing or the installation of new infrastructure systems to support new development and its demand on utilities and services," said HAVAN in their report this week. "However, the costs associated with these infrastructure requirements create significant public sector burdens. Increasingly, all governments are facing significant constraints in the use of general purpose taxation and have placed greater emphasis on the 'growth pays for growth' principle."

Whether "growth pays for growth" is just is the crux of the debate around DCCs, with more and more developers arguing that it's unfair to tax new housing construction. Furthermore, DCCs not only continue to increase, but governments are now introducing ACCs, and the DCCs collected by the Metro Vancouver Regional District are also set to increase significantly.

Following their letter-writing campaign, the group of developers who wrote letters have been granted their wish to speak to the Metro Vancouver Board, with a special meeting called for Thursday, October 17, Wesgroup told STOREYS. Multiple developers are expected to have the opportunity to speak.