When a real estate development project is facing insolvency, it’s almost always during the pre-construction phase or mid-construction phase — which makes the insolvency of the LJM Tower in Hamilton, Ontario an outlier.

Located at 2782 Barton Street East, about midway between Varga Drive and Grays Road, the LJM Tower by Burlington-based LJM Developments is a 16-storey condominium building with 313 residential units, 311 vehicle parking spaces, and 243 storage lockers.

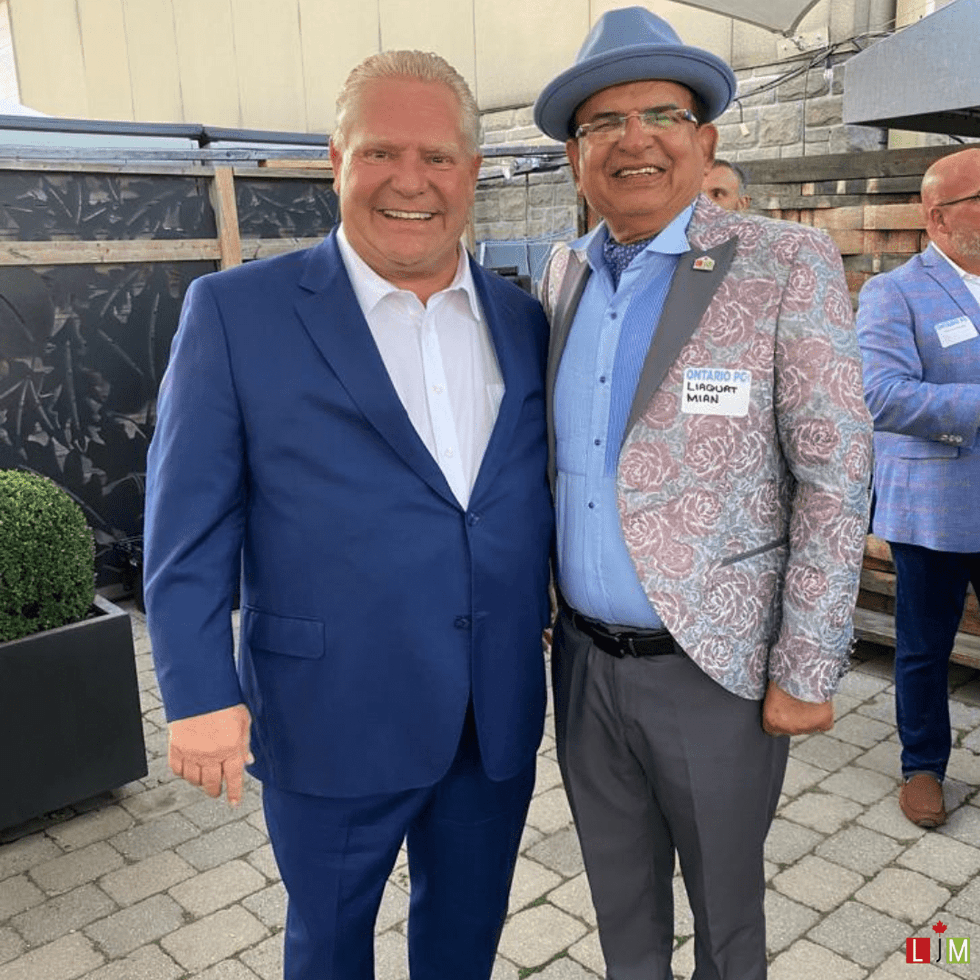

According to court documents, LJM Developments — led by President Liaquat Mian — started developing the project in December 2016, and substantially completed it last year, registering the building and creating the condo corporation on May 22, 2025.

LJM Developments had entered into 301 presale agreements, and began the process of closing those presale agreements after the condo was registered. However, only 258 of those transactions were completed, leaving 43 remaining. The developer says it is now holding 55 unsold units, and not being able to close these sales has resulted in debts piling up and a “liquidity crisis.”

Construction-Related Charges

For the project, the developer secured approximately $79 million in construction financing from DUCA Financial Services Credit Union. In another example of this case greatly diverging from the typical insolvency, LJM successfully repaid the loan around July 31, 2025, using the sales proceeds from the units that closed, and the mortgage was discharged.

Nonetheless, LJM Developments still owes approximately $30,700,000 to various other parties, including to a handful of contractors and suppliers.

After the project completed substantially last year, bills became due, but LJM was unable to pay some of the outstanding amounts because of the shortfall resulting from some purchasers not closing. Beginning in November, contractors — Speedy Electrical Contractors Limited, Classic Tile Contractors Limited, and Stephenson’s Rental Services Inc., to name a few — began registering liens against the unsold units.

Liens, like other encumbrances registered on land titles, prevent the property from transacting, which meant the developer could not sell the unsold units to pay off the outstanding amounts — a total of around $5,740,304.85, as of January 26, 2026.

Because the building has been substantially completed and units have been turned over to buyers, they now also have warranty obligations. According to LJM, they have received “35 construction deficiency warranty requests from homebuyers, which include subfloor/finishing issues, minor mechanical failures, and electrical defects.” LJM says they estimate $30,750 is needed to address those warranty requests.

Furthermore, LJM said “there may be many more warranty requests from homebuyers in the near future, in particular as we reach the one-year anniversary of Unit occupancies.” They also said they have received three delayed occupancy compensation requests from purchasers in the total amount of $22,500, and are expecting more to come.

Again, because the building has been completed and the condo corporation has been created, the developer owes condo management fees that it cannot pay. A condo fee lien was registered on December 31 for $93,581, and is accruing interest at around $30,000 per month. Various real estate brokerages have also filed claims, presumably related to unpaid commission.

Taxes

The biggest portion of the $30,700,000 owed is as it relates to taxes.

As is the case with many development projects, the developer was obligated to pay development charges to the City. Most governments require payment upon issuance of the building permit, but the City of Hamilton has a DC Deferral Program that was created for industrial developments, but is also open to some residential developments.

According to LJM Developments, they entered into a DC deferral agreement on October 26, 2021 and the City then registered a charge of $6,154,661 against the property. On June 1, 2023, they entered into a second DC deferral agreement, and the City registered another charge of $1,530,562. The developer now owes $7,685,223 in development charges to the City, with interest accruing for the two charges at, respectively, 6.67% and 11.05%.

In addition the development charges, LJM also owes the City $1,530,562 in property taxes, which accrues interest at 1.25% per month (15% annually).

The single largest amount owed, however, is $12,500,000 in HST to the Canada Revenue Agency, which is accruing interest at 7% annually.

Troubles Mounting

“While significant progress has been made towards completing the Project and selling all remaining units, a recent downturn in the Hamilton condominium market and the registration of various construction liens against the Units have created a liquidity crisis for the applicant,” said LJM Developments in its application.

LJM made the case that it needs the creditor protection granted by the Companies’ Creditors Arrangement Act (CCAA) in order to fulfill their outstanding obligations, and was granted creditor protection on February 10.

LJM Developments’ application was pertaining to just this project and the associated corporate entity known as LJM Developments (Hamilton) Inc., but their “liquidity crisis” extends to several other projects as well.

In November, the Home Construction Regulatory Authority (HCRA) issued a Notice of Proposal to Refuse to Renew/Revoke a License against LJM Developments Group and several related corporate entities, revealing the depths of their financial trouble.

According to the HCRA, three corporate members of LJM Developments Group — LJM Halton Hills, LJM Kitchener, and LJM Cambridge, each representing one project — have defaulted on loans. LJM Halton Hills and LJM Kitchener owe $3.2 million and $6.4 million, respectively, to Windsor Family Credit Union, while LJM Cambridge owes $9.7 million to Northern Credit Union.

“The HCRA sought an explanation from the LJM Development Group as to how it intended to resolve the outstanding loans and demand letters,” the HCRA said in its notice. “The LJM Development Group replied that it was not necessary to explain to the HCRA as there was no cross-collateralisation of the companies, that each individual lender would look to their remedies including selling the mortgaged land, that purchaser money continued to be held in trust and was not at risk, and that this was not a reasonable concern for the HCRA to have. In the Registrar’s view, this glib response only further underscores the blasé attitude that the LJM Development Group has taken towards its obligations to both the HCRA and its creditors.”

It’s unclear exactly which projects those corporate entities are associated with, but LJM Developments’ website lists one project in Kitchener and one project in Cambridge, both of which consists of multiple towers. Insolvency proceedings do not appear to have been initiated against those projects, but are likely coming soon now that the dam has been broken.