TD Economics is doubling down on its forecast that there could be some relief on the interest rate front come summer. After Statistics Canada (StatCan) released its most recent gross domestic product (GDP) figures on April 30, Canada’s big banking players – BMO Economics, CIBC, and TD Economics – weighed in, predicting that a deceleration of the economy in Q2 would result in a long-awaited cut in interest rates come June.

A few days later, in its Weekly Bottom Line report, TD Economics reiterated its stance that a cut can be supported by the Bank in July (though admitting markets are "slightly favouring the first BoC cut to occur" in June), further fuelling the hope for would-be Canadian homebuyers who are sitting on the sidelines and waiting for rates to drop before making a move.

In the report, released on Friday (May 3), economist Marc Ercolao first turns his eyes south to the American economy. Last week, the Federal Reserve held its policy rate steady, and the country’s central bank signified that that interest rates will likely remain higher for longer. Meanwhile, the TD report highlights how the “US job engine” slowed in April, adding 175K jobs, and that the country’s unemployment rate rose “modestly” to a still low 3.9%. Furthermore, in no uncertain terms, it outlines how last year’s economic productivity surge has come to an end. Productivity growth slowed to stall in Q1. At the same time, labour costs “turned sharply higher.”

While TD economists weren’t surprised by this, the report highlights that it wasn’t that long ago that investors were expecting US rate cuts to come at last week’s meeting. However, thanks to three months of hotter-than-expected inflation readings, the Federal Open Market Committee (FOMC), citing the need for “greater confidence that inflation is moving sustainably back towards 2%.” Currently, the US inflation rate reached 3.5% in March.

“What exactly that means remains to be seen, but it will likely require a further rebalancing in the labor market, which ultimately leads to more sustained downward pressure on wage growth,” writes Ercolao of America’s inflation situation. He did predict, however, that – while further rate hikes in the US are “highly unlikely” – given the “economy’s sustained strength alongside the recent stalling on inflation,” the Fed will remain on hold until December.

It’s been a slightly different story on Canadian soil. After the Federal Reserve policy meetings, two and ten-year Canadian yields fell by about 15 basis points (bps) and our dollar finished the week flat, after being down almost 1% to its US counterpart mid-week. Then, the economic growth report for February saw the GDP advance at a below-consensus 0.2% month-on-month. The real GDP rose 0.2% in February. According to StatCan, February’s expansion came as services-producing industries increased 0.2%, helped by gains in transportation and warehousing.

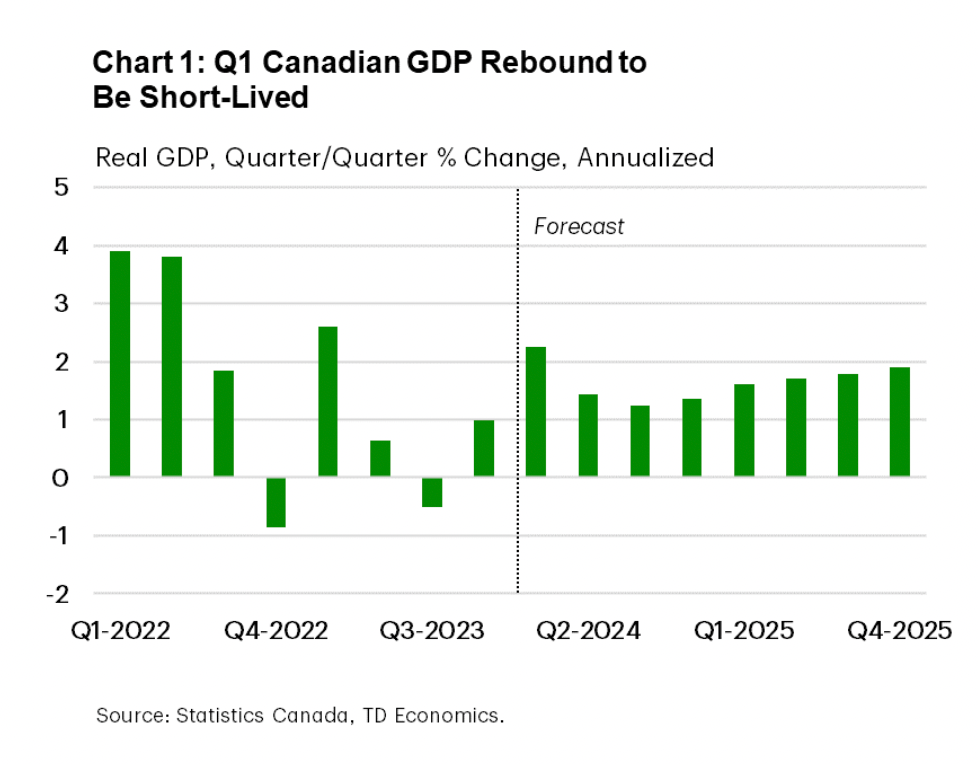

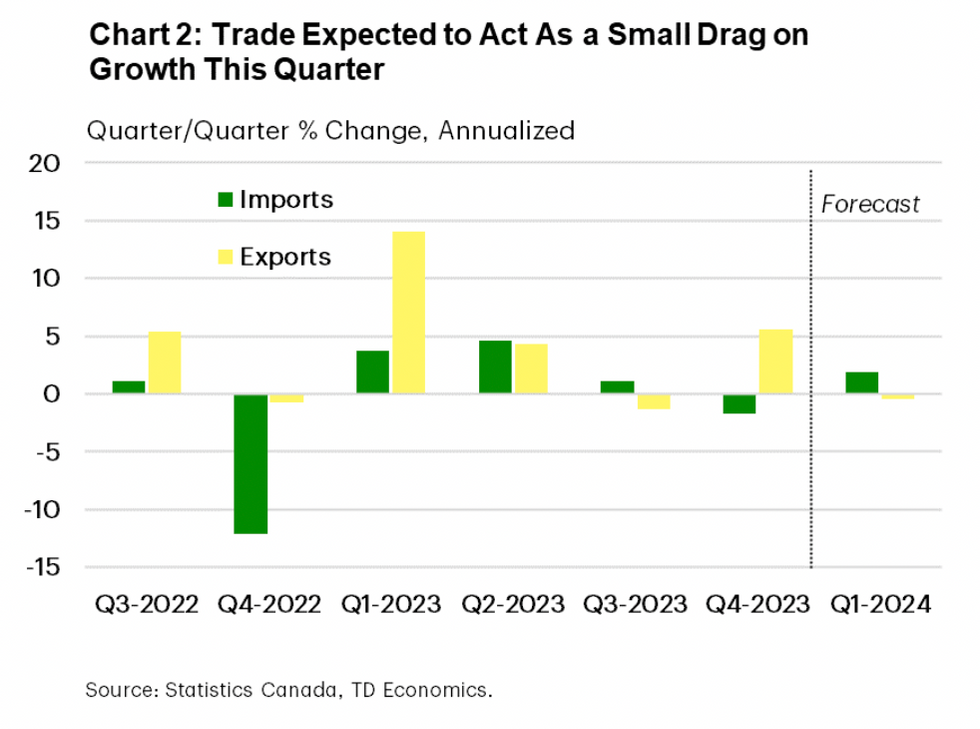

While the Canadian economy continued to grow in February, it’s been losing momentum since January’s surge. “Still, first quarter GDP growth is on pace for a sturdy print,” writes Ercolao. With that said, the report points to trade data that confirms this strength will be short-lived, “with net trade posing a headwind to Q1 growth.” The biggest take away of StatCan’s latest report, says Ercolao, is that the guidance for flat GDP in March signals that this rebound is unlikely to last.

“March’s soft handoff into Q2 suggests the re-emergence of weaker, below-trend growth patterns,” writes Ercolao. “Overall, Canada’s economy has weathered high interest rates relatively well, which has allowed the BoC to keep interest rates elevated to fight the last leg of the inflation battle.”

Ercolao also points to trade data for the end of March that the healthy growth expected in the first quarter will be short-lived. “As we’ve seen in the past several quarters, net trade has been a major swing factor on the expenditure-side GDP readings,” writes Ercolao. “A sharp reversal in export volumes for March coupled with trade revisions for February now put net trade tracking as a headwind to growth.”

While the report acknowledges that great debate as to whether Canada will see a rate hike come summer wages on, TD economists seems pretty confident that there is one in store, though we likely won’t do so at an accelerated pace until the end of the year. “We think a July cut is supported by fundamentals,” writes Ercolao.

Here’s to hoping he’s right.