[Editor's Note: This article will continue to be updated as the CCAA creditor protection proceedings for Hudson's Bay progresses. Last update: August 1, 2025.]

Canada's oldest retailer and one of its most-storied companies, the Hudson's Bay Company, is insolvent. It's a stunning turn of events for a company that is so deeply ingrained in Canada's history, and the company's downfall will undoubtedly be thoroughly analyzed and studied in the days, weeks, and years to come.

The Hudson's Bay Company (HBC) was incorporated on May 2, 1670 — 354 years ago — and was granted creditor protection as an insolvent company under the Companies' Creditors Arrangement Act on March 7, 2025.

Below is a timeline of the company's extensive history, the breadcrumbs leading up to HBC filing for creditor protection, and the ongoing CCAA proceedings.

The Early Years (1670 - 1999)

1670

- May 2: The Hudson's Bay Company is incorporated as "The Governor and Company of Adventurers of England Trading into Hudson's Bay." (Source)

- The Hudson's Bay Company absorbs its biggest rival in the fur trade, the Montreal-based North West Company. (Source)

1881

- Hudson's Bay opens its first store, located at Portage Avenue and Memorial Boulevard in Winnipeg. (Source)

1907

- The Hudson's Bay Company establishes a wholesale division to sell liquor, tobacco, coffee, tea, confectionaries, and blankets. (Source)

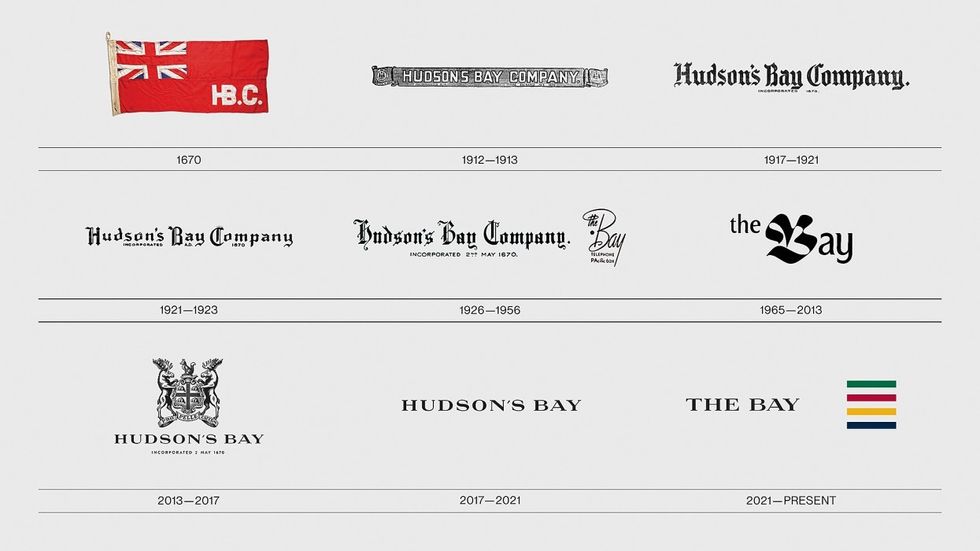

1912

- The company begins modernizing and opens their "original six" department stores in Victoria, Vancouver, Edmonton, Calgary, Saskatoon, and Winnipeg. (Source)

- Hudson's Bay establishes a joint venture with US-based Continental Oil Company called the Hudson's Bay Oil and Gas Company (HBOG). (Source)

- Hudson's Bay begins regularly serving as the official outfitter for Canada's Olympic teams. (Source)

- Hudson's Bay begins expanding towards the east, acquiring Montreal-based department store chain Morgan's. (Source)

- On the company's 300th birthday, Queen Elizabeth II formally transfers HBC from the United Kingdom to Canada, with its new headquarters in Winnipeg. (Source)

- November 24: Hudson's Bay acquires a 70% stake in Ottawa-based department store Freimans. (Source)

- HBC acquires a 64.3% interest in Markborough Properties Limited, a real estate development company. (HBC 1978 Annual Report)

- HBC opens its first store in Toronto, at Yonge and Bloor, and moves its corporate office to Toronto. (Source)

- February: HBC sells its investment in Glenlivet Distillers for $6 million. (HBC 1978 Annual Report)

- June: HBC acquires another 35.5% interest in Markborough Properties Limited for $40,532,000. (HBC 1978 Annual Report)

- August: After discount store chain Zellers makes an attempt to buy HBC, HBC turns the tables and acquires a 57% ownership interest in Zellers for $76 million. (HBC 1978 Annual Report) At the time, Zellers was majority-owned by Fields Stores Limited, who acquired a 50.1% stake for $32,675,000 in 1976, thus HBC's acquisition of Zellers also included Fields. (Source)

- November: HBC acquires an 88% interest in department store chain Simpsons and a 36% interest in Simpsons-Sears Limited for $347 million. (HBC 1978 Annual Report)

- May 1: Kenneth Thomson, a Toronto-based newspaper magnate, buys a 75% interest in HBC for $400 million, beating a bid by George Weston. (Source)

- July 31: HBC acquires the remaining 12% interest in Simpsons for $19.5 million. (HBC 1979 Annual Report)

1981

- February: HBC acquires the remaining 43% interest in Zellers for $97,430,000. (HBC 1982 Annual Report)

- June: Dome Petroleum Limited acquires a 53% interest in Hudson's Bay Oil and Gas. (HBC 1981 Annual Report)

1982

- Dome completes its takeover of HBOG, buying HBC's remaining stake in the company. (Source)

1990

- November 4: HBC acquires Towers Department Stores Inc. from The Oshawa Group Limited for $181.5 million. (HBC 1990 Annual Report)

- January 30: Hudson's Bay announces that it is exiting the fur trade, as public opinion shifts towards anti-fur. (Source)

- February 1: Towers is merged with Zellers, with Towers store relaunching as Zellers. (HBC 1990 Annual Report)

- After Vancouver-based Woodward's files for bankruptcy, HBC buys Woodward's and its 26 stores. (Source)

- The Thomson family sells its remaining shares in the company. (Source)

- HBC acquires Kmart for $240 million, merging Kmart with Zellers, as competition with Walmart heats up. (Source)

- HBC launches the Home Outfitters store concept. (HBC 2000 Annual Report)

The 2000s (2000 - 2024)

2006

- January: American businessman Jerry Zucker acquires HBC for $1.1 billion. (Source)

- March: Jerry Zucker becomes Governor and CEO of HBC. (Source)

- April 12: HBC Governor & CEO Jerry Zucker passes away after a battle with cancer. His wife, Anita, steps in and becomes the first female Governor in HBC history. (Source)

- July 16: New York-based NRDC Equity Partners, owned by Richard Baker, announce their acquisition of HBC for "slightly" higher than $1.1 billion. (Source)

2011

- January 11: Target enters Canada with an announcement that it was acquiring Zellers' leases from HBC for $1.825 billion. (Press Release)

- January 24: HBC acquires American department store chain Lord & Taylor. (Press Release)

- November 26: HBC completes its initial public offering on the Toronto Stock Exchange, generating $365,075,000. (Press Release)

- November 4: HBC completes its acquisition of Saks Incorporated for USD $2.9 billion. (Press Release)

2015

- February 25: The Hudson's Bay Company and RioCan REIT (TSX: REI.UN) announce a new joint venture entity, RioCan-HBC Limited Partnership, with HBC contributing 10 properties it owned, via either freehold or leasehold, and RioCan contributing 50% stakes in two shopping centres. The JV entity then subleased the spaces to HBC to operate the stores.

- Hudson's Bay opens its first store outside of Canada, in the Netherlands. (Source)

- May: HBC and RioCan reach an agreement to sell the Downtown Vancouver store at 674 Granville Street for $675 million. (Source) The sale later falls through, however.

- February 21: HBC announces that it will be closing all 37 Home Outfitters stores. (Source)

- March 25: RioCan-HBC Limited Partnership enters into a first mortgage with RBC for the principal amount of $161 million, secured against the Downtown Montreal store at 585 Saint Catherine Street West. (Credit Agreement)

- August 28: HBC announces that it has sold Lord & Taylor for $100 million to Le Tote. (Source)

- August 31: HBC says it is closing all 15 locations in The Netherlands. (Source)

- October 21: HBC agrees to be taken private by a group of shareholders, at $10.30 per share. (Press Release)

- March 3: The transaction to take HBC private completes, 10 days before provinces across the country begin declaring a statement of emergency as a result of the COVID-19 pandemic. (Source)

- November 25: In an effort to enhance liquidity during the pandemic, HBC reached a credit agreement with Pathlight Capital LP for a loan of USD $150,000,000. (Source)

- March 22: Hudson's Bay announces the creation of Hudson's Bay Marketplace on thebay.com. (Press Release)

- June 14: RioCan-HBC Limited Partnership enters into a first mortgage with Canada Life and TD for the principal amount of $87,400,000, secured against the Oakville Place shopping centre at 240 Leighland Avenue in Oakville, Ontario. The mortgage matures in or around August 2025. (Mortgage Agreement)

- February 25: RioCan-HBC Limited Partnership enter into a first mortgage agreement with BMO for $105 million, secured against the Downtown Calgary store at 200 8 Avenue SW. The mortgage matures on February 24, 2025. (Mortgage Agreement)

- May 24: RioCan-HBC Limited Partnership enter into a first mortgage agreement with HSBC for $202 million, secured against the Downtown Vancouver store at 674 Granville Street. The mortgage matures on April 30, 2025. (Mortgage Agreement)

- August 17: HBC announces that it is bringing back the Zellers brand as a store-within-a-store concept.

- Janaury 2023: HBC lays off 250 employees from its corporate ranks. (Source)

- May 2023: HBC lays off another 250 employees from its corporate ranks. (Source)

- June 26: After approaching several institutions to seek out "incremental liquidity," HBC enters into a credit agreement with Cadillac Fairview (2171948 Ontario Inc.) for a credit facility in the maximum amount of $200 million. (Source)

- November 23: HBC raises USD $340 million via real estate transactions, after falling behind on payments to suppliers. (Source)

- November 28: Former-President Liz Rodbell returns to HBC as President & CEO. (Press Release)

- January 26: RioCan-HBC Limited Partnership enters into a credit agreement with RBC for the principal amount of $75,000,000, secured against its leasehold interest in the Yorkdale Mall shopping centre in North York, Ontario. The loan matures on January 26, 2027. (Credit Agreement)

- February 12: RioCan-HBC Limited Partnership enters into a first mortgage agreement with Desjardins for $110,000,000, secured against its 50% stake in the Georgian Mall at 509 Bayfield Street in Barrie, Ontario. The mortgage matures in February 2029. (Mortgage Agreement)

- February 12: RioCan-HBC Limited Partnership enters into a second mortgage agerement with RioCan (RC Holding II LP) for $19,500,000, secured against its 50% stake in the Georgian Mall at 509 Bayfield Street in Barrie, Ontario. The mortgage matures in February 2029 and was later amended to $24,500,000. (Mortgage Agreement)

- July 4: HBC announces that it is acquiring American retailer Neiman Marcus Group for USD $2.65 billion. HBC also announced the creation of Saks Global to house the Neiman Marcus, Saks Fifth Avenue, Saks OFF 5TH, and Bergdorf Goodman companies. (Press Release)

- October 3: RioCan-RBC (Ottawa) Holdings Inc. enters into a first mortgage agreement with Desjardins for $56,525,000, secured against the Downtown Ottawa store at 73 Rideau Street. The mortgage matures on October 3, 2029. (Mortgage Agreement)

- October 3: RioCan-RBC Limited Partnership enter into a second mortgage agreement with RioCan (RC Holding II LP) for $16,650,000, secured against the Downtown Ottawa store at 73 Rideau Street. The mortgage matures on October 3, 2029. (Mortgage Agreement)

- November: HBC says that it will not be returning to the Oakridge Park development in Vancouver. (Source)

- December 23: The acquisition of Neiman Marcus Group is completed. (Source)

The Uncertain Future (2025 - )

February 2025

- February 21: RioCan-HBC Limited Partnership and BMO amend the first mortgage agreement secured against the Downtown Calgary store to extend the maturity date to August 29, 2025. (Amendment)

- February 24: The original maturity date of the first mortgage between RioCan-HBC Limited Partnership and BMO secured against the Downtown Calgary store. (Mortgage Agreement)

March 2025

- March 7: The Hudson's Bay Company files for CCAA creditor protection and its application for a 10-day initial period is granted that same day.

- March 14: HBC announces that it will undergo a full liquidation unless it finds a last-minute solution. (Press Release)

- March 17: HBC returns to court with a proposed liquidation process, with an outside end date of June 30, 2025. (Application) The court extended the creditor protection, but delayed a decision on HBC's liquidiation plan and RioCan's motion challenging the rent suspension. (Judge's Endorsement)

- March 19: The court continued to adjourn a decision on the liquidation plan and RioCan's motion until March 21. (Judge's Endorsement)

- March 21: HBC revises their liquidation plan for all but six stores and reaches an agreement with RioCan over rent payments. (March 21 motion)

April 2025

- April 30: RioCan-HBC Limited Partnership's first mortgage with HSBC for $202 million, secured against the Downtown Vancouver store, matures. (Mortgage Agreement)

- May 15: Canadian Tire announces that it has entered into a definitive agreement to buy the brand assets of HBC, including the coat of arms and stripes, for $30 million. (Press Release)

- May 29: RioCan files an application to place its joint venture with HBC under receivership. (Application)

- June 23: Ruby Liu receives court approval to buy HBC's leases at three malls owned by Central Walk, the company chaired by Ruby Liu, for $6 million. (Lease Assignment Order)

- July 22: Cadillac Fairview says in a court filing that it is "resolutely opposed" to the transaction that would see Ruby Liu acquire 25 additional HBC leases. (Court filing)

- July 29: HBC and its senior lenders officially file a motion seeking approval to sell 25 HBC leases to Central Walk for $69.1 million, revealing the full list of 25 leases and Liu's business plan. (Motion)

- August 28-29: The Ontario Superior Court will hear the motion to approve the transaction to Central Walk.

- August 29: RioCan-HBC Limited Partnership's first mortgage with BMO for $105 million, secured against the Downtown Calgary store, matures. (Credit Agreement)

- October 3: RioCan-HBC Limited Partnership's first mortgage with RBC for $161 million, secured against the Downtown Montreal store, matures. (Credit Agreement)