These days, the dream of owning a home for most people is just that: a dream. And according to new data from online comparison platform Ratehub.ca, it’s a distant one at that.

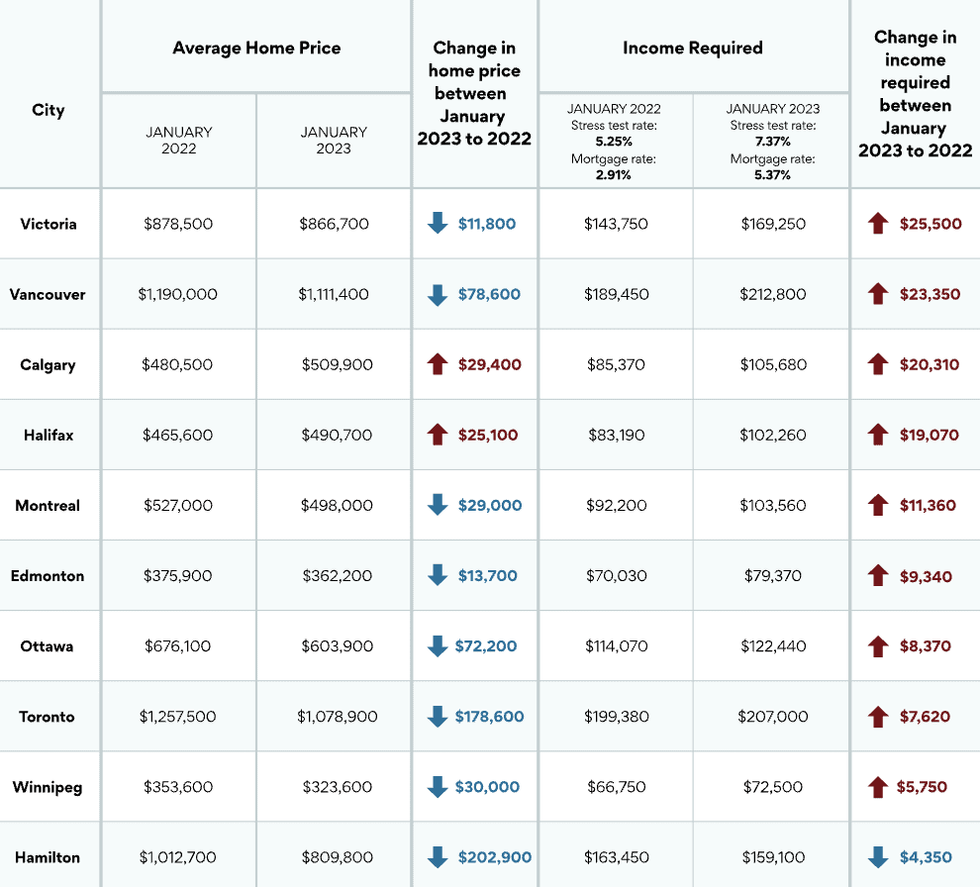

Using data released Wednesday by the Canadian Real Estate Association (CREA), and taking into account changes to mortgage and stress test rates, Ratehub.ca reports that, in January, the income required to buy a home spiked in almost all major markets compared to the year prior.

That comes in spite of the fact that prices have softened substantially nationally and in nearly every Canadian market.

“Home prices are down, but affordability is worse than 12 months ago,” says James Laird, Co-CEO of Ratehub.ca and President of CanWise mortgage lender. “With current fixed rates, the stress test is currently around 7.37%, which is over 2% higher than a year ago. The increase in rates is more material than the decrease in home values so far, which means homes are less affordable in nine out of 10 of the cities we looked at compared to a year ago.”

According to Ratehub.ca’s rankings, housing affordability has eroded the most in Victoria, where the amount of income required to buy a home has climbed $25,500 year over year. Vancouver trails closely behind, showing a markup of $23,350. Calgary -- one of two major markets to see a year-over-year uptick in prices -- ranks third, with a $20,310 increase.

Surprisingly, Toronto -- a city plagued by chronic affordability challenges -- ranks seventh, with required income edging up only $7,620.

The one outlier of the bunch was Hamilton, where the income requirement is $4,350 less. This is attributed to plunging home prices in the city.

Overall, it’s a pretty gloomy picture, but there are some bright spots.

“Compared to Ratehub’s October affordability analysis, recent stabilization among both fixed and variable mortgage rates has been enough to turn the dial slightly for buyers’ affordability, with the required income declining in every market except Halifax,” writes Penelope Graham, Director of Content for Ratehub.ca.

Graham notes that with 47,025 new listings to the market in January, those who can afford to buy will have options -- a rarity in today’s habitually undersupplied market. “However, from a historical perspective, supply still remains extremely tight, down to a low not seen since 2000.”