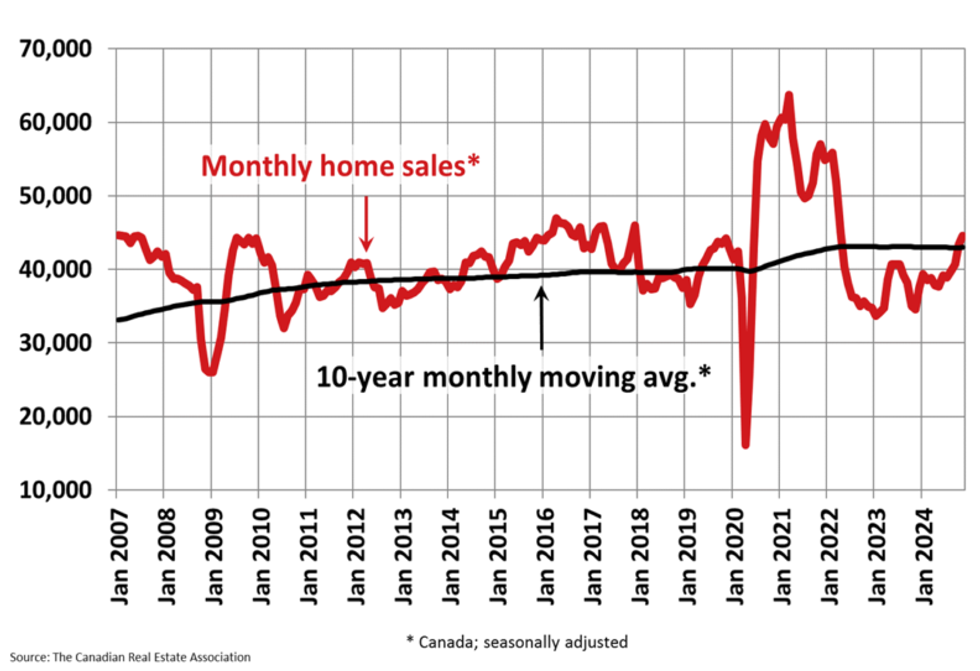

October brought a healthy 30% jump (year over year) in Canadian home sales, and November more or less followed suit. The latest statistics from the Canadian Real Estate Association (CREA), released Monday morning, show that actual, non-seasonally adjusted sales ended last month 26% above the year-ago level.

Though sales rose just 2.8% month over month, they “now stand a cumulative 18.4% above where they were in May, just before the first interest rate cut in early June,” CREA said in a press release. “The November increase was driven by gains in Greater Vancouver, Calgary, Greater Toronto and Montreal, as well as by some double-digit sales increases in smaller cities in Alberta and Ontario.”

CREA Chair James Mabey said in the release that October and November mark “the start of the long-awaited rebound in resale housing activity,” something he attributes to “lowering bowering costs” and “more properties to choose from coaxing buyers off the sidelines.”

To Mabey’s point, there were just over 160,000 properties listed for sale across all MLS® Systems by the end of last month, and that number is up 8.9% year over year. The long-term seasonal average for the metric is 178,000 listings.

Active listings recorded in November translates to 3.7 months of inventory, down from 3.8 months recorded in the month prior and well below the long-term average of 5.1 months. As anything below 3.6 months points to a sellers’ market and anything above 6.5 months points to a buyers’ market, November remained in balanced territory, though veering in favour of sellers.

Meanwhile, new listings came down 0.5% between October and November 2024, following a 3% decline observed between September and October. This, combined with the fact that sales rose last month, put the latest national sales-to-new listings ratio at 59.2%, up from 57.3% in October. As anything between 45% and 65% is “generally consistent with balanced housing market conditions,” November’s ratio indicates, again, that the market is still in a place of balance. “The measure had been in the 52% to 53% range between April and September this year,” CREA also noted.

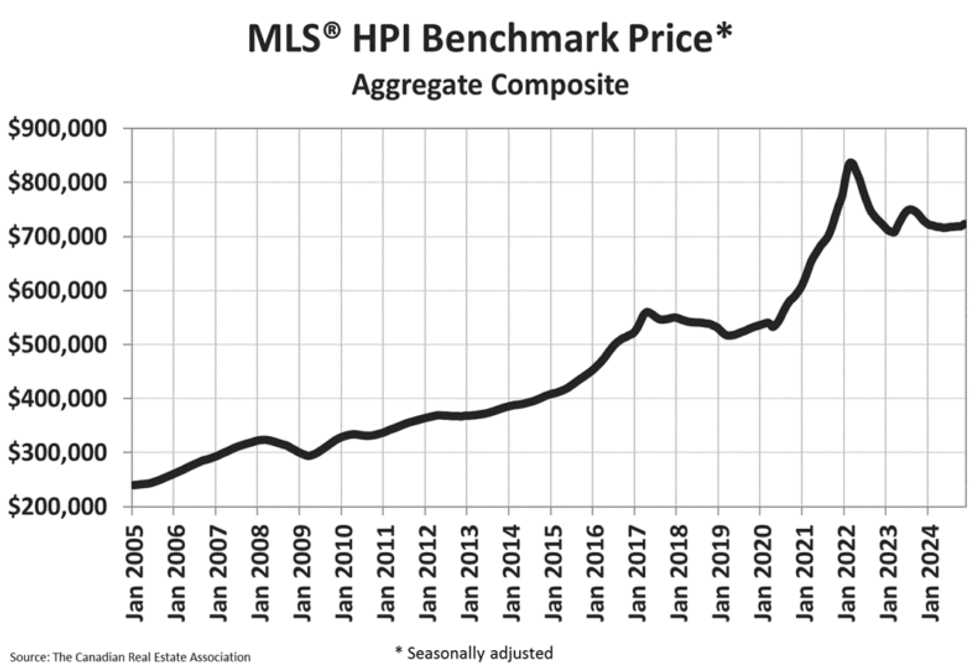

On the price side of things, the National Composite MLS® Home Price Index ticked up slightly by 0.6% between October and November to to $723,100, marking the largest month-over-month rise since July 2023 (in 16 months).

Meanwhile, the non-seasonally adjusted version of the index ended last month 1.2% below the year-ago level. Without adjusting for seasonal effects, the national average home price was $694,411 in November 2024, representing a 7.4% rise year over year.

Last month was the first time in a year in a half that home prices moved “materially higher” on a national basis, said CREA Senior Economist Shaun Cathcart in the release. “Normally we might expect this market rebound to take a pause before resuming in the spring; however, the Bank of Canada's latest 50-basis point cut together with a loosening of mortgage rules could mean a more active winter market than normal.”