Prospective homebuyers -- particularly first timers -- looking for a foothold in today’s housing market found better balance in the condo segment this past spring, as sales dropped and long-term inventory significantly improved.

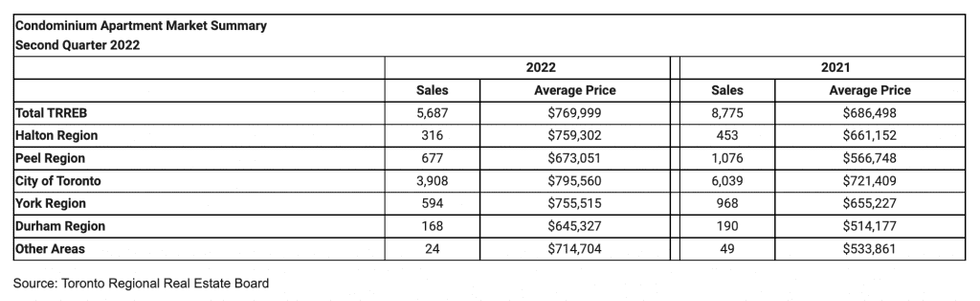

The Q2 stats released by the Toronto Regional Real Estate Board (TRREB) reports a total of 5,687 condo units traded hands between April and June, representing a year-over-year decline of 35.2%. Meanwhile, the supply of new listings stayed relatively flat -- a total of 14,316 came to market, an annual difference of -0.9%. That’s led to a 27.5% surge in active listings, with total inventory clocking in at 5,210 at the end of the quarter.

The average selling price of a unit rose 12.2% from the same period in 2021 to $769,999, with the strongest price appreciation in markets outside of the City of Toronto core, especially at the sub-$700,000 price point.

Durham Region experienced the strongest price growth, up 25.5% YoY to an average of $645,327, followed by Peel Region, up 18.7% to $673,051. The CoT, where unit prices are the highest at $795,560, saw an increase of 10.2%.

TRREB President Kevin Crigger says that the condo segment has been more resilient than other home types following recent interest rate hikes from the central bank, which have whittled borrowers’ buying power.

READ: RBC Downgrades Housing Market Forecast, Calls for Historic Correction

“While some would-be first-time buyers have temporarily focused on renting as they sit on the sidelines, the less expensive entry prices of condos versus freehold homes has provided an alternative option for purchasers looking to mitigate the impact of higher borrowing costs,” he says. “The lower average price point in the condo segment has performed better than many low-rise segments of the market since the onset of the Bank of Canada rate hikes in the spring.”

Dividing the number of sales by the number of new listings reveals a sales-to-new-listings ratio of 38.7% in the GTA, officially dipping into buyers’ market territory. According to the Canadian Real Estate Association, this measure indicates balanced conditions within a range of 40 - 60%, with below and above that threshold reflecting buyers’ and sellers’ markets, respectively.

“Condo market conditions became more balanced in the second quarter, with buyers benefitting from substantially more choice. However, the pace of annual average price growth remained above the rate of inflation, particularly in areas outside of Toronto that are offering attractive price points,” says TRREB Chief Market Analyst Jason Mercer.

Condo Rentals Continue to Tighten Dramatically

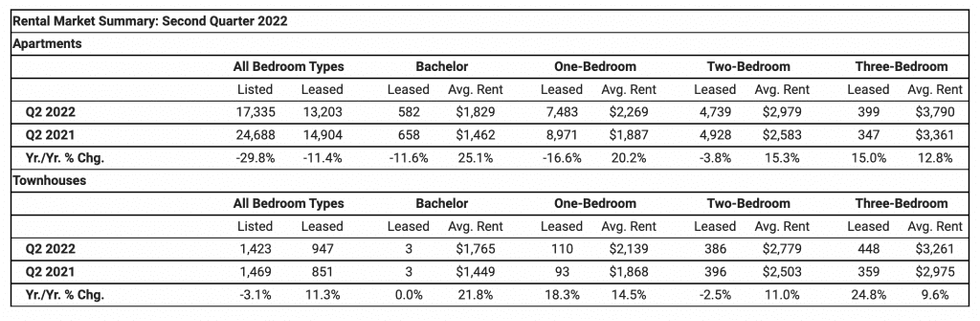

In contrast to the ownership market, condo apartment rental conditions are becoming even more competitive. According to TRREB, the average rents for one- and two-bedroom apartments have hit new records, even surpassing the pre-pandemic peak recorded in the third quarter of 2019.

The board says there were 13,203 condo apartment rental transactions made through the MLS System in Q2 2022 – down 11.4% compared to Q2 2021. However, the decline isn’t due to less demand; a dearth of rental listings, which dropped nearly 30% from last year, is the culprit behind fewer leases. “With less choice, it was much more difficult for renters to get deals done,” reads TRREB’s report.

Crigger says that as higher mortgage rates have knocked more would-be homebuyers out of the market, they’re flooding into the rental space, putting immense pressure on supply. Prospective tenants will see lease prices soar in the near term as this trend plays out.

“Expect rental market conditions to tighten further in the coming months,” he says “Higher borrowing costs may have temporarily precluded home buying for some households, but the Greater Toronto Area (GTA) population continues to grow alongside a booming regional economy. This means that an increasing number of people requiring a place to live will turn to the rental market.”

Average condo rents rose by double-digit percentages across the board, for all bedroom types, in Q2; one-bed units now fetch 20.2% more YoY at $2,269, with two-bed unit rents up 15.3% to $2,979.

“Competition between renters continues to heat up, resulting in extremely strong upward pressure on average rents. Rental supply remains a major issue in the GTA and will become more pronounced in the short term, as an increasing share of well-employed individuals turn to the rental market. Policymakers need to develop a diversity of options to bring more rental supply online, whether we're talking about investor-held condominium apartments or purpose-built rental developments,” said TRREB Chief Market Analyst Jason Mercer.